Wetrade Group Group, founded in the second half of 2019, is the world's first WeChat business cloud intelligent system technology service provider, benefiting from the outbreak of WeChat market demand and private traffic dividends, only about a year after its establishment, Yue Shang Group (Wetrade Group) was listed on Nasdaq OTC in July 2020 and is expected to land on the NASDAQ motherboard in recent days.

On the main board, Yueshang Group plans to issue 10 million shares at a price of US $4-6, raising funds for science and technology research and development (58 per cent), marketing and domestic talent introduction (22 per cent), strategic investment and day-to-day operations (20 per cent).

Yue Shang Group:The world's first technical service provider for WeChat cloud intelligent system

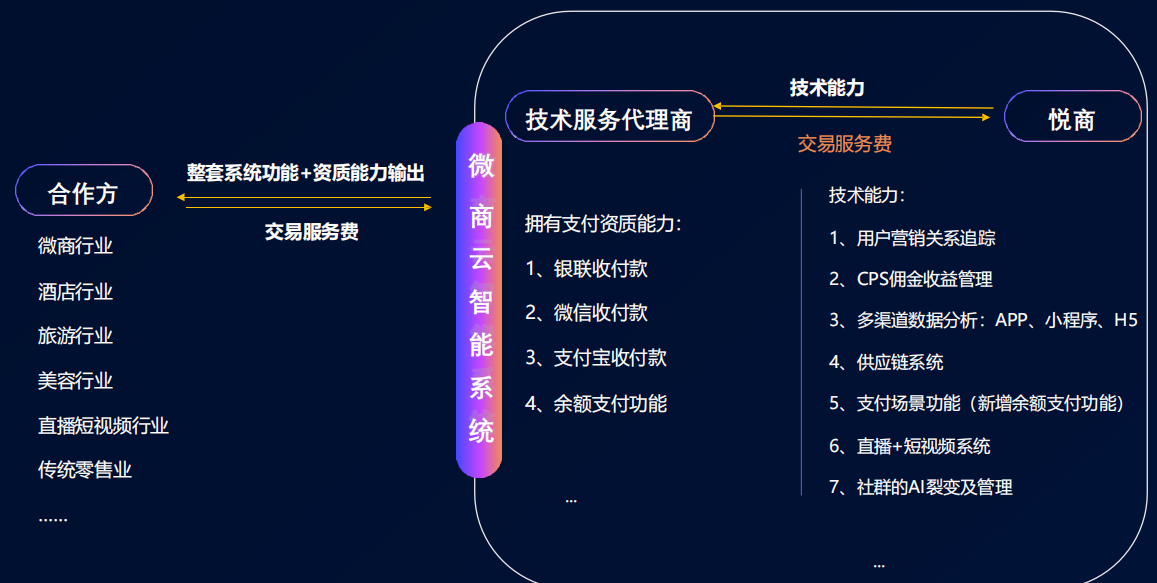

Yue Shang Group isThe world's first WeChat cloud intelligent system technical service provider. Yueshang Group independently developed a cloud-based intelligent brain system for WeChat merchants, referred to as "WeChat Cloud Intelligent system YCloud". WeChat cloud intelligent system YCloud helps customers increase revenue through powerful technology and big data learning, user marketing relationship tracking, CPS commission revenue management, multi-channel data analysis, community AI fission and management, sound supply chain system, increased payment scenario functions, revenue and head management.

Source: IPO information

Yue Shang Group's income comes from service fees collected through YCloud. Through an agreement with the customerYue Shang GroupReceiveFetch3.5% of the GMV generated on the application platform is used as a service charge. So far, YCloud business has successfully landed in Chinese mainland, Hong Kong, Philippines, Singapore and other countries, coveringWeChat business industry, tourism industry, hotel industry, live video industry, medical and beauty industry and traditional retail industry.

The WeChat business industry is developing rapidly, and the number of practitioners is expected to exceed 300 million.

As the main service object of Yue Shang Group, WeChat business first appeared when the social platform was just beginning to expand. WeChat business owners are usually individual users of social platforms, who use the platform as a business tool. Gradually, the expansion of social platforms has given rise to a variety of independent brands and stores that have flourished on various social platforms. As a concept, WeChat business has won more trust from business owners and consumers, and more and more business owners are trying to gain market share through WeChat business channels.

One of the difficulties that WeChat businessmen generally face is the lack of technical support. The YCloud system of Yue Shang Group not only opens up new resources for WeChat merchants, but also clears the entry threshold for WeChat merchants in the technology industry.

