木頭姐“知行合一”!

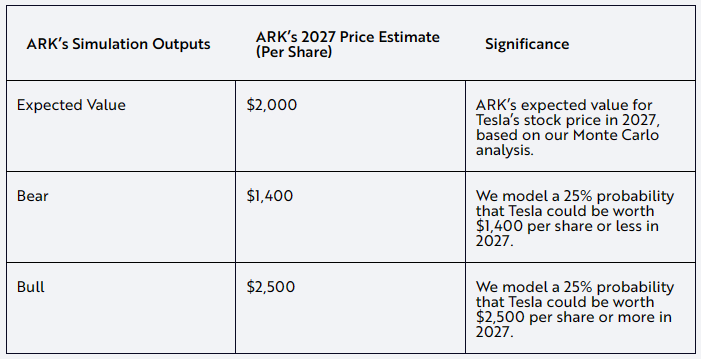

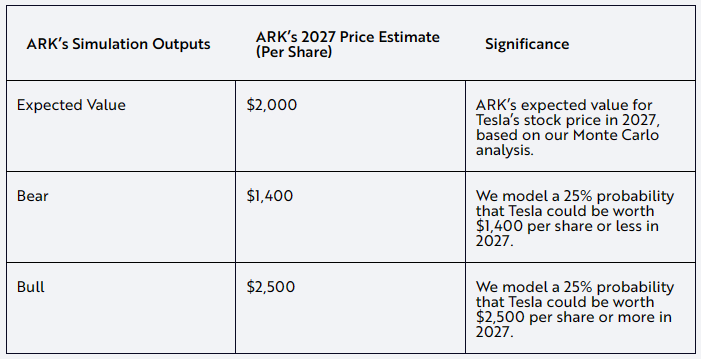

木頭姐”凱西·伍德旗下ARK投資管理公司預測,到2027年,特斯拉(TSLA.US)的股價將爲2000美元。具體來說,在牛市情況下,該股股價將爲2500美元;在熊市情況下,該股股價將爲1400美元。在唱多特斯拉的同時,ARK旗下基金ARKK和ARKW週四合計買入了25.6萬股特斯拉股票,按週四收盤價162.99美元計算,價值4170萬美元。

