一個月翻7倍!期權做空中概股到底有多爽?

在全球監管收緊、美聯儲加息等一系列因素疊加下,中概股和納斯達克先後集體暴跌,瞬間抹去的,不止2020年的虛假繁榮,部分中概股甚至抹去了過往十年甚至二十年的紅利。恆生指數、恆生科技指數也連日暴跌,創2011以來最低水平。

在市場大跌下,對於會做空的投資者來說,其實不是危機,反而是發財良機。港美股市場,有很多金融工具用來對衝下跌風險,合理利用這些工具,能幫投資者規避不少損失,甚至“逆勢”大賺。

其中最好的工具,莫過於期權。巧妙使用期權工具,可有效控制市場風險。

買入看跌期權策略:做空中概股,一個月賺7倍

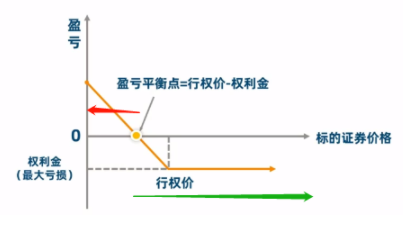

買入看跌期權適合的場景是基於對標的證券出現大幅下跌的預期。當標的證券跌到零時,盈利最大。

買入看跌期權的優點是損失有限,最大損失爲付出的權利金,可以對衝股票下跌的風險。

真實案例:期權做空中概互聯(KWEB)一個月賺7倍

KraneShares中國海外互聯網ETF(KWEB)是跟蹤在美股、港股上市的中國互聯網企業的指數,是目前全球投資者投資中國企業中,最大規模的指數基金之一。

9月12日,KraneShares中國海外互聯網收盤價爲29.4美元;10月11日,ETF收盤價爲22.57美元;一個月內,ETF下跌23%。如果投資者在此期間賣空ETF,便能賺到這部分下跌利潤。

但如果使用期權工具,效果會更爲驚人。以2022年10月21日到期,行權價爲23的看跌期權爲例。

9月12日,看跌期權的報價爲0.2美元;10月11日,短短一個月內,看跌期權當日的最高報價已經達到1.41美元,收盤價爲1.18美元。

假設投資者在9月12日使用1萬美元買入看跌期權,到了10月11日最高點賣出,本金一個月內翻了7倍有餘。1萬美元已經變成了7.05萬美元。

看跌期權除了做空,還可用於對衝

從理論上來說,賣空的風險是無限的,因此許多投資者在賣空時都會有所顧慮。對這些賣空股票的投資者來說,股票價格的上漲會讓他們心緒不安。投資者有可能會由於情緒的緣故而被迫作出也許是不正確的決定如回補賣空頭寸等,以減低心理壓力。但期權除了做空,也可給做多者當保險使用。

對於在市場危機時刻想要抄底的投資者,買入看跌期權也有大用。以阿裏巴巴爲例,阿裏巴巴今年截止目前最低點爲73.28美元,有投資者可能在股價100美元時,就做出已經見底的判斷。如果100美元時買入,就難免造出巨大虧損,但是如果在100美元買入的同時,同時花費一些金額買入行權價爲100的看跌期權,那麼在期權合約的有效期內,阿裏巴巴的任何暴跌,都不會讓投資者手足無措。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.