期權大單 | “AI神股”成交躍升,阿里巴巴被低估50%?

uSMART盈立智投 04-19 17:58

市場概覽 (4月18日)

週二,市場繼續關注大企業財報及美聯儲政策,美股三大指數基本平收,納斯達克指數跌0.04%,道瓊斯指數跌0.03%,標普500指數漲0.09%。

昨日美股期權市場總成交量31,074,588張合約。其中,看漲期權佔比54%,看跌期權佔比46%。

期權成交總量TOP10

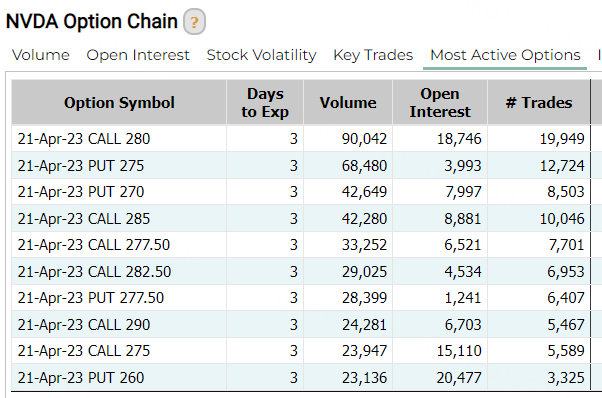

值得注意的是,英偉達居然超過特斯拉,在期權成交榜單中排在第三的高位。周內合約的成交非常活躍,多空交織。

行情方面,英偉達可能是ChatGPT掀起的生成式AI革命的最大贏家,週二(4月18日),英偉達的股價升至一年來高點,年內股價漲幅接近90%。若從去年10月份的低點算起,該股已經暴漲了約150%。

從目前芯片市場的現狀看,作爲整個AI大潮的算力基礎,英偉達的A100和H100 GPU正成爲搶手貨,特別是旗艦級別的新款H100在全球範圍內受到了熱炒。

英偉達創始人兼CEO黃仁勳上月表示,“我們正處於AI的‘iPhone時刻’。人工智能發展至今,對社會的影響可能像蘋果iPhone打開智能手機市場那樣。

目前,英偉達的市值已經超過6800億美元,僅次於蘋果、微軟、谷歌和亞馬遜,比特斯拉還要高出約1000億美元。

異動觀察

異動榜方面,特斯拉居首,阿里巴巴緊隨其後。消息面上,阿里巴巴3月下旬提出拆分六大業務的重組計劃之後,有分析師認爲阿里的股價被大大低估。

高盛集團的的羅納德·龔(Ronald Keung)估算認爲,與阿里巴巴業務和資產的價值相加的潛在股票價值相比,目前的股價已被低估約50%。

SBI證券的李燕表示,如果各項業務的獨立融資和IPO變得具體,“隨着增長潛力的提高和財務信息的公開等,市場也更容易進行評估,這可能帶來折價的縮小”。

而有美國媒體今年3月報道稱,阿里巴巴旗下的物流公司力爭最早年內在香港上市。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.