現金流ETF成“香餑餑”!

美國知名ETF發行商Pacer正尋求利用旗下“現金流導向型”ETF產品的高熱度,計劃推出一隻全新聚焦高現金流標的的交易所交易基金(ETF)。根據週二提交的一份文件,該發行商希望推出美國大盤股現金牛增長型領導者ETF (Large Cap Cash Cows Growth Leaders ETF),這是一隻被動型基金,專注於羅素1000指數成份股中自由現金流水平較高的大盤標的。

隨着投資者在市場動盪中尋找避風港,這些所謂的“現金牛”公司一直吸引着投資者的目光。這份提交的文件中沒有具體說明管理費或擬推出ETF的交易代碼。

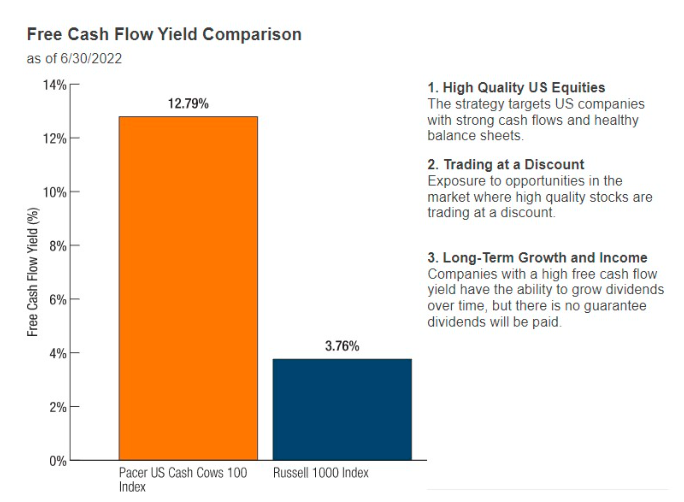

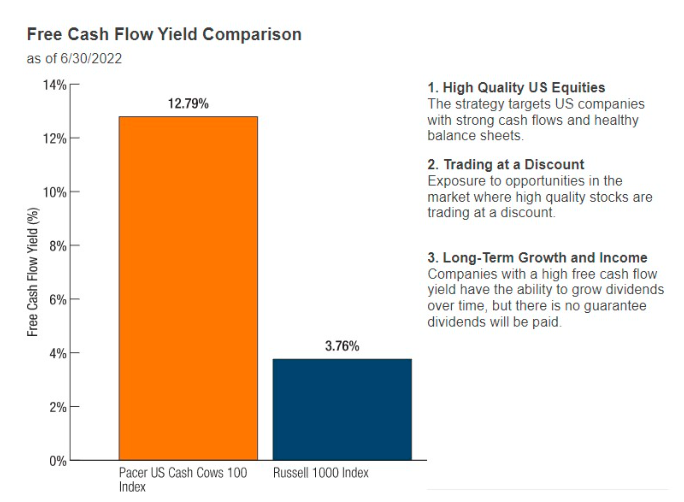

ETF流入量數據顯示,投資者今年青睞現金流較爲充裕的公司。該公司此前已經發行一款備受投資者青睞的聚焦高現金流的ETF產品——Pacer US Cash Cows 100 ETF (COWZ.US),專注於投資自由現金流水平較高的公司。根據彭博社彙編的數據,自去年2月以來,該產品每月都有大量資金涌入。今年,超過66億美元資金流入該ETF產品,有望成爲創紀錄的現金流入年。

儘管COWZ在2022年的總回報率下降了約14%,但它的表現遠遠優於標普500指數,後者今年以來跌幅超過23%,另外COWZ還大幅跑贏羅素1000指數。該ETF的主要持倉股票包括再生元製藥公司(REGN.US)、艾伯維公司(ABBV.US)和百時美施貴寶(BMY.US)等高現金流標的。

今年,在美聯儲激進加息預期的影響之下,股票、債券和加密貨幣等風險資產都受到了劇烈衝擊,使得市場投機領域遭受重創。投資者普遍認爲,在經濟增長放緩期間,現金流充裕的公司更具有投資價值。

早在今年8月份,來自Pacer的高管Sean O’Hara接受媒體採訪時表示,今年的市場環境對公司的COWZ這隻ETF來說非常有利。他表示,該基金每90天進行一次重新調整,剔除現金流爲負的股票,包括金融類股票。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.