On April 30, 2024, six virtual asset spot ETFs were listed in Hong Kong, marking the first introduction of such products

in the Asian market. The listed ETFs include BUT244,BUU885,BUU104,BUU105,BUU163 and BUU164.

The six virtual asset spot ETFs listed today

|

The First Batch of Virtual Asset Physical ETFs Listed in Hong Kong |

|||

|

Fund companies |

ETF |

Code |

Management fee |

|

Harvest Global Investments Limited |

BUT244 |

03439 09439 |

0.3%,Management fee waived within 6 months of holding |

|

BUU885 |

03179 09179 |

||

|

Bosera Fund Management Co., Ltd |

BUU104 |

03008 09008 |

0.6%,Management fee waived within 4 months of issuance |

|

BUU105 |

03009 09009 |

||

|

China Asset Management (Hong Kong) ) |

BUU163 |

03042 09042 83042 |

0.99% |

|

BUU164 |

03046 09046 83046 |

||

In terms of the issuance price, Harvest Global and China Asset Management (Hong Kong) )products were issued at $1 per share, while the initial issuance prices of BUU104 and BUU105 corresponded to approximately 0.0001 BTC and 0.001 ETH, respectively, meaning that holding 10,000 shares is roughly equivalent to 1 BTC, and holding 1,000 shares is roughly equivalent to 1 ETH.