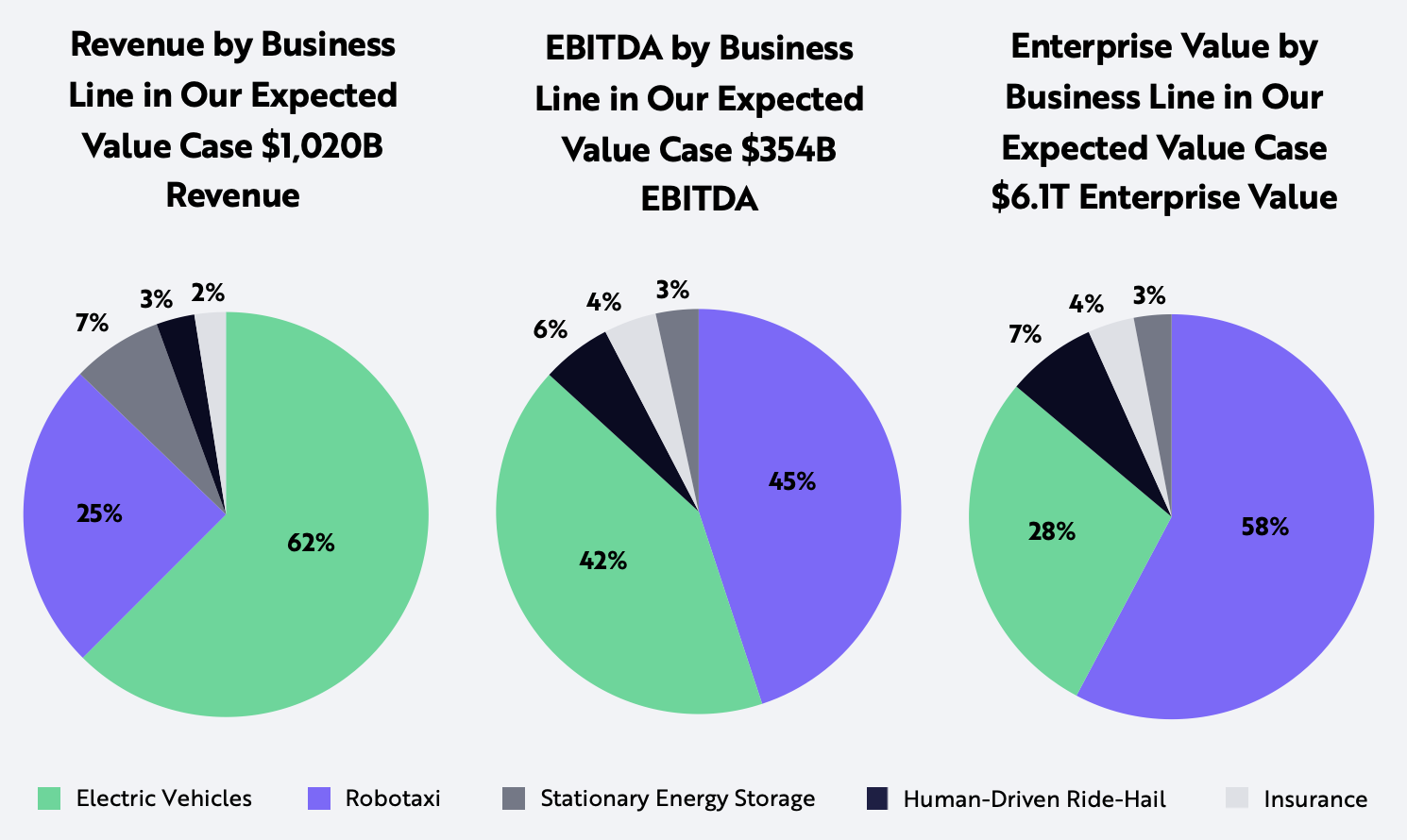

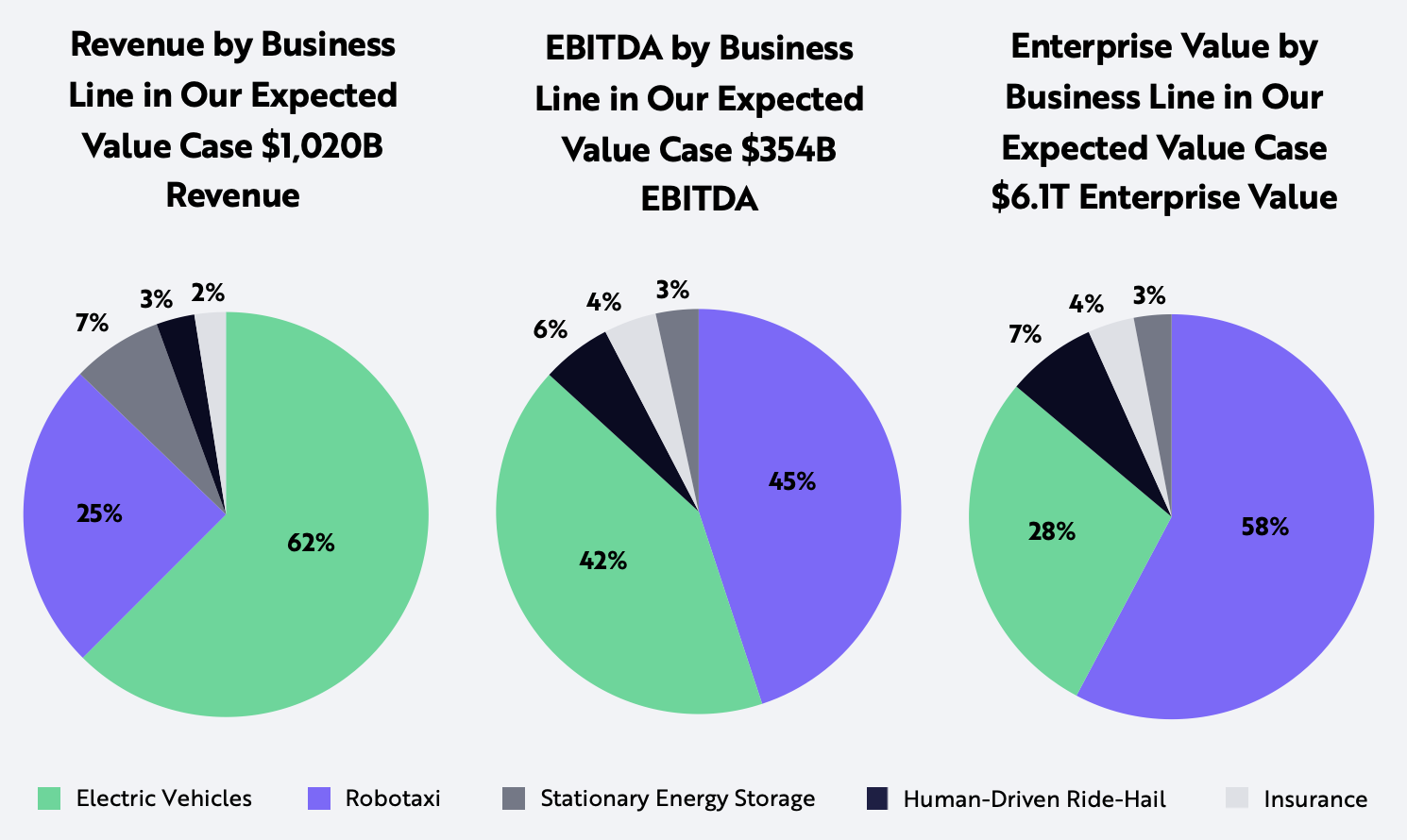

ARK表示,特斯拉未來的自動駕駛出租車業務是一個關鍵驅動力,在2027年將貢獻58%的預期企業價值和45%的息稅折舊攤銷前利潤(EBITDA)。ARK表示,到2027年,電動汽車業務將佔營收的62%,但其利潤率將遠低於自動駕駛出租車業務。

ARK表示,越來越相信特斯拉很快就會推出自動駕駛出租車服務。該公司表示,近期人工智能的一系列進展應該會加速自動駕駛行業的創新。特斯拉的垂直整合戰略和Dojo超級計算機是關鍵的競爭優勢。特斯拉計劃明年將Dojo的訓練規模擴展兩個數量級,這將幫助該公司縮短模型更新之間的時間。

