期權大單 | 跌過頭了?做多資金押注京東將"反擊";航空股齊挫,看漲期權紛紛進場

一、市場概覽

美東時間週三(4月12日),美股收跌。美國3月CPI同比增長5%,增幅創兩年新低,低於市場預期。美聯儲3月貨幣政策會議紀要顯示,該機構預計銀行業危機將在今年引發經濟衰退。截至收盤,道瓊斯指數跌0.11%,納斯達克指數跌0.85%,標普500指數跌0.41%。

週三,期權市場總成交量達36,016,504張合約,其中,看漲期權佔比53%。

標普指數ETF-SPY期權成交878.6萬張合約,其中,看跌期權佔比52%。

二、期權成交總量TOP10

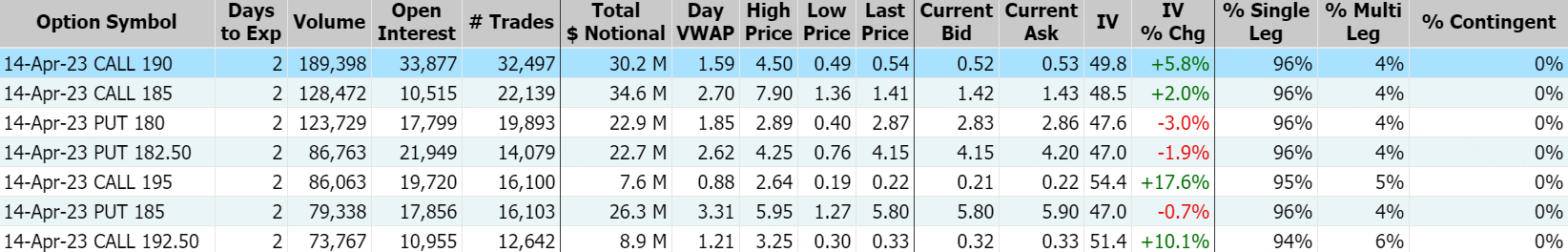

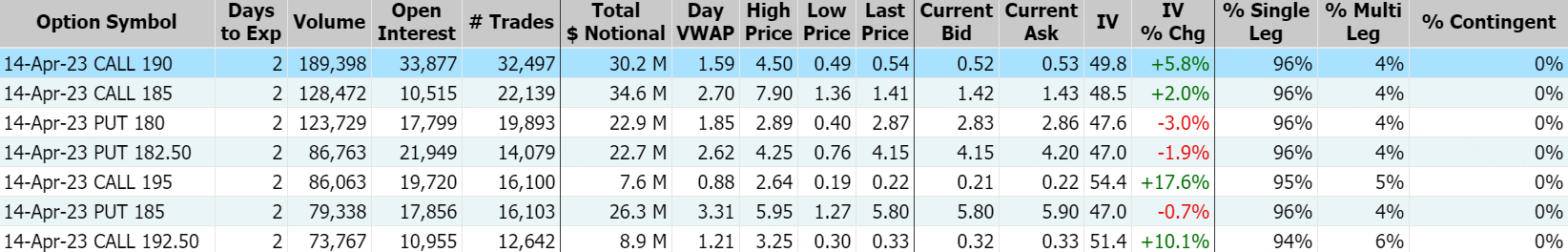

$特斯拉(TSLA)$週三跌超3%,報180.54美元。期權合約成交215.7萬張,看漲期權佔全部期權交易的54%。2023年4月14日到期行權價爲190美元看漲期權的成交量特別高,成交量爲189,398張。

$蘋果(AAPL)$週三微跌,報160.10美元。期權合約成交69.20萬張,看漲期權佔全部期權交易的56%。2023年4月14日到期行權價爲162.50美元看漲期權的成交量特別高,成交量爲98,390張。

