期權大單 | 13F出爐,華爾街巨頭增持看跌期權

市場概覽 (5月15日)

週一,美股收高,納斯達克指數漲0.66%刷新去年8月25日以來最高,標普500指數漲0.3%,道瓊斯指數漲0.14%。當日美股期權市場總成交量31,598,037張合約。其中,看漲期權佔比54%,看跌期權佔比46%。

期權成交總量TOP10

消息面上,包括高瓴HHLR、全球最大對衝基金橋水、伯克希爾·哈撒韋等多家巨頭向美國證券交易委員會(SEC)提交了13F報告。數據顯示,2023年一季度,高瓴旗下的HHLR圍繞中概股和科技公司進行集中配置,對阿里巴巴、華住等9只中概股進行了增持、新進買入等加倉操作。橋水則主要減持金融股,同時加碼谷歌、微軟等科技股。巴菲特大舉增持2000多萬股蘋果,同時大幅減持雪佛龍、清倉臺積電。

總的來說,投資大佬們的興趣,正在由此前的金融、消費轉至熱門賽道生成式AI,例如ChapGPT概念股,大手筆加倉科技股正是“轉向”的一大表現。

投行佈局指數期權

除了上述機構之外,大型投行的動態也很值得關注,它們的佈局中包含多類期權資產。

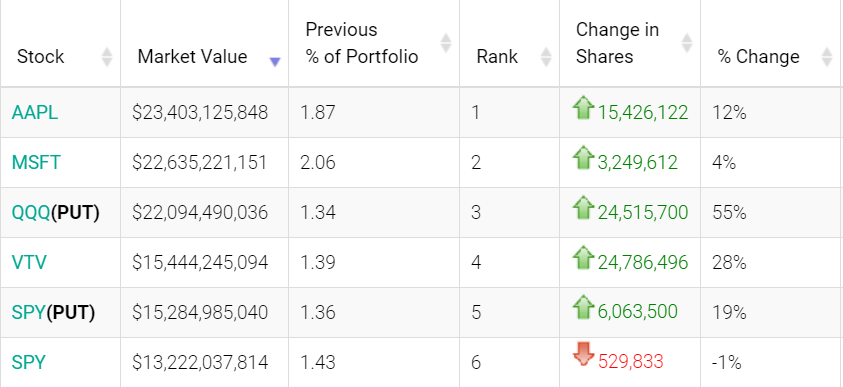

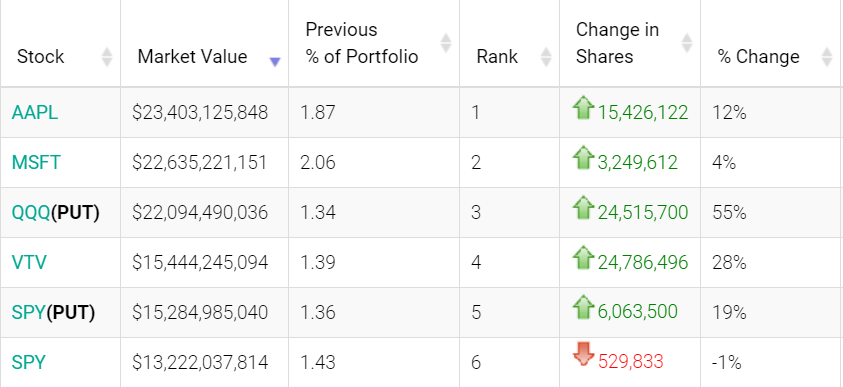

美國銀行:Q1增持多隻科技股及價值股ETF,調整看跌、看漲期權資產

美國銀行13F文件顯示,該行一季度持倉總市值從上季的8780.15億美元增加至9736.8億美元,期內新建倉或清倉的資產多爲個股的看跌、看漲期權。一季度該行重倉市值前五分別爲蘋果、微軟、納斯達克100指數ETF(QQQ)看跌期權、Vanguard價值股ETF及標普500ETF-SPDR(SPY)看跌期權,其中QQQ看跌期權的增持比例高達55%。

