跌到極致是反彈?

uSMART盈立智投 09-20 21:41

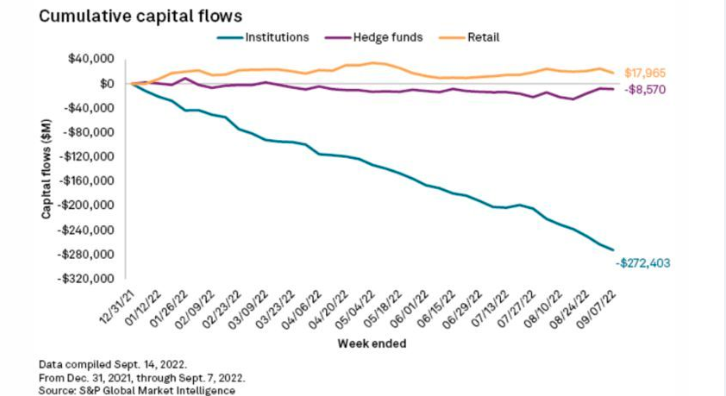

要想了解最近投資者情緒惡化的速度有多快,看看職業基金經理的資金流動態就知道了。

根據標普全球市場情報(S&P Global Market Intelligence)的分析,在從8月中旬至9月7日的五週時間裏,只做多的機構投資者拋售了價值512億美元的美國股票,約爲今年前31周拋售規模的四分之一。

值得一提的是,這些數據不包括上週的數據,彼時意外超出預期的美國8月通脹數據引發了人們對美聯儲收緊貨幣政策力度超過預期的擔憂。媒體彙編的數據顯示,這種焦慮情緒已導致標普500指數在過去四周內下跌8.4%,而自疫情以來只有兩次四周累計跌幅超過這一數字。

儘管能源和公用事業板塊在2022年逆市上揚,但這並沒有必然轉化爲機構的資金流動。數據顯示,機構投資者拋售了11個行業板塊中以工業類股票爲首的10個,流向公用事業股票的資金則持平。

媒體彙編的數據顯示,剔除今年標普500指數表現最好的5個交易日之後,該指數2022年以來的跌幅將從19%擴大至30%。瑞銀全球財富管理首席投資官Mark Haefele表示,不斷擴大的跌勢開始創造買入機會。他建議投資者“不要退守場外”,尤其是考慮到通脹上漲對現金的拖累、以及在不錯過反彈的情況下重返市場的時機存在風險。

週一美股收盤,標普500指數收漲0.69%,報3899.89點,十分接近3900點這一關鍵點位。BTIG編制的數據顯示,這一點位是標普500指數過去三年成交量最大的水平,分析師Jonathan Krinsky認爲,如果該指數跌破這一點位,則可能觸及6月低點3666.77點。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.