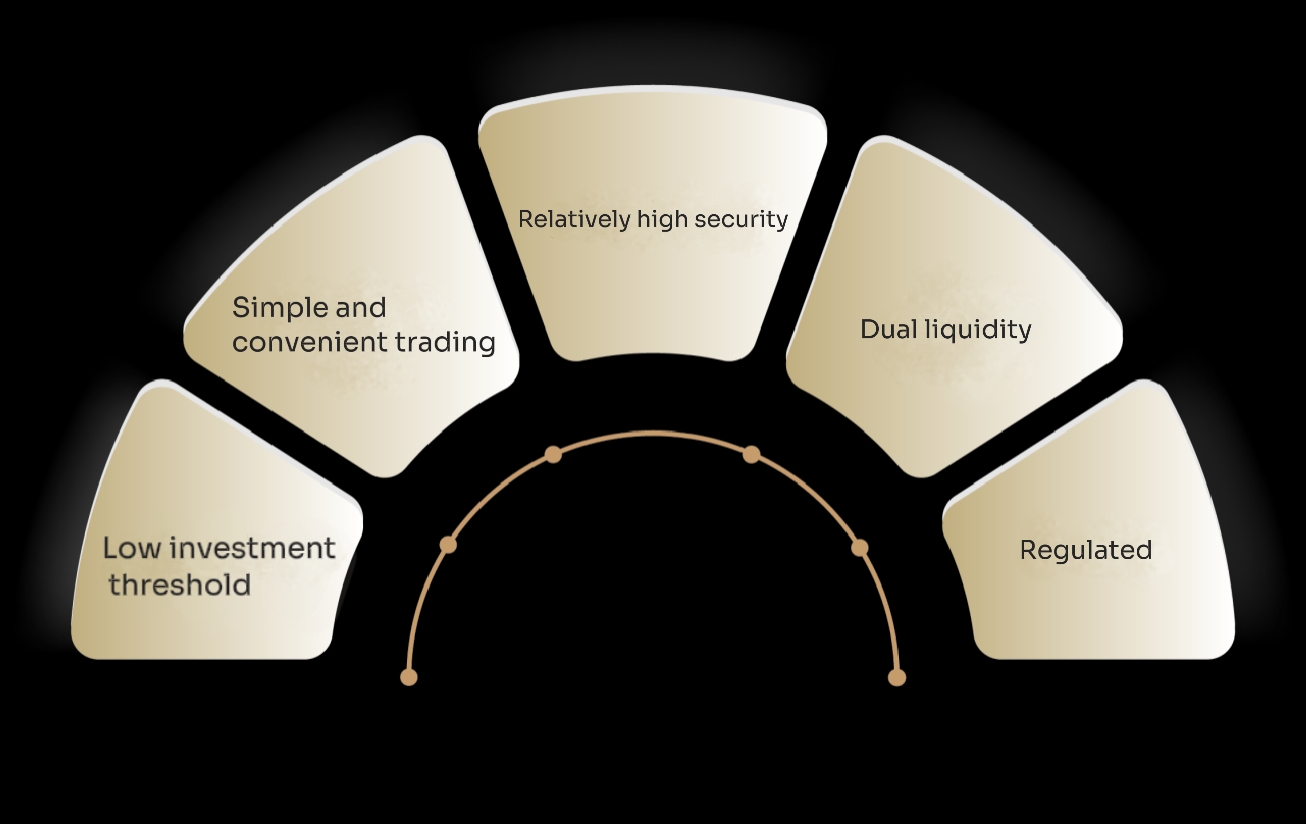

Why trade spot ETFs

1. Diversified asset allocation: Bitcoin, as an asset class with lower correlation to traditional assets, offers high liquidity and global market accessibility, with attractive risk-adjusted returns. This asset class provides an emerging investment opportunity for investors seeking portfolio diversification and recognizing the potential of digital assets. With more institutions starting to hold long-term strategic positions, there is still significant growth potential for Bitcoin and Ethereum.

2. Enhanced compliance: While the regulatory environment for the cryptocurrency market remains uncertain, these six virtual asset spot ETFs are regulated by the Hong Kong Securities and Futures Commission to protect investors' assets.

3. Convenient trading: Allows trading in HKD/USD/physical redemption. Investors can easily buy and sell on the same day through their stock brokerage accounts, reducing operational complexities and risks.

4. Increased transparency: These ETFs track only the prices of Bitcoin and Ethereum (net of fund expenses). The prices, holdings, net asset values, and secondary market information of the ETFs will be publicly disclosed.

5. Lower costs: ETFs can significantly reduce other costs and fund operation expenses through economies of scale, offsetting the costs for individual investors in purchasing, storage, insurance, and other aspects, thereby enhancing investors' satisfaction.

Why choose uSMART for trading?

· uSMART provides legal and secure cryptocurrency investment opportunities for investors.

uSMART is a licensed corporation recognized by the Hong Kong Securities and Futures Commission (Central Number: BJA907). It holds licenses for Type 1 (Dealing in Securities), Type 4 (Advising on Securities), and Type 9 (Asset Management) regulated activities. It collaborates closely with regulated cryptocurrency exchanges and issuers, providing a safer alternative to direct Bitcoin purchases.

· uSMART is among the first supporting trading brokers in Asia.

Virtual asset spot ETFs remove traditional barriers that hinder investors from using virtual assets as investment and trading tools. uSMART offers a diverse range of investment products, opening the door for you to enter the virtual asset market. Today, you can directly search for the codes on the uSMART HK app and trade. Stay tuned for the latest information!

· Diverse investment product portfolio.

Furthermore, uSMART HK continuously expands its product line to meet investors' needs for diversified asset allocation. After the successful listing of the first batch of virtual asset spot ETFs in Asia, uSMART HK will also enable trading of this product, further enriching its global investment services. We will continue to update relevant product information and trading dynamics, so investors can seize investment opportunities in the international market. uSMART is committed to providing comprehensive financial services to help investors capture growth potential in the global capital markets.

