盤點前三季度美股ETF:通脹受益ETF的盛宴,最高上漲1.4倍

在通脹和美聯儲持續加息的背景下,今年美股和其它主要股票市場全線走熊,但是藉助可以投資多空兩個方向的ETF,以及和股票一樣便利的交易形式,不少投資者仍然獲得了亮眼的回報。

另一方面,市場波動劇烈的情況下,跟蹤一籃子股票或指數的ETF,也幫助投資者實現了資產配置、分散投資的需求,降低做空/做多單一資產的不確定性。

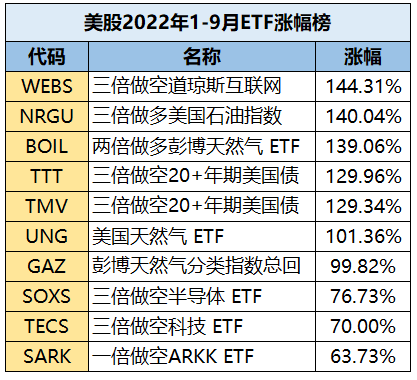

從榜單來看,2類受益於大通脹週期的ETF表現最佳:1類是做空股票和相關指數的ETF,1類是做多石油天然氣以及國債的ETF。

以2022年1月4日-9月23日數據統計,奪得漲幅頭籌的是三倍做空道瓊斯互聯網ETF(代碼:WEBS),期間漲幅達到144%。前三季度,美股成長和科技板塊的股票遭受重創,道瓊斯美國互聯網指數下跌40%,作爲三倍反向做空該指數的ETF,WEBS迎來大牛市。

漲幅榜第二、三、六、七位均是石油、天然氣相關的做多ETF。作爲本輪通脹週期的“原爆點”,化石能源價格在今年前三季度迭創新高,俄烏局勢嚴重影響資源輸出,疊加疫情救市大放水的通脹後遺症,使得石油、天然氣價格走入大牛市。

三倍做多美國石油指數ETF(代碼 NRGU)、兩倍做多彭博天然氣ETF(代碼 BOIL)在統計期間漲幅分別達140%和139%。

此外,成長股集中營的半導體、科技股步入熊市,三倍做空半導體、三倍做空科技的ETF也均有亮眼表現。其中值得一提的是,完全沒有槓桿的單倍做空ARKK的ETF(代碼 SARK)漲幅也高達63%,這是資管公司Tuttle Capital Management發行的ETF,跟蹤的是Cathie Wood木頭姐的ARKK創新科技ETF,只不過這隻SARK是反向跟蹤,坊間稱其爲“伐木基金”。2022年木頭姐投資創新成長股的ARK基金淨值遭遇重大下挫,“伐木基金”的投資者堪稱躺贏。

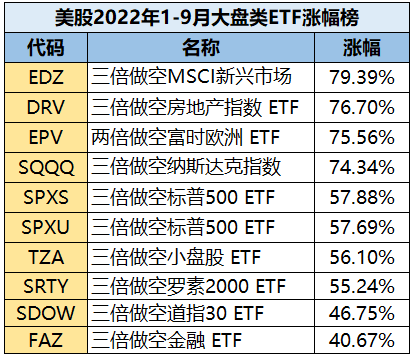

除了做空美國成長股、科技股的ETF表現出色,做空大盤指數的ETF雖波幅較小,但也普遍錄得較高漲幅。

漲幅最高的三倍做空MSCI新興市場ETF(代碼 EDZ),房地產、納斯達克、標普500等指數的反向ETF漲幅靠前。

值得注意的是兩倍做空富時歐洲ETF(代碼 EPV),雖然該ETF的槓桿係數比其它上榜ETF都低,但是歐洲作爲今年受通脹打擊最嚴重的的發達經濟體,其股票下跌較爲激烈。

今年表現相對抗跌的指數是傳統行業的比如道指30、金融指數,它們的三倍反向做空ETF漲幅只有40%左右。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.