買騰訊虧七成,買ETF賺166%,你選什麼?

uSMART盈立智投 10-11 15:36

在通脹和美聯儲持續加息的背景下,今年美股和其它主要股票市場全線走熊。

比如港股扛把子——騰訊控股,從最高750港幣跌至257港幣,幾近打三折。即是說,最高點買騰訊的投資者虧了差不多七成。

炒股不行,換個思路呢?

藉助可以投資多空兩個方向的ETF,以及和股票一樣便利的交易形式,不少投資者仍然獲得了亮眼的回報。

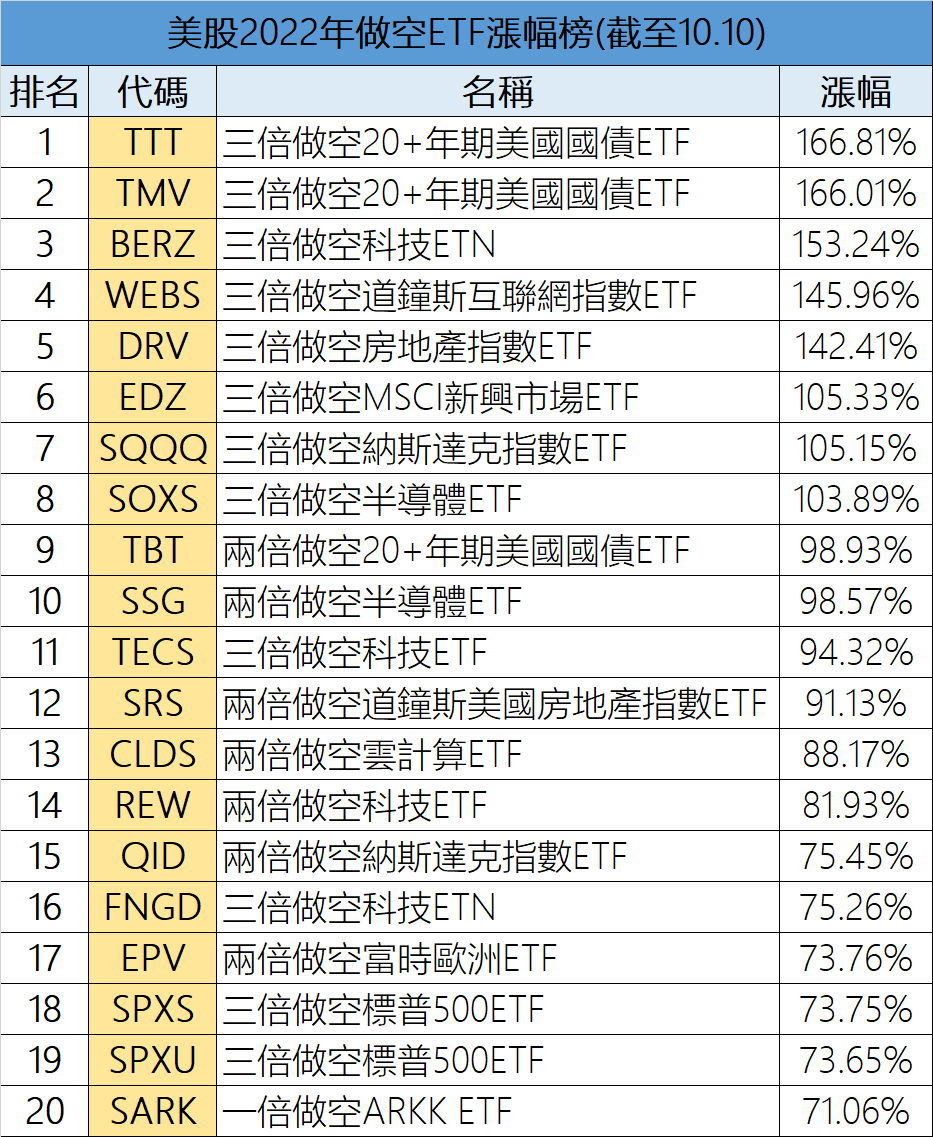

uSMART統計的美股ETF漲幅數據顯示,做空ETF收益頗豐,主要爲幾大類,國債、科技股、半導體、房地產,以及各市場的大盤指數,包括新興市場、美三大指數和歐洲。

美聯儲激進加息之下,美債收益率節節攀升,10年前美債收益率一度飆升至4%以上,做空美債的ETF迎來牛市,三倍做空20+年期國債ETF(代碼TTT和TMV)累計漲幅超過166%,位列榜單1、2名,兩倍槓桿的TBT也將近翻倍。

美股成長和科技板塊的股票遭受重創,做空科技股的ETF上榜數量最多,除了投資者較熟悉的SQQQ(漲幅105%),還有三倍做空的BERZ、WEBS、SOXS漲幅也都在100%以上。

做空大盤指數的ETF雖波幅較小,但也普遍錄得較高漲幅。漲幅最高的是三倍做空MSCI新興市場ETF(代碼 EDZ),納斯達克、標普500等指數的反向ETF漲幅也靠前。

值得注意的是兩倍做空富時歐洲ETF(代碼 EPV),雖然該ETF的槓桿係數比其它上榜ETF都低,但是歐洲作爲今年受通脹打擊最嚴重的發達經濟體,其股票下跌較爲激烈。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.