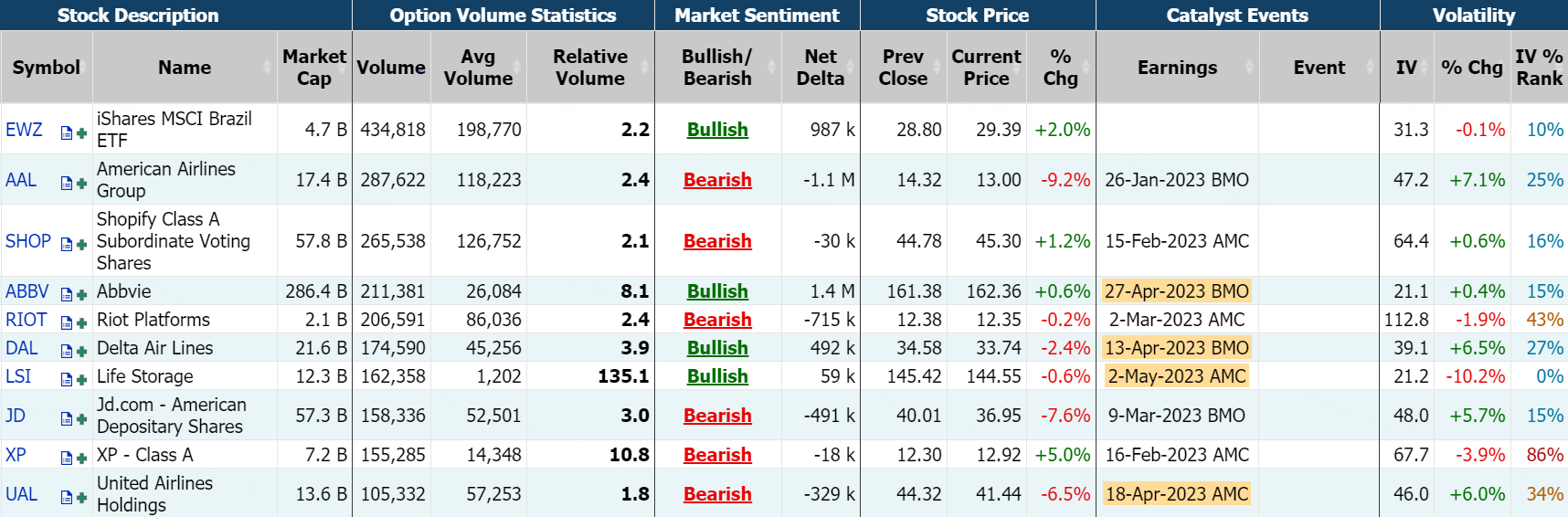

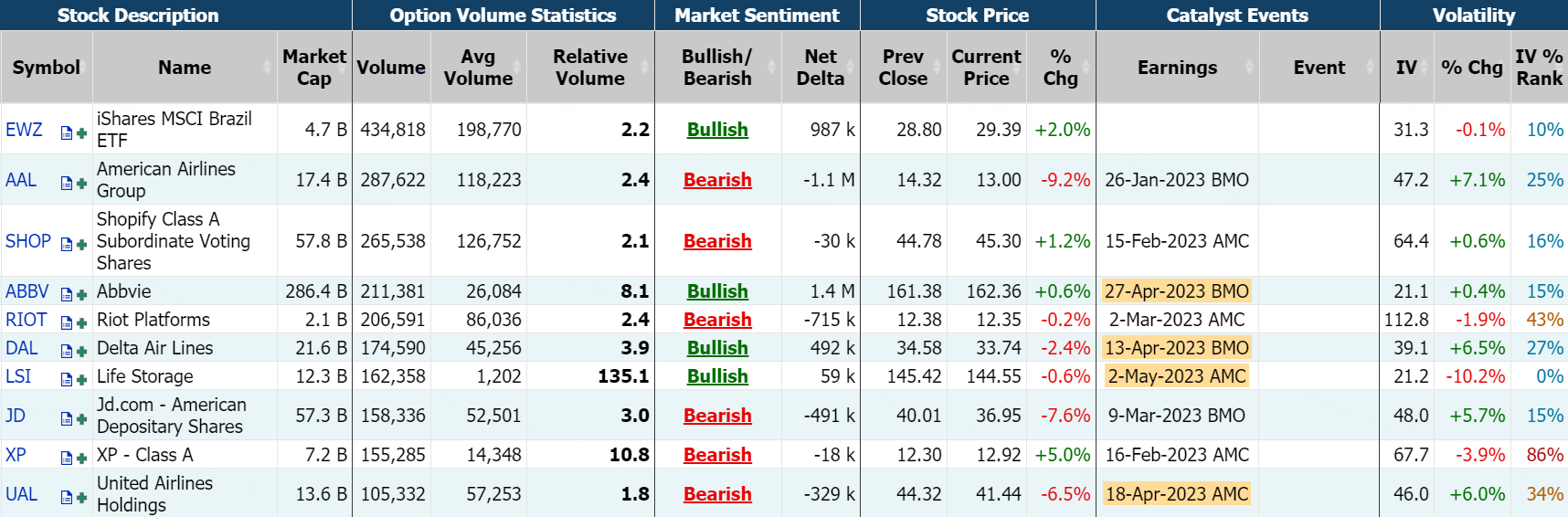

三、異動觀察

$美國航空(AAL)$週三跌超9%,報13美元。當日的看跌期權佔全部期權交易的49%。2023年5月19日到期行權價爲14美元看漲期權的成交量特別高,成交量爲13,831張。

消息方面:美國航空公佈Q1盈利初步指引,不及市場預期。在週三發佈的一份8-K文件中,該公司的每股收益預測雖然較1月份的指引有所提高,但與華爾街的共識相比略有下降。該航空公司預計,第一季度經調整後的攤薄每股收益將在0.01美元至0.05美元之間,區間中點低於0.04美元的普遍預期,而此前的指引爲接近盈虧平衡。

Shopify週三上漲1.16%,報45.30美元。當日的看漲期權佔全部期權交易的74%。2023年4月14日到期行權價爲50美元看漲期權的成交量特別高,成交量爲69,101張。

$達美航空(DAL)$週三跌超2%,報33.74美元。當日的看跌期權佔全部期權交易的49%。2023年4月14日到期行權價爲34美元看漲期權的成交量特別高,成交量爲24,809張。

京東週三跌超7%,報35.95美元。2023年4月21日到期行權價爲52.50美元看漲期權的成交量特別高,成交量爲5,145張。這意味着在期權市場中,做多資金押注京東在下週(4月21日前)將有大幅反彈。

$聯合大陸航空(UAL)$週三跌超6%,報41.44美元。2023年4月14日到期行權價爲43美元看漲期權的成交量特別高,成交量爲8,044張。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.