Due to market speculation that the US SEC's opposition towards an Ethereum ETF may start to ease, Ethereum prices surged overnight, posting the largest gain in 18 months. This rally also lifted other digital currencies across the board. As of May 21st, Ethereum has surged nearly 20%, while Bitcoin has risen over 7%, breaking above the $70,000 mark.

(Source:Coinmarketcap,2024.05.21)

(Source:Coinmarketcap,2024.05.21)

Hong Kong Crypto ETFs Mostly Surge, With Huaxia Ethereum ETF Rising Over 25%

Amid this positive news, most Hong Kong-listed crypto ETFs have seen gains, with the CAM ETH (03046.HK) and the BOS HSK ETH (03009.HK) rising over 25% at their peaks. The HGI ETH (03179.HK) surged over 19%, while the CAM BTC (03042.HK) gained 6.65%.

(Source:uSMART,2024.05.21)

(Source:uSMART,2024.05.21)

Reason for the rise: Bullish sentiment towards Ethereum ETF

Until the 21st, the cryptocurrency market generally had a negative outlook on Ethereum ETF. There were several reasons for this: the question of whether Ethereum itself is a security has yet to be determined, and this issue is the core question in SEC and several cryptocurrency exchange cases. The resolution of this issue will directly determine the fate of the cryptocurrency market and whether it needs to be disclosed as a security ETF. In comparison, Bitcoin has never had such a debate and has always been considered a commodity, making it eligible to form less regulated ETF assets, similar to gold. Additionally, Ethereum has higher market volatility and a shorter history compared to Bitcoin, which may pose greater regulatory opacity and market manipulation risks, as previously mentioned by the SEC.

Therefore, 'most people expect that the SEC will not approve it.'

Media reports cited insiders who revealed that on May 20th, the U.S. SEC requested an Ethereum ETF issuer to update its 19b-4 filing. Form 19b-4 is usually used to notify the SEC of rule changes allowing funds to trade on exchanges. The ETF issuer needs approval for both the 19b-4 form and the S-1 registration statement to officially launch the product.

Subsequently, analysts indicated that after they raised the probability of approval for a physical Ethereum ETF from 25% to 75%, the increase in Ethereum's value expanded.

Meanwhile, according to CoinDesk, the SEC requested exchanges to expedite updates on the 19b-4 filings for physical Ethereum ETFs. This series of signals indicates a potential reversal in the SEC's attitude towards Ethereum ETF. From previous indifference (likely indicating disapproval) to the current change, the market quickly responded to this series of positive news.

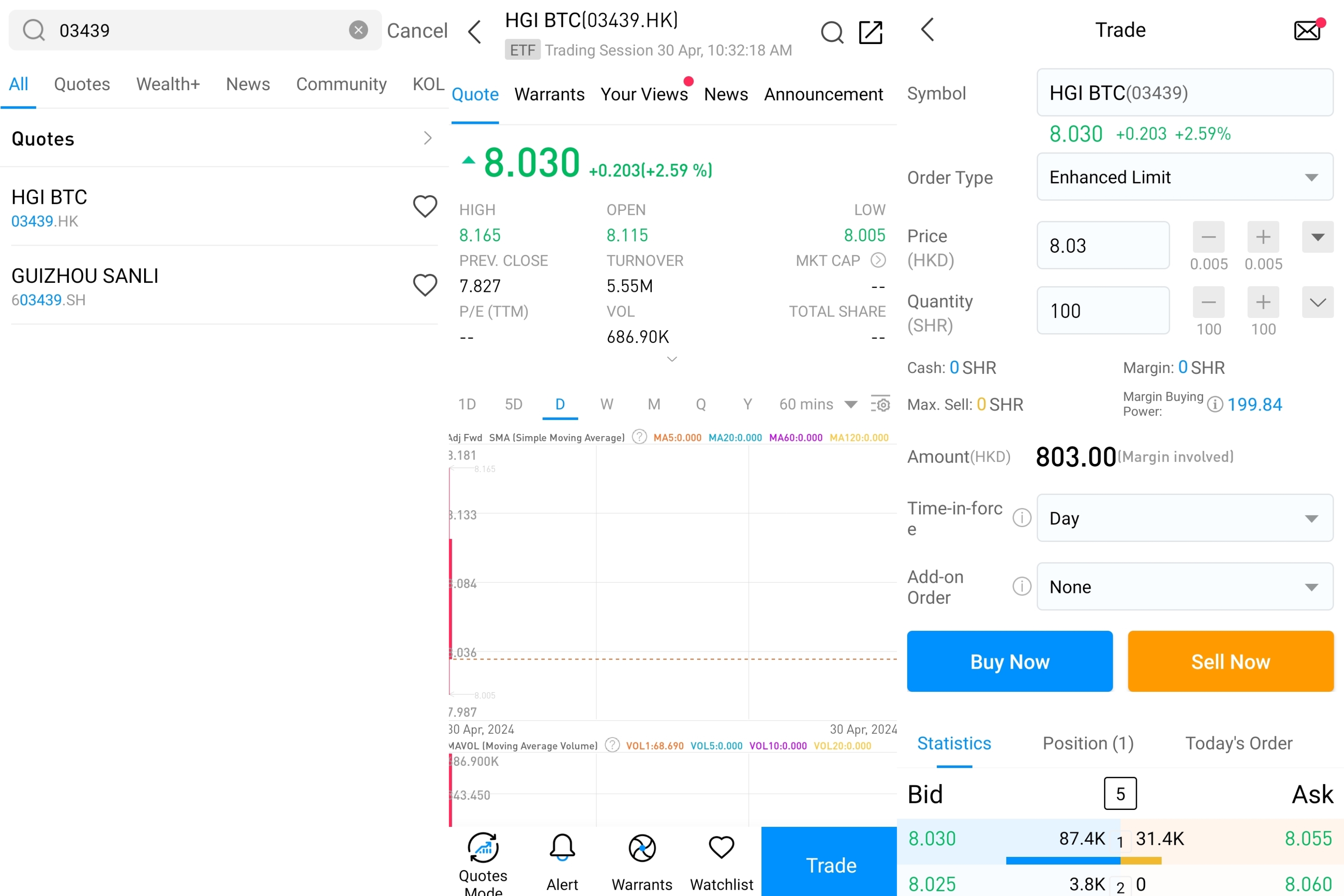

How to place a trade on uSMART mobile application

After logging into the uSMART HK app, click on "Search" at the top right corner of the page. Enter the stock code you want to learn about, and you can access the details page to understand the trading details and historical trends. Click on the "Trade" button at the bottom right corner, select the "Buy/Sell" function, fill in the trading conditions, and unlock the trade. The following images provide step-by-step instructions:

This diagram is provided for illustrative purposes exclusively