9月22日uSMART交易熱榜 | 美股三連跌,UUP、GLD等避險資產受捧

uSMART盈立智投 09-23 09:33

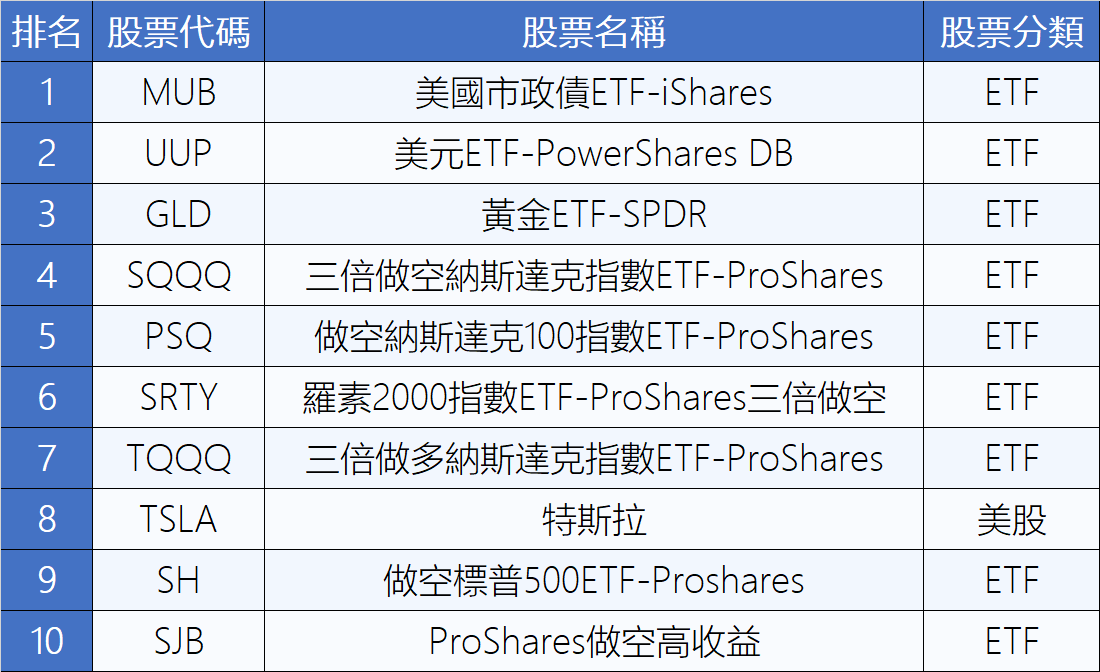

9月22日uSMART交易熱度排行榜

全球央行上演加息風暴,美股連續三日下挫,弱勢環境中選擇兩個投資方向。

一是避險資產,包括美債、美元、黃金。

美債方面,美國市政債ETF(MUB)再次衝上交易熱榜第1名,美債重獲華爾街大型基金的青睞,他們相信美債將成爲對衝下一次經濟衰退的工具。

在美聯儲激進加息環境下,美元成爲今年的強勢資產,美元ETF(UUP)年初至今累計漲幅近16%,有分析認爲,在美聯儲放緩加息步伐之前,美元還將有最後一衝。

作爲傳統的避險資產,黃金自俄烏衝突以來就備受關注,黃金ETF(GLD)成爲投資者的首選標的。

二是做空股指。

三倍做空納指(SQQQ)常駐榜單,此外昨日交易熱度靠前的還有一倍做空納指(PSQ)、三倍做空羅素2000(SRTY)、做空標普500(SH),投資者根據自身風險承受能力選擇不同槓桿倍數的做空標的。

做空高收益公司債ETF(SJB)排第10名,今年累計漲幅近12%。SJB提供期限在3-15年之間的高收益公司債券的每日反向敞口,反向債券ETF可以對衝利率上升,這些基金做空債券,意味着當利率上升時,這類ETF的價格會上漲。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.