On January 8, 2026, Alibaba's (BABA.US) stock price saw a strong rebound, closing at $154.47, up $7.72 from the opening price, reflecting a 5.26% increase. The surge in stock price is attributed to the company's growing maturity in its AI, cloud computing, and smart hardware strategies, which have boosted investor confidence.

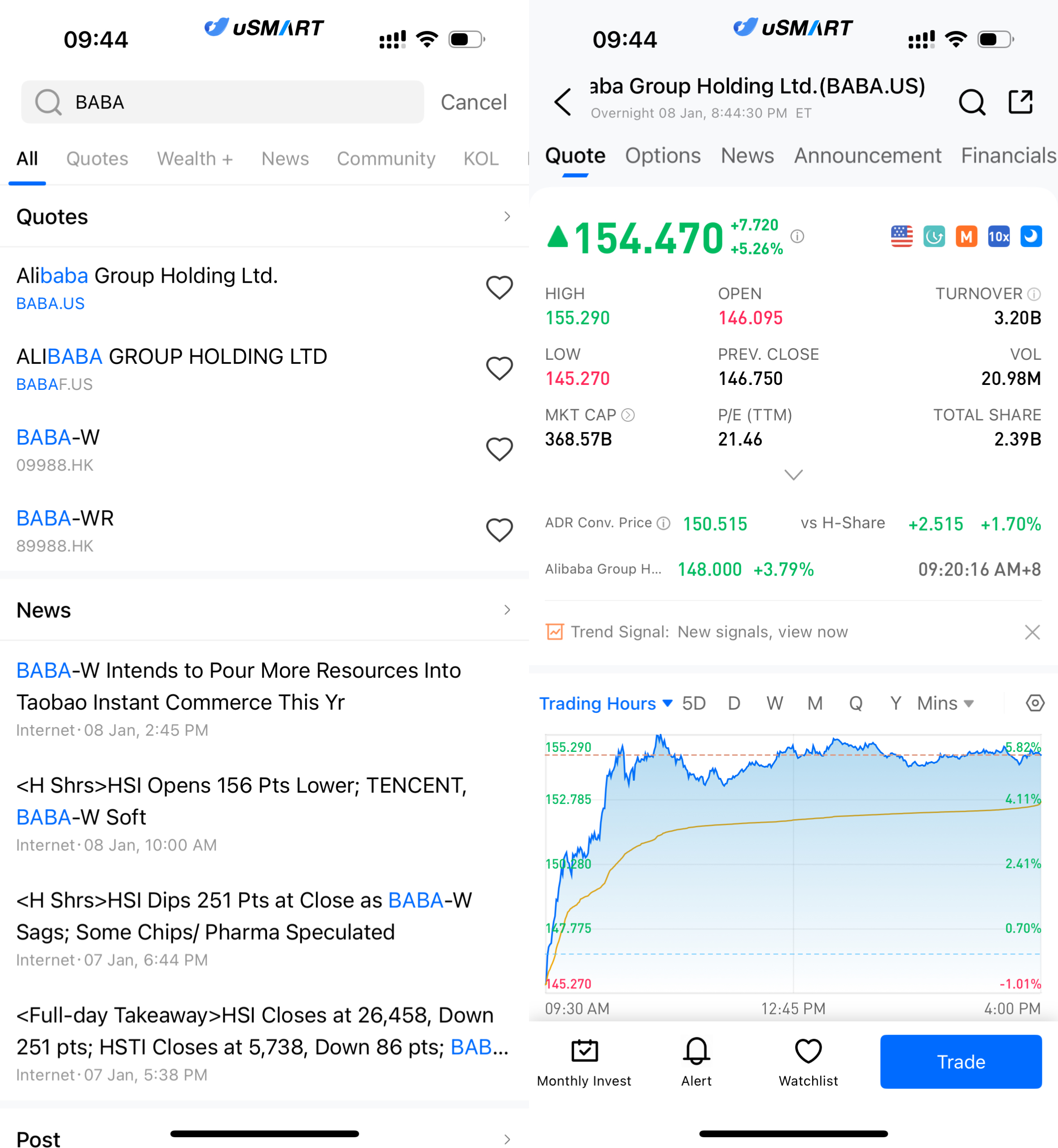

(Image source: uSMART HK app)

AI Strategic Breakthrough: Promoting Deep Integration of Smart Hardware and Cloud Computing

Recently, Alibaba Cloud released its multimodal interaction development suite, which integrates three foundational models from Tongyi, namely Qianwen, Wanxiang, and Bailing. These models feature capabilities in listening, vision, thinking, and interaction, and can be applied in smart eyewear, companion robots, and other hardware devices. This marks a deeper step in Alibaba's smart hardware expansion, especially in breakthroughs in technologies such as voice recognition, image recognition, and natural language processing.

The suite launched by Alibaba Cloud not only represents a technological innovation but also brings about an ecosystem upgrade in the market. By adapting to the RISC-V architecture, Alibaba has showcased its strengths at the chip level, further enhancing collaboration between software and hardware optimization.

Accelerating Global Expansion: Strengthening Alibaba's Competitiveness in International Markets

In addition to technological breakthroughs, Alibaba is continuously expanding its presence in international e-commerce, cloud computing, and logistics. According to Alibaba's latest financial report, the company’s international business revenue grew by over 30%, which has been achieved through robust technological support and localized operational strategies.

In the global competition, Alibaba no longer solely relies on traditional e-commerce business. Instead, it is creating a strong market moat through AI-driven smart logistics, digital retail, and cloud computing solutions. Particularly in emerging markets like Southeast Asia and Europe, Alibaba’s advantages are becoming increasingly apparent, further boosting market expectations for its long-term growth.

From Innovation to Application: A Full-Scenario Strategy Led by Technology

Alibaba is no longer just a traditional e-commerce platform. As its technological capabilities increase, the company is positioning itself as a full-scenario intelligent service provider. The multimodal interaction suite launched by Alibaba Cloud not only boasts powerful AI voice, video, and text-image interaction capabilities but can also be deeply applied across multiple scenarios. For example, in the fields of smart eyewear and robots, Alibaba Cloud’s technology can offer real-time voice translation, photo translation, voice assistant services, and more, greatly enhancing user experience.

This technology's widespread application not only empowers hardware devices but also provides strong support for the upstream and downstream of Alibaba's industrial chain. From AI assistants to smart homes, from cloud computing to the Internet of Things, Alibaba is driving deep integration across industries through technological innovation, securing its place in the global smart hardware market.

AI and Globalization Strategy: Dual Engines Driving Alibaba’s New Growth Cycle

Overall, the surge in Alibaba’s stock price reflects the market’s strong recognition of its diversified strategy and technological innovations. As Alibaba continues to make breakthroughs in AI, cloud computing, and smart hardware, its accelerated global expansion further boosts the market’s optimism about the company’s growth potential.

The strong stock rebound is not only a reward for Alibaba’s technological innovations but also a positive response to its increased competitiveness in international markets. Investors widely believe that as the global economy recovers, Alibaba will continue to create value for its shareholders through technological leadership and global expansion in the coming years.

How to Buy Alibaba via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (BABA.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)