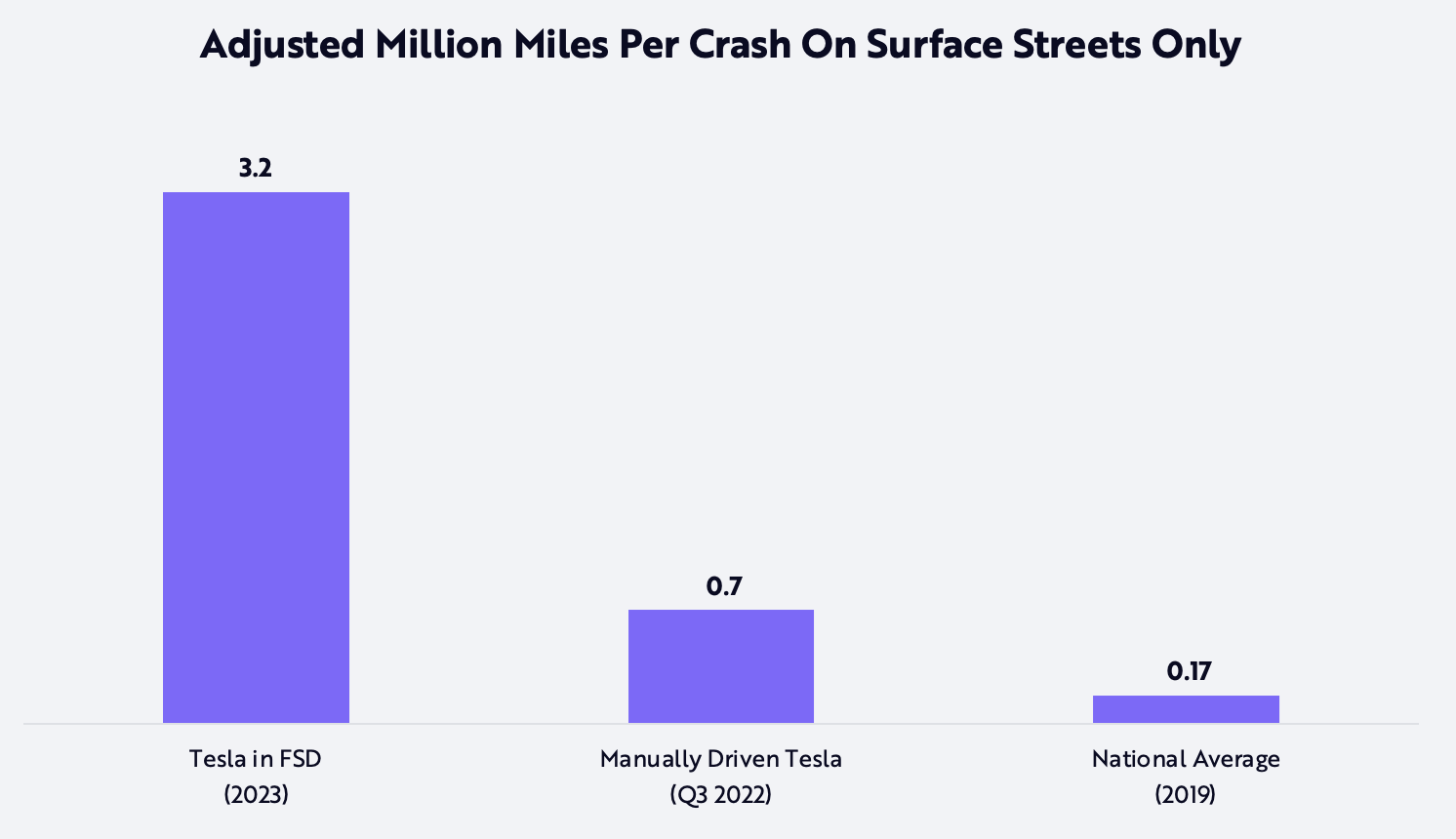

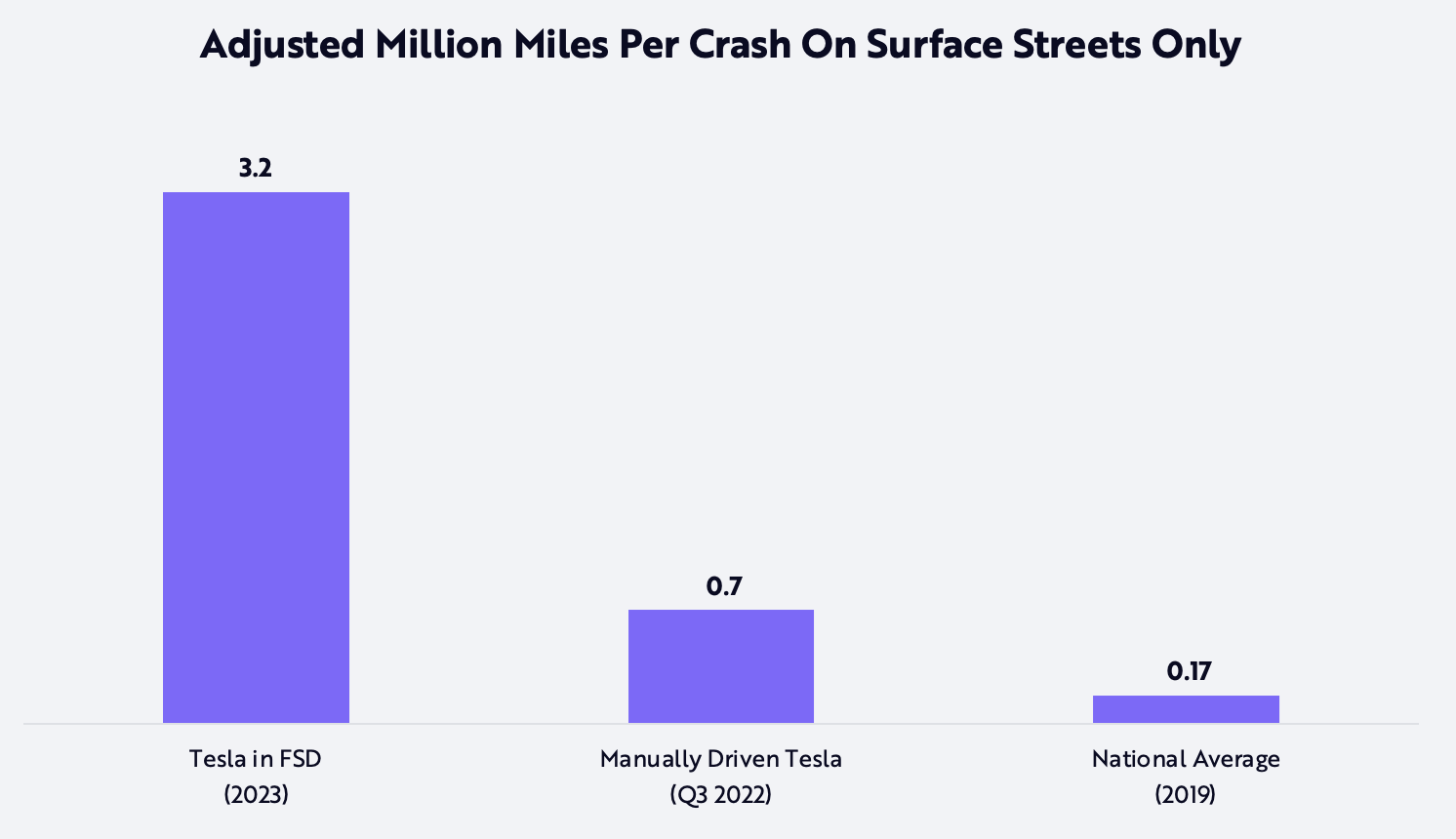

此外,ARK指出,特斯拉的數據庫應該有助於從統計數據上證明其自動駕駛車輛的安全性,從而使其在監管審批過程中比同行具有顯著優勢。特斯拉旗下車型每天行駛超過1.2萬億英里,其中在FSD Beta版本軟件控制下的行駛里程每天超過100萬英里。ARK還表示,事故統計數據表明,特斯拉已經取得了優於人類駕駛員的性能。