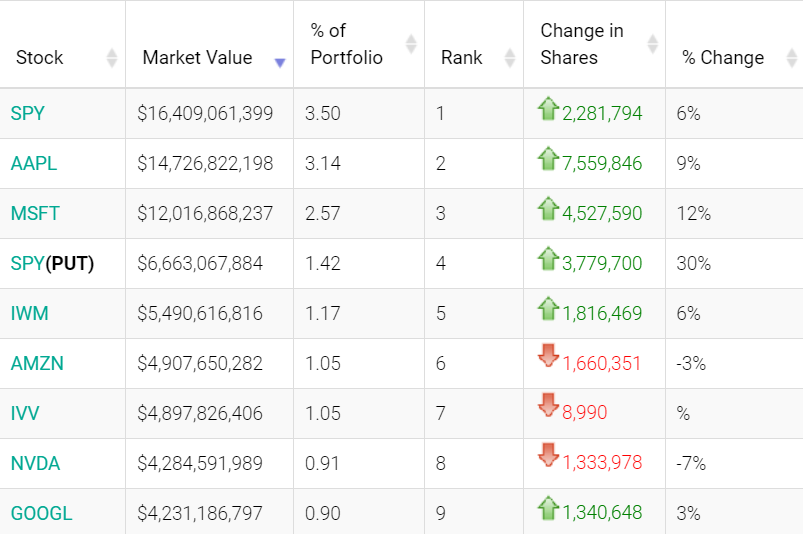

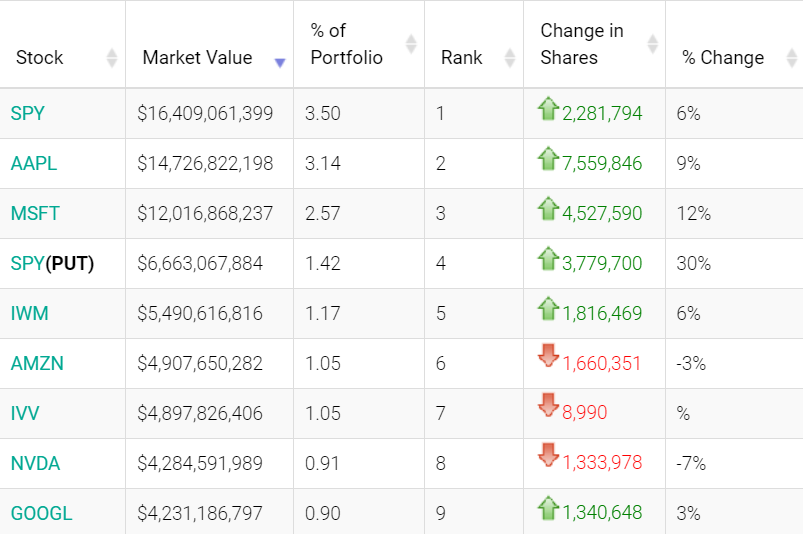

高盛:Q1增持蘋果、微軟、特斯拉,減持亞馬遜、阿里ADR

高盛13F文件顯示,該行一季度持倉總市值從上季的4467.77億美元增加至4684.76億美元。一季度高盛對標普500ETF-SPDR(SPY)、蘋果、微軟、iShares羅素200指數ETF(IWM)、谷歌A等重倉資產均有增持,另外增持特斯拉超210萬股,增持比例達24%,減持亞馬遜、英偉達等。中概股方面,增持拼多多37%的持倉,減持臺積電、阿里巴巴,其中對阿里ADR的減持比例高達57%。

