期權大單 | 機構狂買科技股,投資者提前“末日對衝”

市場概覽 (5月16日)

美股週二收跌,市場關注美國債務上限談判的進展。道瓊斯指數跌1.01%,標普500指數跌0.64%,納斯達克指數跌0.18%。

當日美股期權市場總成交量33,007,890張合約。其中,看漲期權佔比52%,看跌期權佔比48%。

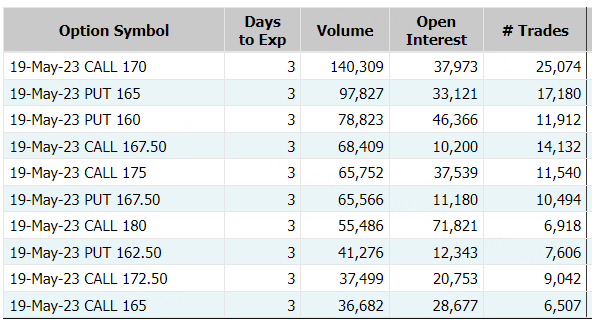

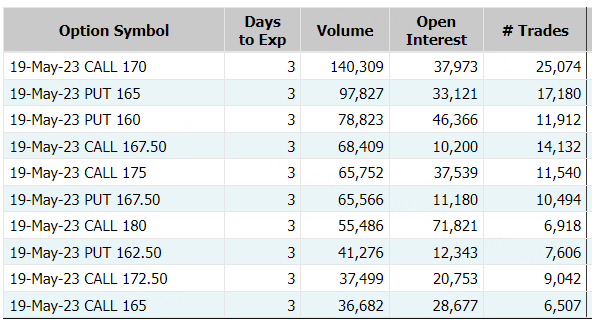

期權成交總量TOP10

排名前十的依然是指數ETF+熱門科技股。特斯拉排在第三的位置。消息面上,當地時間5月16日週二,特斯拉在美國得州奧斯汀的工廠召開今年的年度股東大會。特斯拉CEO馬斯克在大會上說,他預計,未來12個月內,將持續存在具有挑戰性的經濟環境,許多公司會破產。但他相信,在那之後,經濟將會復甦,特斯拉將處於有利地位。

本次股東大會上,馬斯克對特斯拉旗下車型做出預測。他說,特斯拉的Model Y將成爲“今年地球上銷量第一的汽車”。馬斯克還提到電動皮卡Cybertruck,承諾將在今年晚些時候交付量產Cybertruck。

本次股東大會並未對特斯拉股價產生明顯影響,當日微漲0.1%。周內期權交易多空交織,價格區間不大,缺乏方向性指引。

除了特斯拉之外,熱門科技股的期權交易連續出現在榜單前列。宏觀方面,隨着美國經濟風險加大,市場對美聯儲結束緊縮的期待越來越強烈。爲了搶跑“QE/降息”,美國機構投資者選擇了“高久期”資產:科技股。其中,機構投資者對於科技股的配置環比飆升14%達到淨16%的超配。科技股配置比重自3月以來飆升了22%,這是09年3月以來最大幅度的增持。

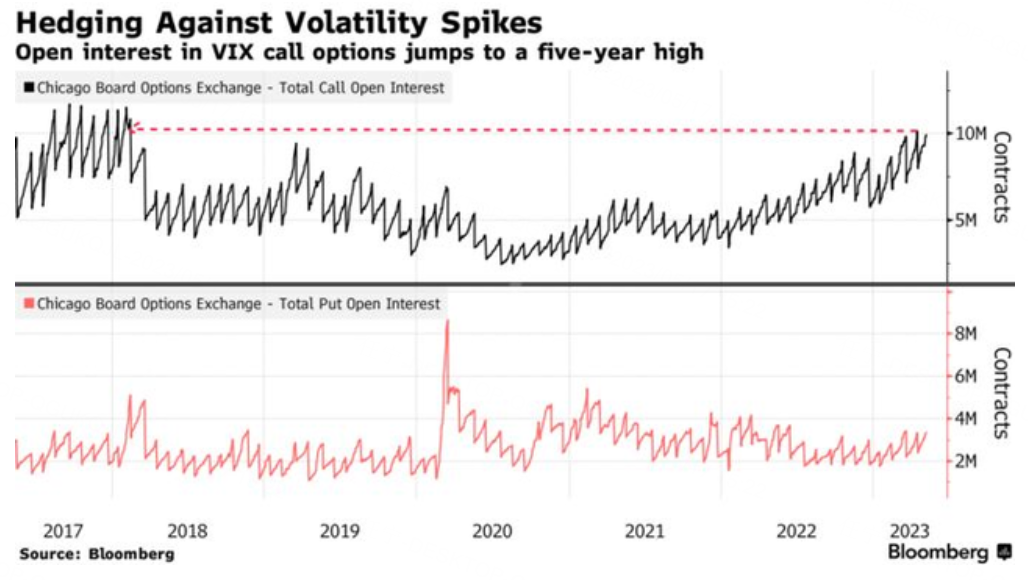

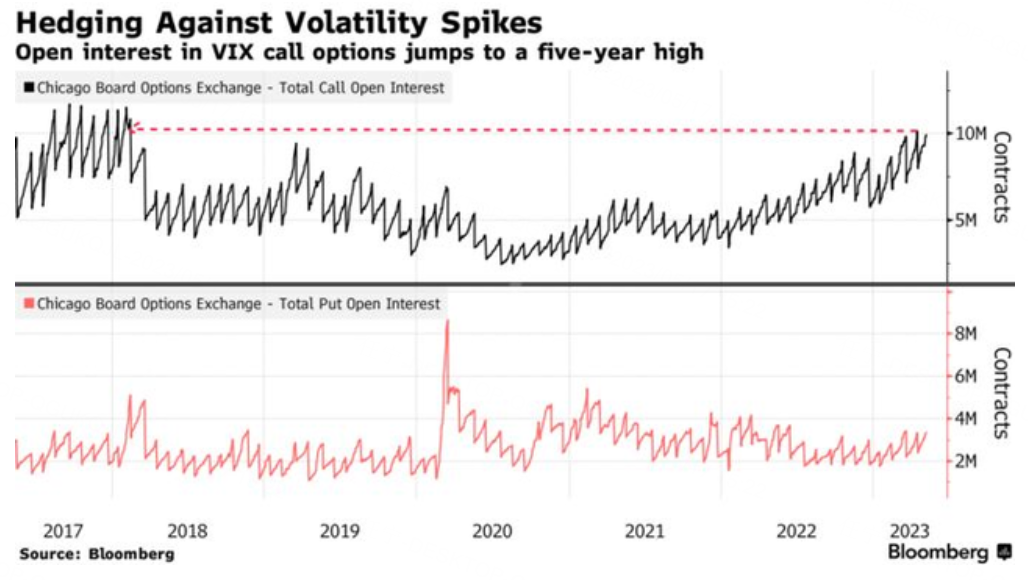

繫好安全帶!市場正在進行“末日對衝”

在華盛頓,兩黨在債務上限的扯皮正有可能將美國推向違約。早在2011年,類似的僵局導致美國政府的信用評級遭到前所未有的下調,標普500指數在10天內下跌16%,而VIX指數則大幅攀升。

對波動性對衝的需求預示着6月份的市場動盪。在通脹維持高位、經濟衰退警燈閃亮、國際形勢複雜緊張的情況下,股市能抗住壓力嗎?購買保護措施似乎是一種必然選擇。

雖然美國的債務上限問題仍可能在最後時刻“懸崖勒馬”,但是對波動率指數期權的需求顯然在增加,防範極端事件的需求依然存在。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.