Alibaba (BABA.US) recently released its earnings report, showcasing a solid financial foundation and strong growth momentum. As of the close on November 25, 2025, the company’s stock price stood at $157.01, a slight decrease of 2.31%. Despite market fluctuations, the company’s financial performance remains impressive. With the release of its Q3 2025 earnings report, Alibaba has further strengthened investor confidence in its long-term value, fueled by growth in revenue, cloud computing expansion, and advancements in artificial intelligence.

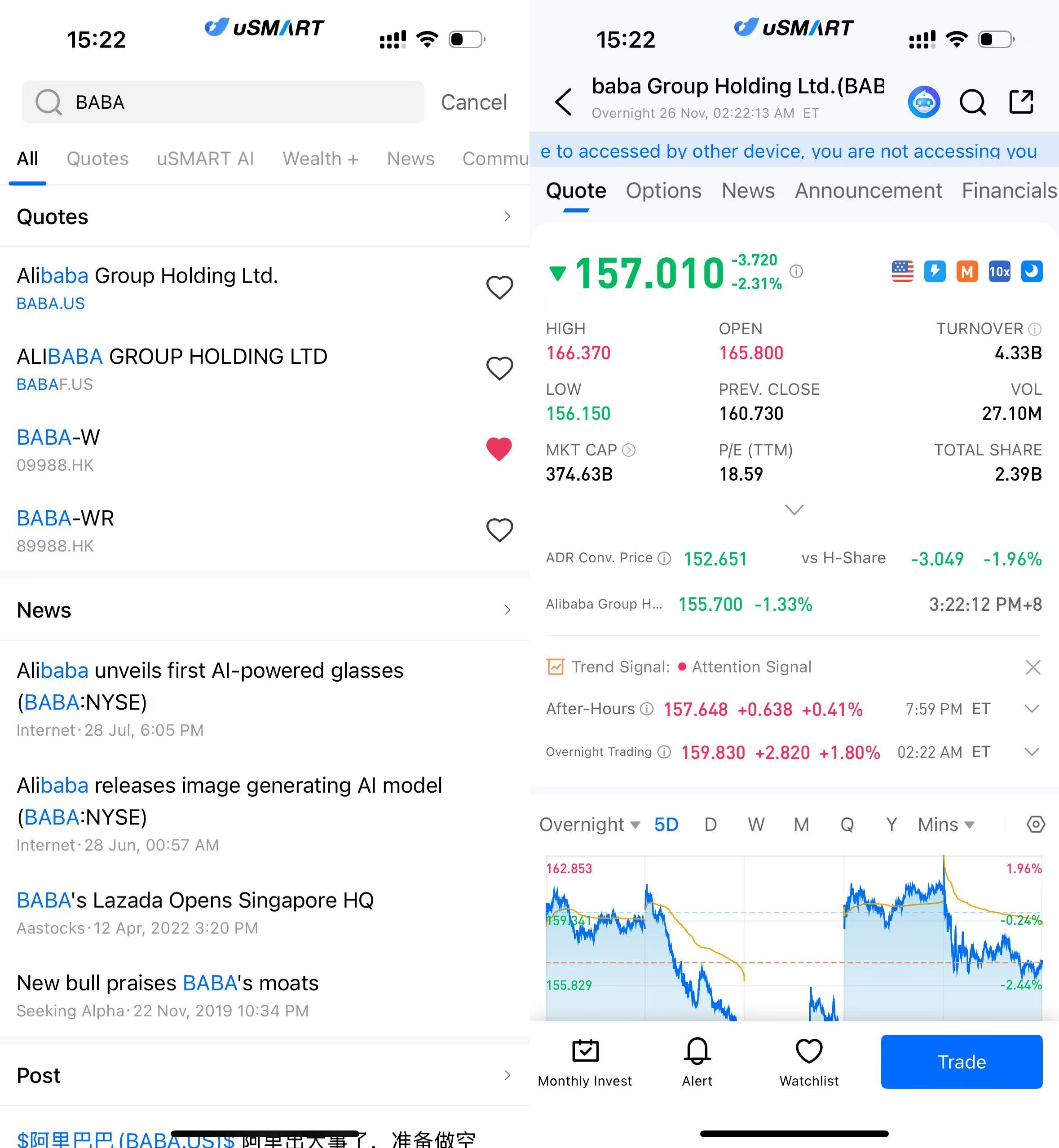

(Image Source: uSMART HK app)

Earnings Highlights: Steady Revenue Growth, Exceptional Cloud Performance

According to the latest financial report, Alibaba posted a strong performance for Q3 of fiscal year 2025, with total revenue of $23.451 billion, a 12% year-over-year increase. Net profit stood at $4.567 billion, up by 9%. The key financial data is as follows:

|

Financial Metric |

Value |

Change |

|

Total Revenue |

$23.451 billion |

+12% |

|

Net Profit |

$4.567 billion |

+9% |

|

Cloud Computing Revenue |

$10.211 billion |

+15% |

|

E-commerce Revenue |

$11.679 billion |

+8% |

|

EPS (Earnings Per Share) |

$2.08 |

+5% |

(Source: Alibaba Q3 2025 Earnings Report)

Notably, the cloud computing business continued to lead the revenue growth, reaching $10.211 billion, a 15% year-over-year increase. This growth reflects strong demand for Alibaba's enterprise-level services and cloud technologies, further consolidating its leadership in the global cloud computing market. Meanwhile, e-commerce revenue also hit $11.679 billion, showing a slight slowdown in growth but still demonstrating strong market competitiveness.

Launch of Qianwen Model: Alibaba Accelerates AI Technology Expansion

In addition to the earnings report, Alibaba has recently announced an important breakthrough in artificial intelligence— the Qianwen Model. As Alibaba's self-developed advanced AI language model, Qianwen shows significant potential in natural language processing and machine learning. The launch of this model will accelerate Alibaba's strategic push into AI, particularly in e-commerce, finance, and cloud computing, greatly enhancing its competitive edge in smart business and technological innovation.

The introduction of the Qianwen Model not only strengthens Alibaba's technological barrier but also provides technical support for future products and services, further boosting its influence in the global technology sector.

Looking Ahead: Innovation and Technology Drive Alibaba’s Continued Growth

Alibaba’s financial report and the launch of the Qianwen Model provide strong momentum for its future development. Although the growth rate of its e-commerce business has slowed, Alibaba still possesses substantial growth potential with the recovery of the global economy and the advancement of technological innovation.

With the dual driving force of cloud computing and AI technology, Alibaba is expected to further expand its market share and maintain its leadership position in the global e-commerce and technology industries. As new technologies like the Qianwen Model mature, Alibaba will continue to make strides in the intelligent business space, driving diversified growth across its entire business portfolio.

How to Buy Alibaba via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (GOOG.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)

(Image Source: uSMART HK app)