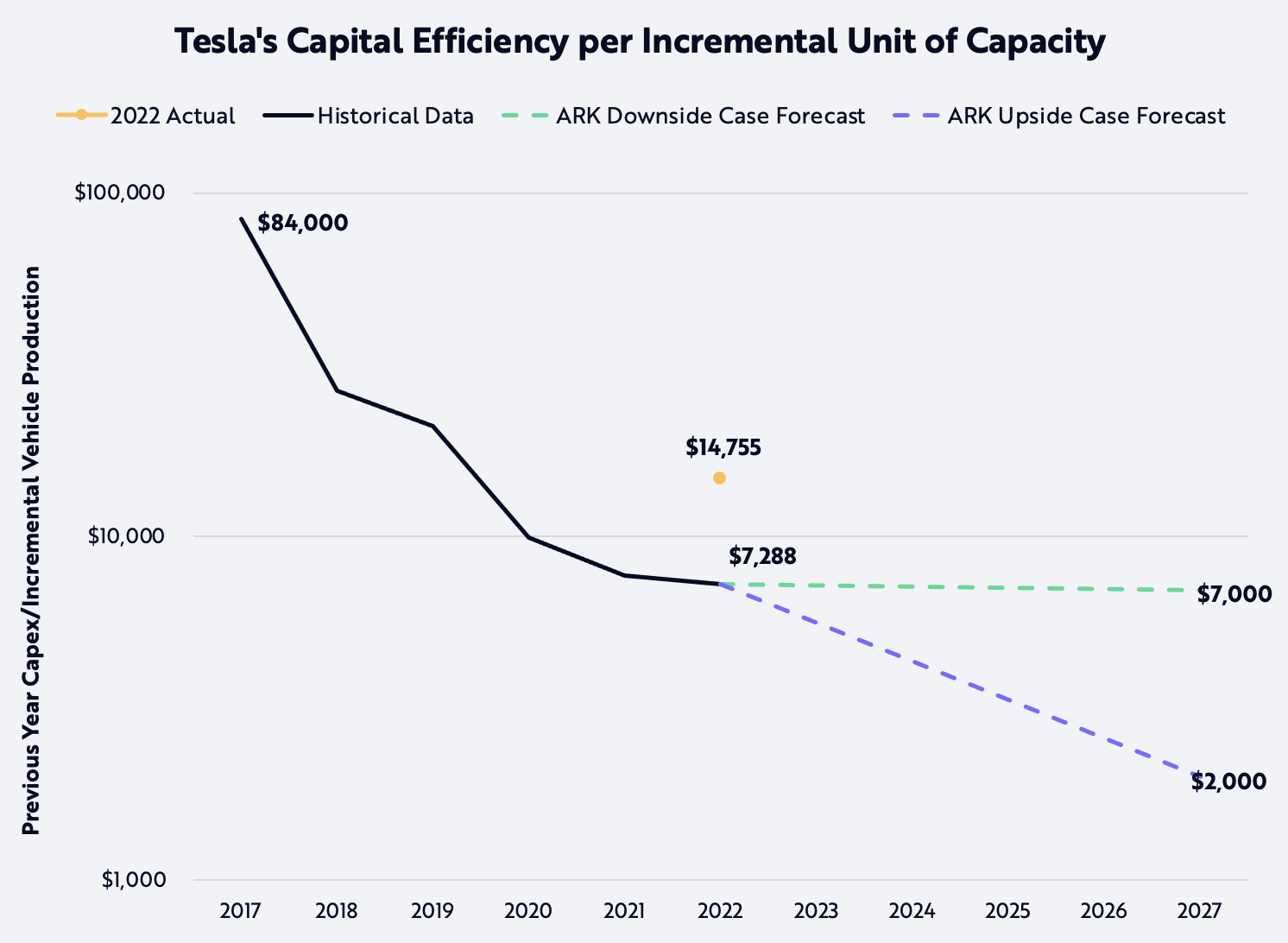

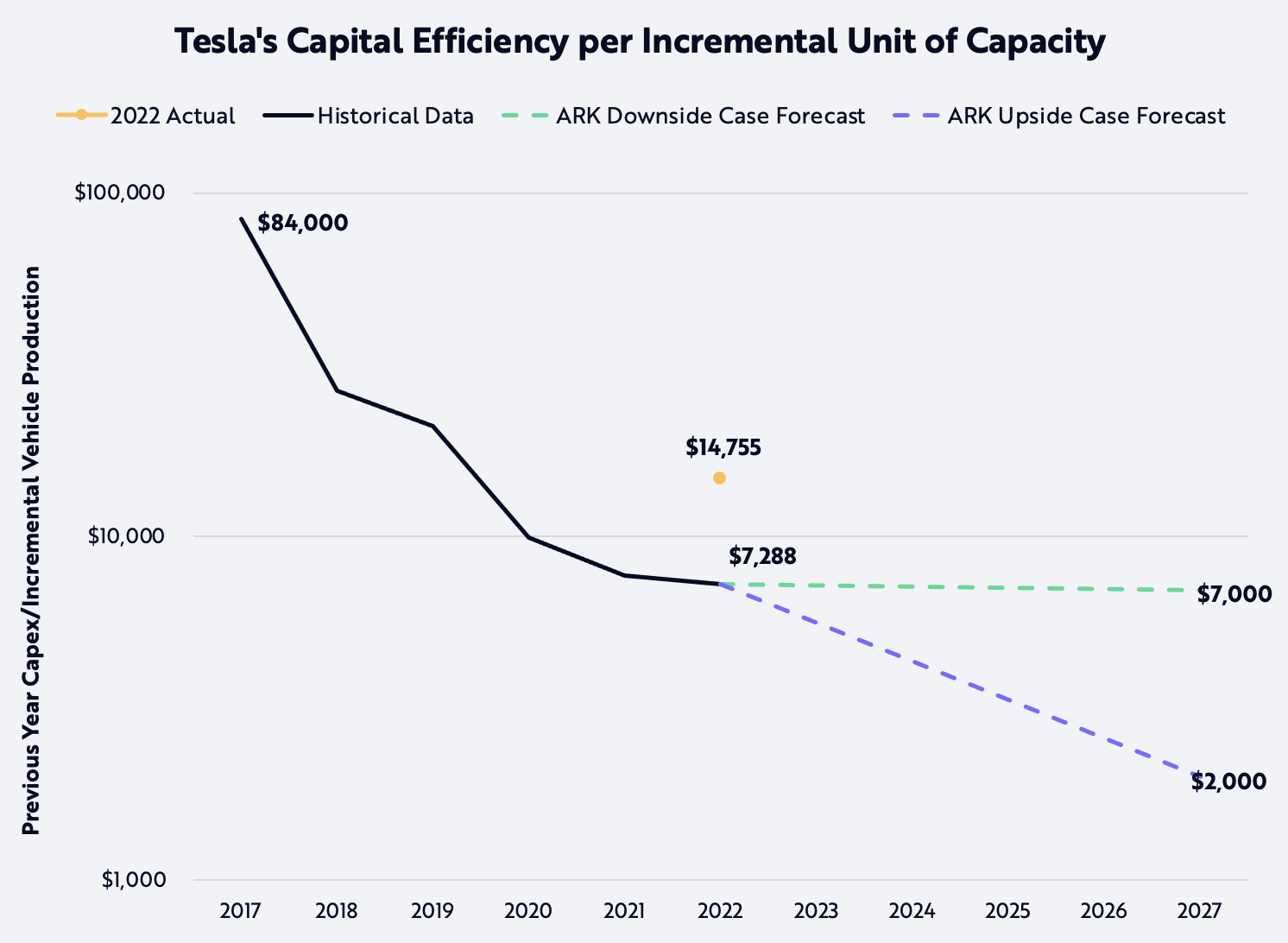

ARK指出,特斯拉每增加單位產能的資本支出從2017年Model 3投產時的8.4萬美元降低到2021年的7700美元左右,這意味着資本效率的提高。不過,由於兩家超級工廠的同時投產,上述指標在2022年底增至14755美元,而一旦這些超級工廠的產能爬坡完成,該指標將再度下降至約7000美元。