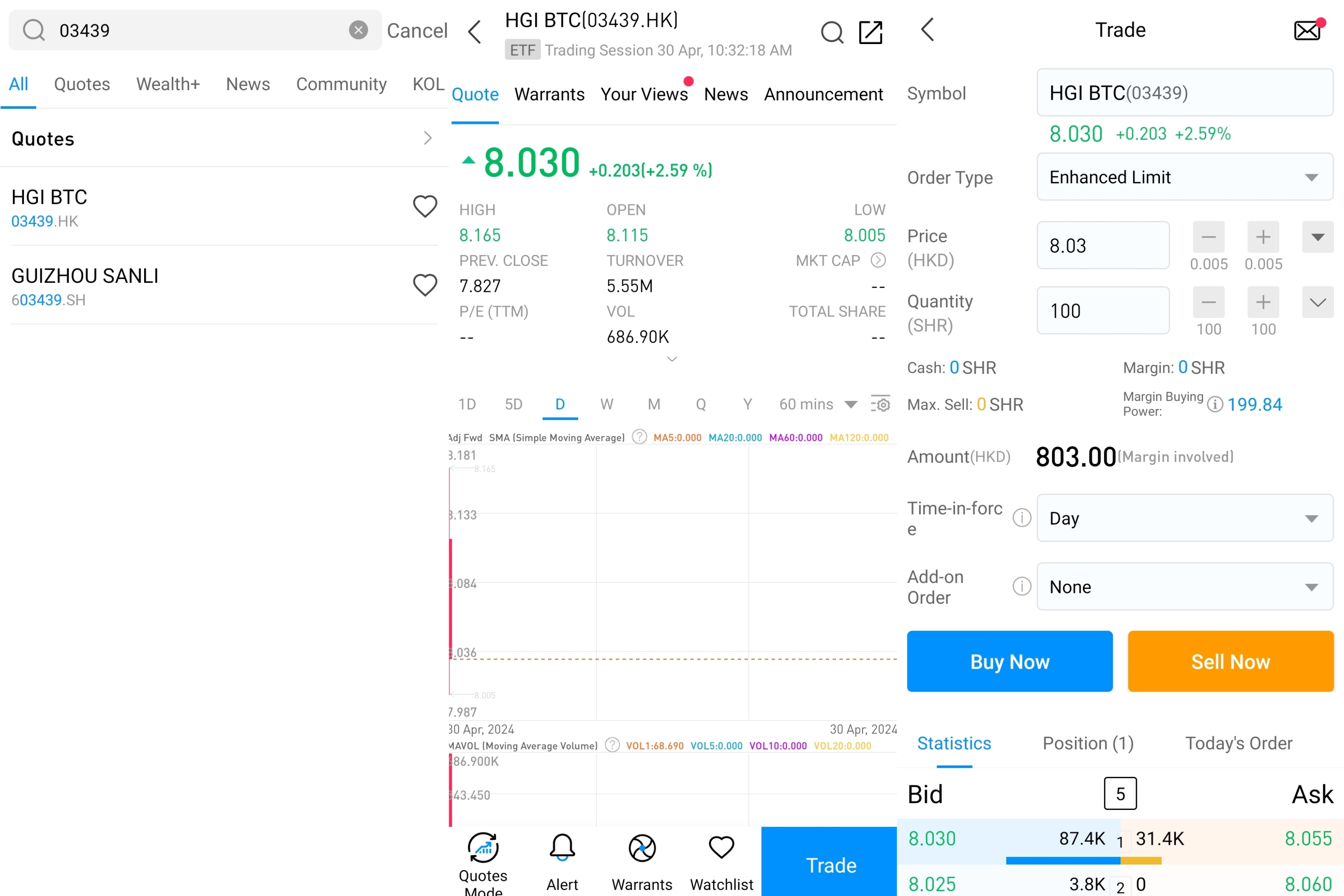

How to place a trade on uSMART mobile application

After logging into the uSMART HK app, click on "Search" at the top right corner of the page. Enter the stock code you want to learn about, and you can access the details page to understand the trading details and historical trends. Click on the "Trade" button at the bottom right corner, select the "Buy/Sell" function, fill in the trading conditions, and unlock the trade. The following images provide step-by-step instructions:

This diagram is provided for illustrative purposes exclusively