ARK持倉追蹤 | 木頭姐認爲,許多創新驅動的戰略和股票可能在未來5至10年成爲富有成效的資產

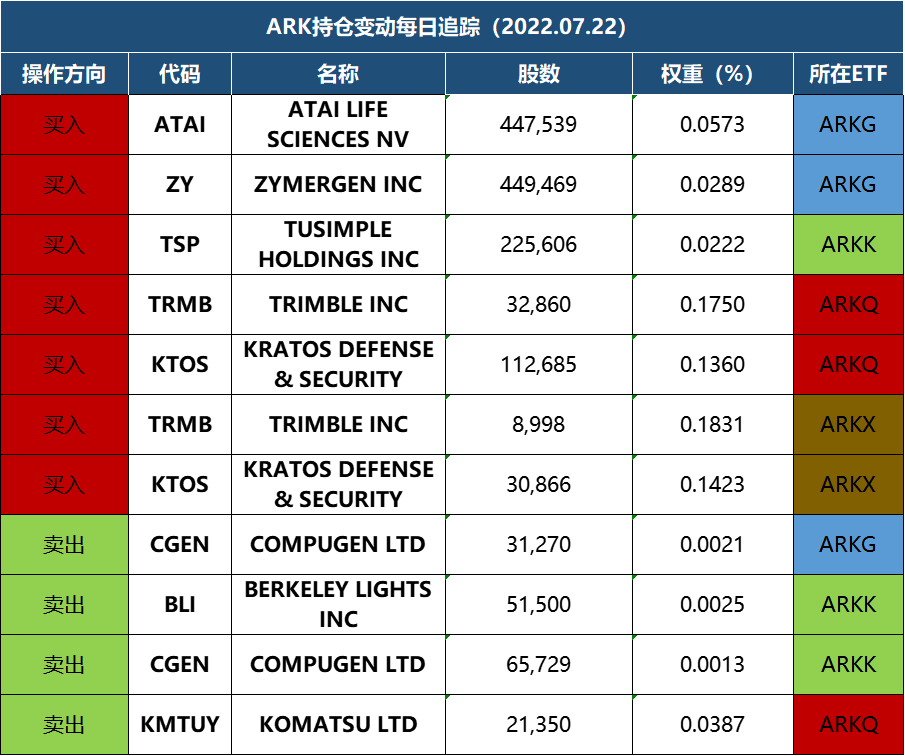

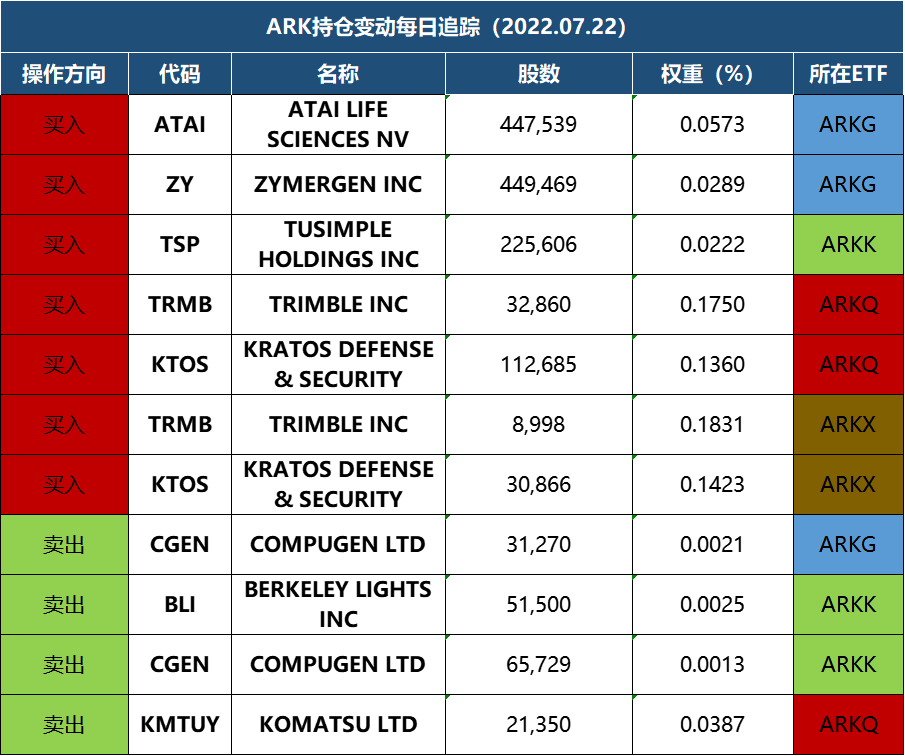

【Ark旗下基金持倉變化小結,2022年07月22日】

2021年至今,“木頭姐”旗下的主要基金都深陷回調之中,受到市場的質疑。在2022年第二季度,ARK旗下6只主動管理的ETF和3只指數ETF的表現均跑輸了標普500指數和MSCI全球指數。

其中,木頭姐管理的旗艦基金方舟創新基金(ARKK)二季度資產淨值爲-39.69%,遠低於同期的標普500指數(-16.19%)和MSCI全球指數(-16.10%)表現。

行業方面,截至2022年二季度末,ARKK重倉的前五大行業分別爲雲計算、數字媒體、基因治療、電子商務和物聯網,分別佔比18.8%、11.4%、9.4%、7.3%和5.2%。前五大重倉股分別爲Zoom、特斯拉、流媒體公司Ruko、基因編輯公司CRISPR THERAPEUTICS AG和企業自動化軟件公司Uipath Inc。

報告顯示,對ARKK貢獻最低的兩隻股票爲加密貨幣交易所Coinbase Global和全球最大的數字健康平臺Teladoc Health,特斯拉位列第三。

木頭姐認爲,許多創新驅動的戰略和股票可能在未來5至10年成爲富有成效的資產。“在我們看來,建立在高市盈率股票基礎上的擔憂之牆對創新領域的股票來說是個好兆頭。最強勁的牛市會爬上一堵擔憂的牆,那些將其與科技和電信泡沫相提並論的人似乎忘記了這一點。1999年的股票市場沒有任何擔憂之牆存在,也沒有經受考驗。這一次,擔憂之牆已經爬到了巨大的高度。”

木頭姐指出,在多數股指中佔據主導地位的幾隻巨盤股,似乎吸引了厭惡風險、對基準敏感的投資者涌入擁擠的交易,遠離以顛覆性創新爲核心的新興增長機會。

①ARKK:以顛覆性創新產業爲主要投資標的

②ARKQ:以自動科技自動機器人技術爲主要投資標的

③ARKF :以金融科技創新爲主要投資標的

④ARKW:以"下一代網絡"爲主要投資標的

⑤ARKG:以生物基因科技創新爲主要投資標的

⑥ARKX: ARKX是美股市場裏的第一支太空概念ETF。

【uSMART目前支持部分美股10倍槓桿日內交易】

以上數據爲Cathie Wood個人/所在機構的過往操作,其交易背後之投資邏輯並不明確,不代表投資建議,注意風險。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.