ARK認爲,雖然這些進步表明特斯拉可以繼續提高利潤率,但更重要的是,資本並不是限制增長的瓶頸。相反,特斯拉應該能夠在管理帶寬和供應限制允許的情況下儘可能快地增長。特斯拉在2023年3月1日的投資者日上強調了其下一代汽車架構和製造流程,包括減少與建造工廠相關的佔地面積和時間的步驟,這將降低帶寬需求並加速擴展。

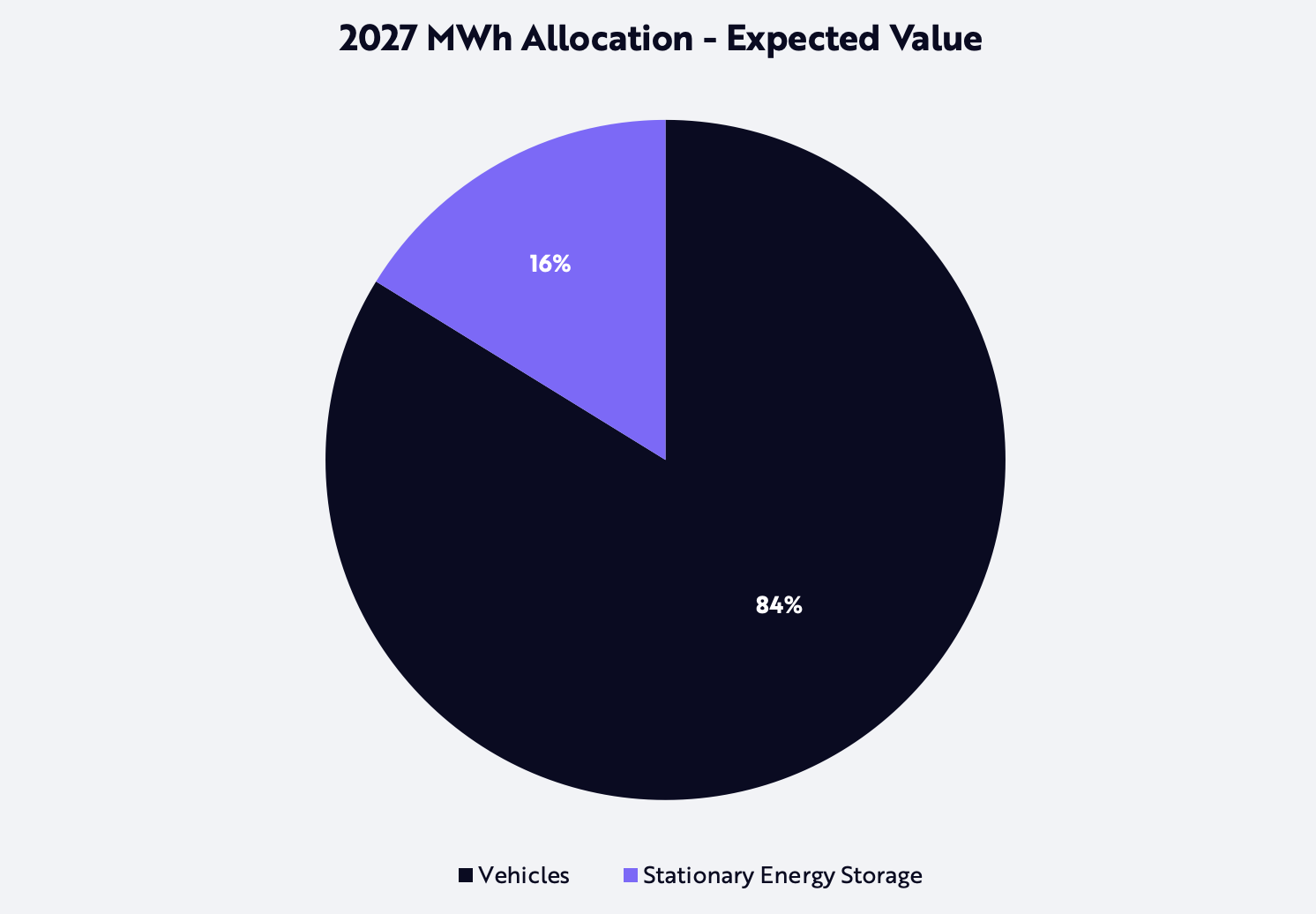