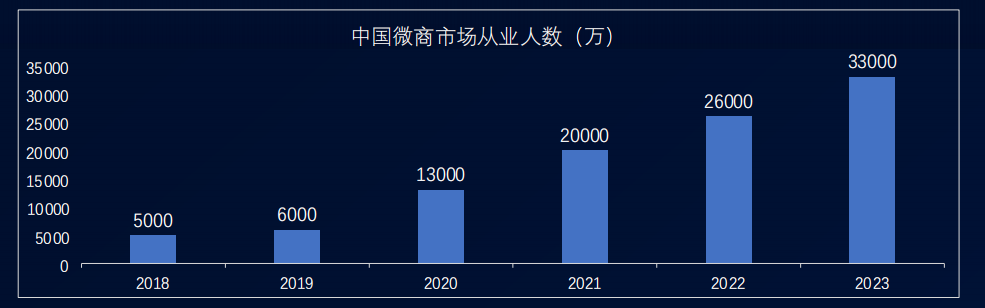

Source: IPO information, iResearch data

According to iResearch, the number of people operating WeChat businesses in China reached 60 million in 2019, 130 million in 2020, 200m in 2021, and is expected to reach 260 million in 2022 and 330 million in 2023.

Source: IPO information

The target companies of Yue Shang Group include Youzan, Weimeng and other SAAS companies. compared with these peer enterprises, Yue Shang Group is different from Weimeng and Youzan in terms of target customers. in addition, the operating income scale and market capitalization of Yue Shang Group are smaller than those of its peers, but it is commendable that Yue Shang Group made a profit in its early days.

The performance has increased rapidly in the past 21 years, and has been "blocked" by the epidemic in 22 years.

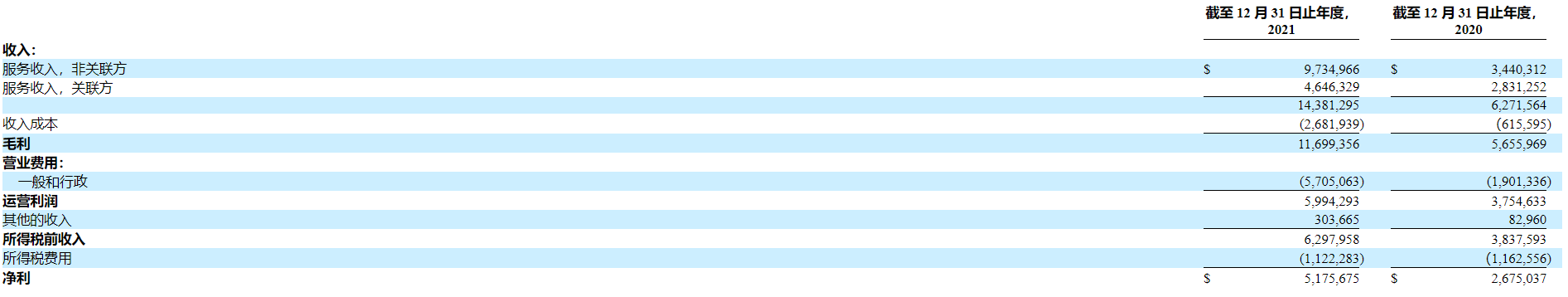

Source: IPO information

In fiscal years 2021 and 2020, the total income of Yue Shang Group was US $14.38 million and US $6.27 million respectively.In 2021, revenue was $14.38 million, up 129.3% from a year earlier, and net profit was $5.18 million, up 93.5% from a year earlier. Yue Shang Group has achieved rapid performance growth in the past 21 years, and the main reason for the increase in income is thatThe total merchandise trading volume ("GMV") of the Ycloud system increased.

Source: IPO information

During the three-month period of March 31, 2022 and March 31, 2021, the total revenue of Yueshang Group was US $2.236 million and US $2.781 million, respectively. The decrease in performance during the period was mainly due toThe impact of the epidemic has led to a decrease in the total merchandise trading volume of the Ycloud system ("GMV") in some major cities in China.

At present, the customers of Yueshang Group are generallyMedia and Internet companies, including Beijing Yidong Linglong Culture Media Co., Ltd. ("Beijing Yidong"), Beijing Maitu International Travel Service Co., Ltd. ("Maitu International"), China Tourism Company, Beijing Youth Travel Co., Ltd. ("Beijing Youth Travel"), Weijiafu Information Technology Co., Ltd. ("Weijiafu"), Changtong rich technology, etc. Through these customers, Yue Shang Group provides "YCloud" services to individuals and business owners in the hotel and tourism industry.

With the continuous growth of domestic WeChat business groups and the development of social e-commerce industry, technology transformation and digital operation have become an industry trend. Yueshang Group, which has leading technology and full-chain ecological services, is worthy of attention.