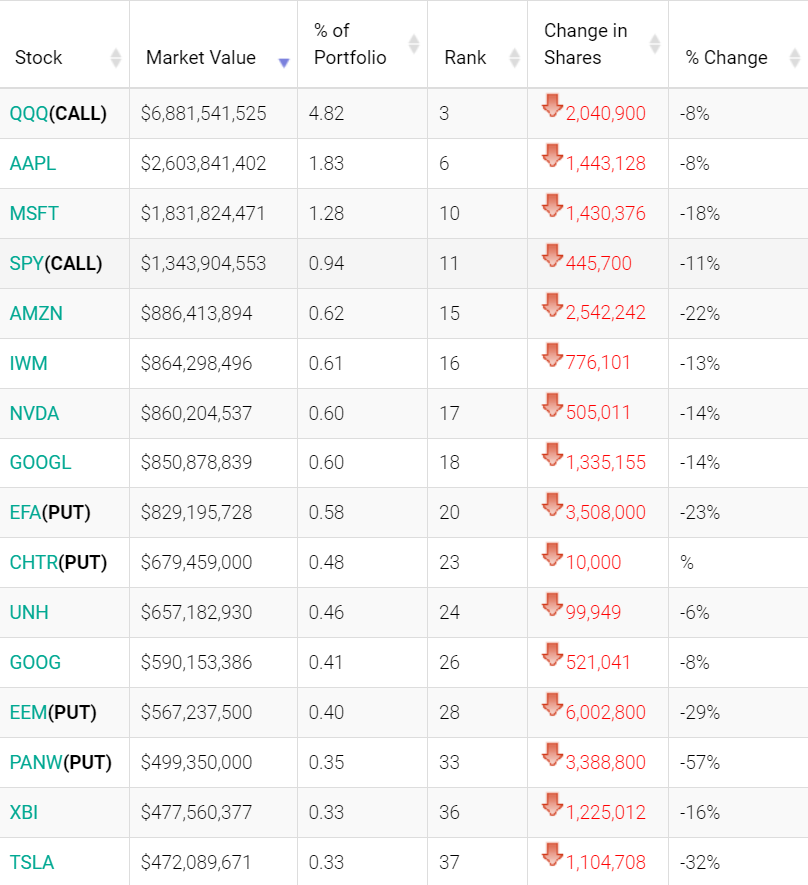

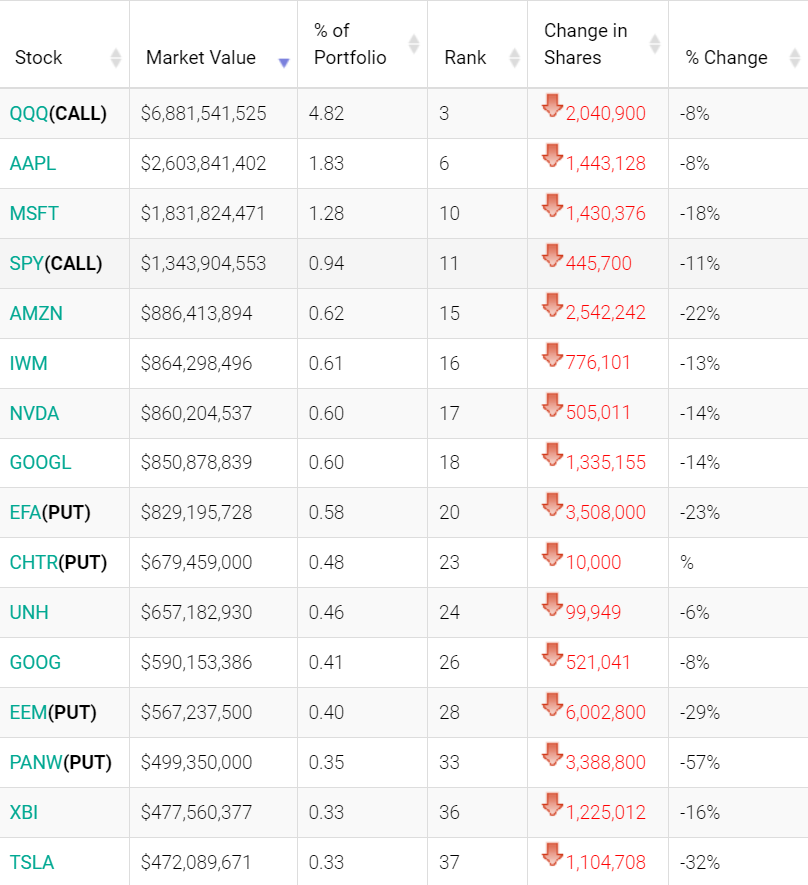

花旗:Q1重倉指數期權,減持多隻重要科技股

花旗集團公佈截至2023年3月31日止的第一季度持倉情況。13F文件顯示,該行一季度持倉總市值從上季的1255.86億美元增加至1426.5億美元。一季度納斯達克100指數ETF(QQQ)看跌及看漲期權、iShares羅素200指數ETF(IWM)看跌及看漲期權,及標普500ETF-SPDR(SPY)看跌期權佔據該公司重倉市值前列。該行一季度分別對蘋果、微軟、亞馬遜、英偉達、Alphabet、特斯拉均有較大幅度的減持,此外花旗還增持了近145萬份蘋果看跌期權。增持摩根大通、高盛、美國銀行、埃克森美孚石油、Visa等傳統價值股。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.