10天翻倍,博彩股終於撥雲見日,防控再優化,小摩稱仍有100%潛在上升空間

11月以來港股飆入牛市,反彈急先鋒除了地產股還有誰?博彩股!從11月1日到12月7日,永利澳門漲了近1.5倍,其中近10個交易日就連漲翻倍,美高梅中國翻了1.4倍,行業整體漲幅在80%左右。

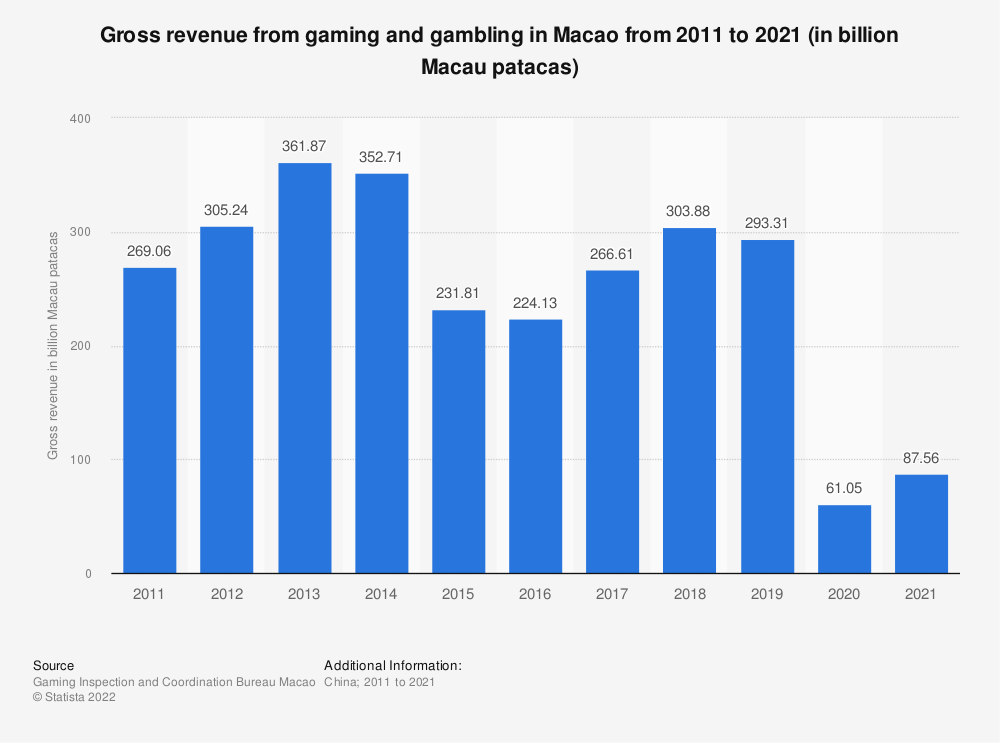

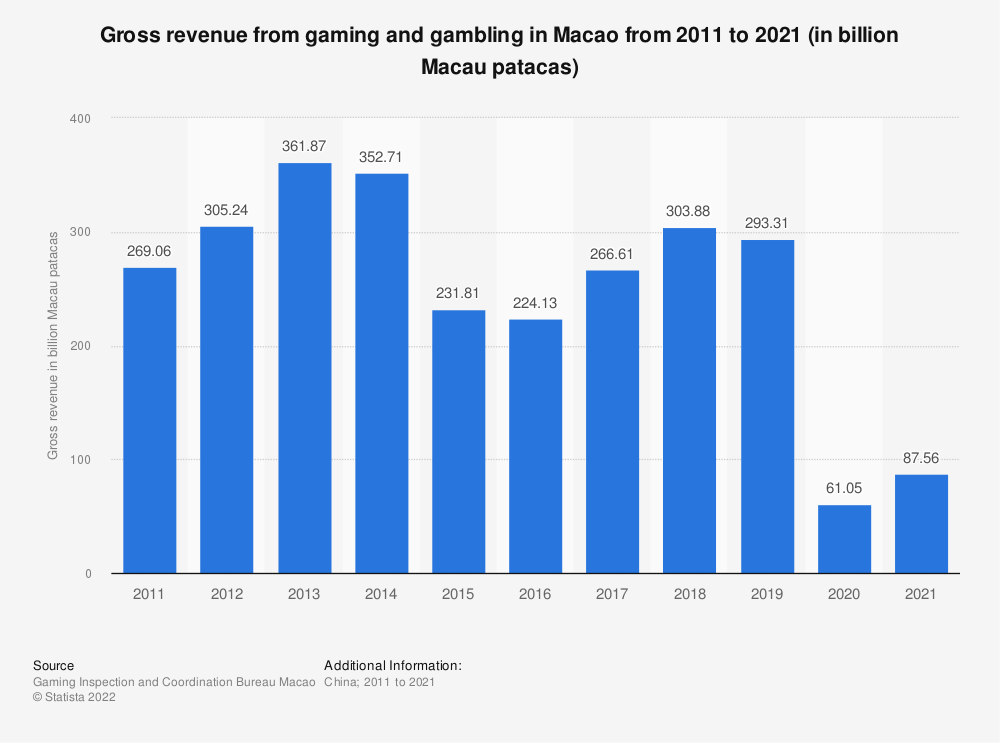

地產股爆發是因爲市場悲觀到了極點的時候出現了政策曙光,而博彩股是防疫政策優化帶來的業績提升預期。看一下澳門歷年的博彩收入就能更好的理解了。

疫情這三年,澳門的博彩收入可以說是腳踝斬,從2019年的近3000億澳門元驟降到700億左右,根據最新的統計數據,今年前11個月幸運博彩毛收入387億澳門元,相較去年腰斬。

不過隨着“二十條”、“新十條”落地,旅遊出行開始復甦,博彩業也迎來曙光。

12月6日,澳門優化了由內地入境澳門人士的防疫措施,來自內地低風險區和常態化疫情防控區的不需要集中隔離,但加強了核酸檢測和抗原檢測的要求。

下一步更值得期待的是澳門放寬入境限制,尤其是港澳通關。

對於未來澳門博彩業的發展,摩根大通仍然明確地看好,因爲賭牌風險清除,行業有一個更清晰的前景、需求增長,加上與過去兩年相比,目前市場環境更加寬鬆,流動性問題改善。基本和牛市情境預測顯示博彩股分別平均有30%和100%的潛在上升空間,認爲目前加倉未算太遲。

天風證券此前也表示,隨着擾動趨於緩和,疊加放開電子籤申請雙重利好,澳門入境旅客數量有望繼續攀升,從而推動博彩企業中場業務及酒店、餐飲、娛樂城等非博彩業務增長。疫情防控措施調整是澳門博彩行業短期內的主要催化因素,在出入境管制趨於放寬的預期下,澳門博彩行業有望迎來業績持續修復。

投資標的涉及澳門博彩股的ETF是VanEck Gaming ETF(代碼BJK),成立於2008年,投資組合包括在線遊戲、賭場、賭場度假村和相關業務。截至12月7日,資產規模8100萬美元,銀河娛樂、美高梅、金沙中國爲第6-8大重倉股,權重分別爲6%、4.8%、4.3%,前十大持倉股總權重爲58.3%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.