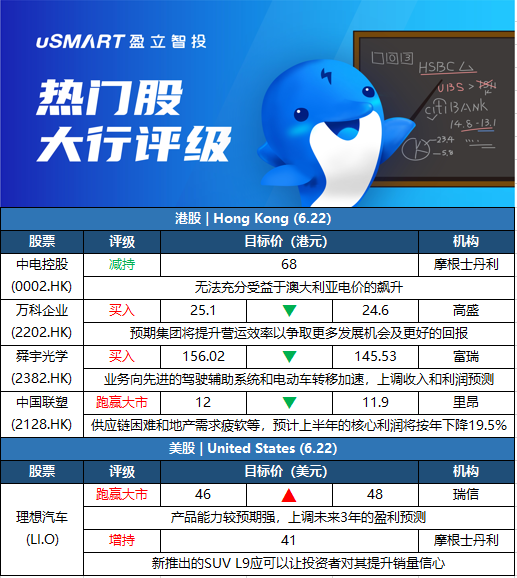

摩根士丹利:重申理想汽車(02015.HK)增持評級,目標價41美元

摩根士丹利發表報告,認爲理想汽車新推出的SUV L9應可贏得投資者對其提升銷量信心,重申對其增持評級及目標價41美元。L9定價售價超過40萬元,該價位的乘用車在中國仍然是一個相對小衆的市場,約佔整體汽車銷量的5%,仍然由寶馬、奔馳和奧迪等豪華品牌主導。

瑞信:理想汽車(LI.O)產品能力較預期強 升目標價至48美元

瑞信發表報告指,由於理想汽車產品能力較預期強,上調2022年至2024年每股經調整盈利預測各7.21倍、30.2%及0.9%,分別至0.39元、2.71元及3.64元人民幣,並提高銷量預測,目標價由46升至48美元,維持跑贏大市評級。瑞信指,新推出的全尺寸SUV理想L9價格爲45.98萬元人民幣,將於8月開始交付。公司給予指引L9的9月交付量將超過1萬輛,高過該行預期的每月平均8,000至9,000輛。

貝雅:將耐克(NKE.N)目標價從165美元下調至150美元

貝雅分析師Jonathan Komp將耐克(NKE.N)的目標價從165美元降至150美元,並保持對該股的跑贏大市評級。該分析師對其第四財季業績進行預測,並降低了其盈利和目標價格,儘管他認爲中國市場的利好消息可能會支撐該公司股價走強。

摩根士丹利:維持對中電控股(00002.HK)謹慎看法 料削派息風險低

摩根士丹利發表報告,鑑於來自澳洲和亞洲業務的持續壓力,維持對中電謹慎看法,但認爲削減其3.1元的年度股息風險不大,目標價看68元,維持減持評級。中電預計,今年首五個月由於EnergyAustralia不利的公平價值變動錄得相關稅後虧損約72億元。由於中電簽訂了遠期電力合同,它以固定價格遠期出售其電量,這意味着它無法充分受益於澳大利亞電價的飆升,除某些營運資金要求外,估計這72億元虧損是非現金項目,料EnergyAustralia上半年的經營虧損爲3億元。

高盛:維持萬科企業(2202.HK)買入評級 目標價下調至24.6港元

高盛發表研究報告,下調萬科企業(2202.HK)目標價2%至24.6港元,維持“買入”評級。

高盛稱,萬科首季收入按年增1%至611億元人民幣,佔該行原先對其全年預測的13%;淨利潤14億元人民幣,佔該行原先對其全年預測的5%。考慮到年初至今推售的項目及銷售率,該行調整對其2022至2024年每股盈利預測平均3%,並下調目標價。

基於預期集團會繼續專注現金流管理、將關鍵業務管理及業務發展決定重新集中由總部層面作決策,並透過提升營運效率以爭取更多發展機會及更好的回報,故維持對其評級。

富瑞:料舜宇光學(2382.HK)今年收益及盈利受壓 降目標價至145.53港元

富瑞發表報告表示,因應對全球智能手機前景的最新下調,導致舜宇(2382.HK)2022年淨利潤預測下降6%,指其79%的收入由智能手機帶動,相信公司今年收益及盈利均受壓,將其目標價從156.02港元下調至145.53港元 ,評級“買入”。

報告補充,隨着舜宇業務向先進的駕駛輔助系統(ADAS)和電動車(EV)的轉移加速,上調公司2023年後長期收入和利潤預測,這意味着每輛車的攝像頭數量將增長得更快。

富瑞認爲,ARVR發展將起飛,因爲全球大型企業都將其作爲下一個重點,建議耐心的投資者應該趁低位吸納。

裏昂:降中國聯塑(2128.HK)評級至跑贏大市 目標價下調至11.9港元

裏昂發表報告,將中國聯塑(2128.HK)目標價由12港元微降至11.9港元,評級由“買入”降至“跑贏大市”。

報告預計,中國聯塑上半年的核心利潤將按年下降19.5%,以反映部分城市封城、供應鏈困難和地產需求疲軟。考慮到成本上升,該行預計中國聯塑上半年毛利率將按年下降7.3個百分點,並於下半年溫和復甦。