美聯儲轉鴿難了?

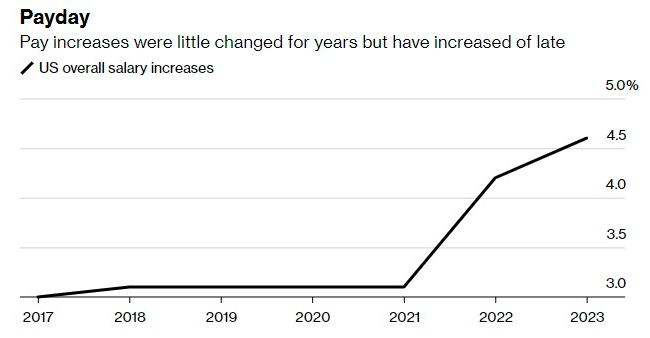

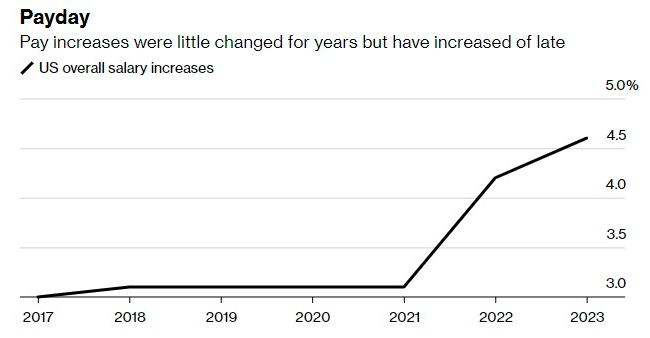

美國企業計劃將明年的工資提高4.6%,高於此前的預期,並高於今年的漲幅,因爲通脹和有彈性的勞動力市場促使企業競相提高工資,否則就有可能失去最優秀的員工。職場諮詢公司Willis Towers Watson(WTW)的一項調查發現,2023年,美國的整體工資4.6%漲幅將達2007年以來最大水平,高於今年4.2%的漲幅。

今年早些時候進行的一項類似的WTW調查僅顯示,2023年美國整體工資預計將增長4.1%。在過去一年中,七成公司在薪酬調整方面的支出超過了計劃,並且原本罕見的年中加薪現象變得司空見慣,一些公司正在通過漲價或減少員工總數來應對漲薪的情況。

修正後的調查顯示,鑑於頑固的通脹、仍然緊張的勞動力市場和冷卻的經濟,僱主和爲他們提供諮詢的顧問公司不得不迅速重新調整明年的薪酬預算。對職場公平的需求增加,加上紐約市等地新的薪酬透明度法律,也給僱主帶來了更大的薪酬預算壓力。WTW調查的四分之三的受訪者表示,他們在招聘和留住人才方面遇到了困難,自2020年疫情爆發以來,這一數字幾乎增加了兩倍。超過一半的公司表示,他們正在以薪酬區間的上限招聘候選人。

不過,諮詢公司Gartner Inc.的研究顯示,只有不到十分之一的僱主計劃提高工資,以匹配通脹。更常見的策略包括增加靈活的工作安排,或提高激勵或基於績效的薪酬。

另外,美國勞工部的數據顯示,上週初請失業金人數意外小幅下降,並保持在歷史低點附近,這證明瞭儘管美聯儲爲遏制數十年來的高通脹而大幅加息,美國就業市場仍韌性十足。儘管推特、亞馬遜公司(AMZN.US)和Facebook母公司Meta Platforms(META.US)等知名僱主企業進行了裁員,但企業仍在以穩健的速度招聘。美國上個月增加的就業崗位超過了預測,幾乎每一個美國人就對應兩個空缺職位。

儘管在美聯儲大幅加息的情況下,利率快速上升,經濟前景日益黯淡,但勞動力需求依然強勁。裁員人數雖然在增加,但仍處於歷史低位,數百萬職位空缺推動了工資的快速上漲。企業計劃漲薪無疑幫助支撐了作爲經濟引擎的消費者支出,但也讓美聯儲爲通脹降溫的行動變得更加困難。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.