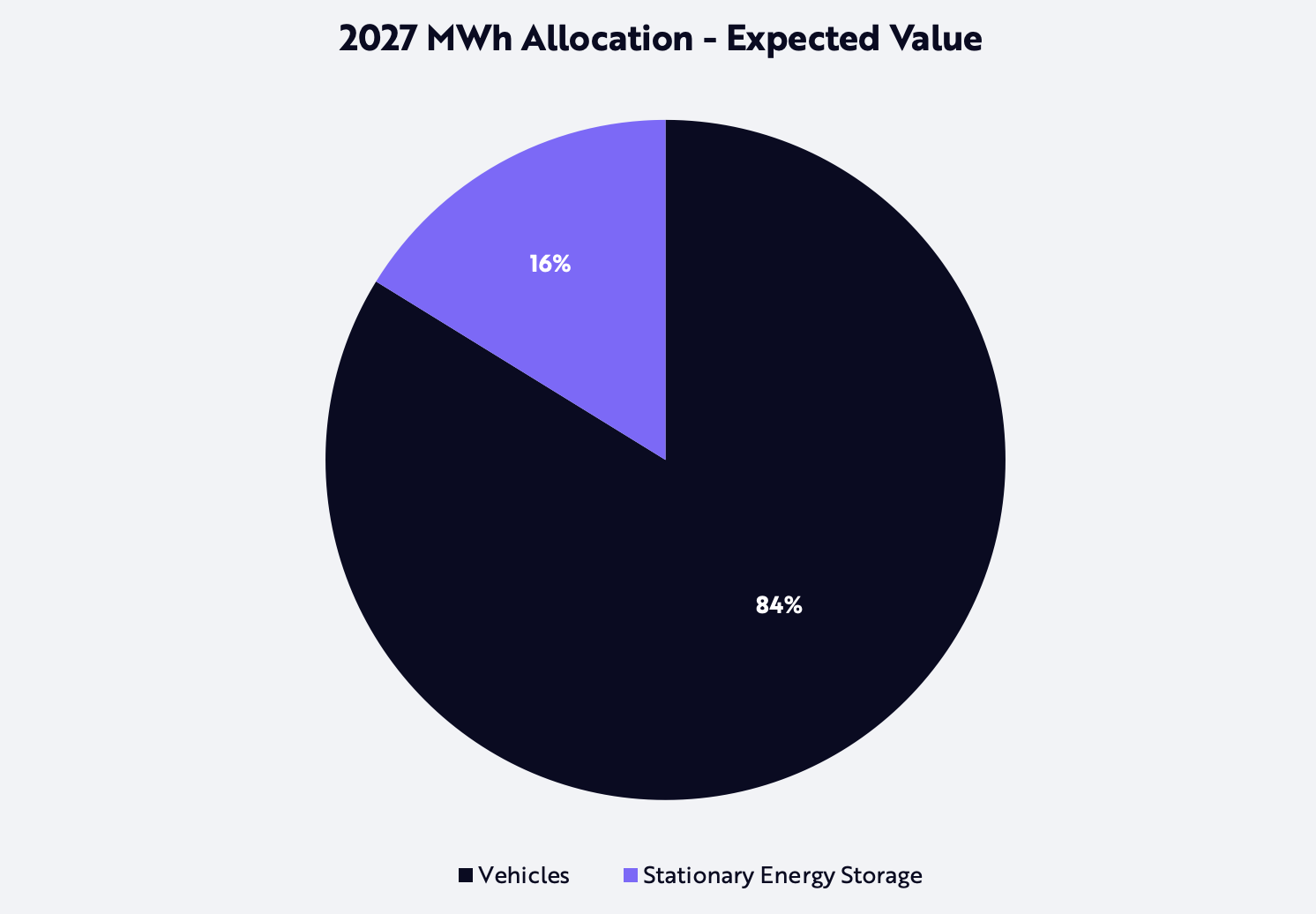

ARK預計,特斯拉將優先發展汽車業務,在汽車業務受到規模限制時才擴展其固定儲能業務。根據其分析,到2027年,儲能將爲特斯拉的預期企業價值貢獻66億美元,即3%。ARK預計,特斯拉將在2027年部署約200GWh的固定式儲能,其中約16%的電池容量用於固定式儲能,約84%用於車輛。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.