透視港股通丨內資加倉科網股、汽車股

北水總結

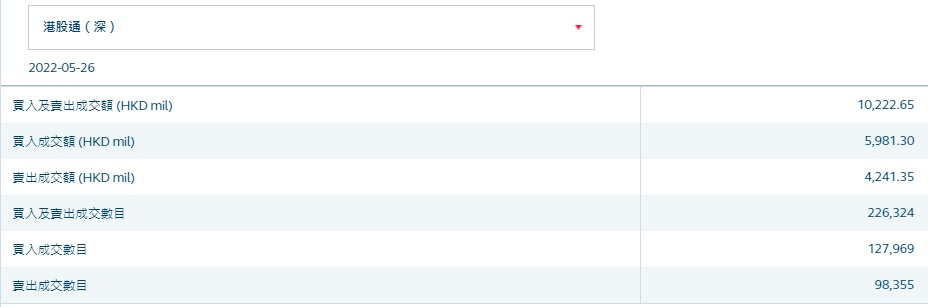

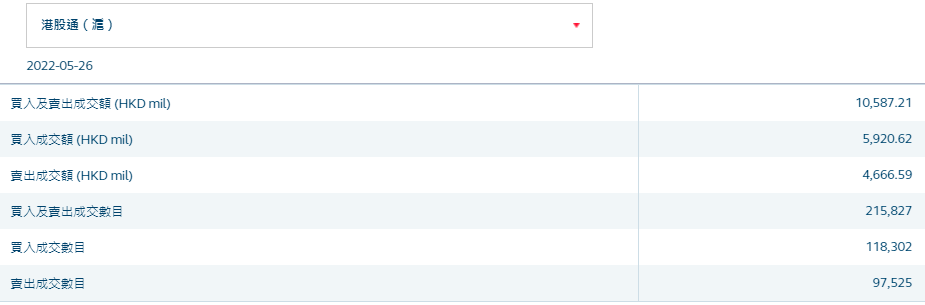

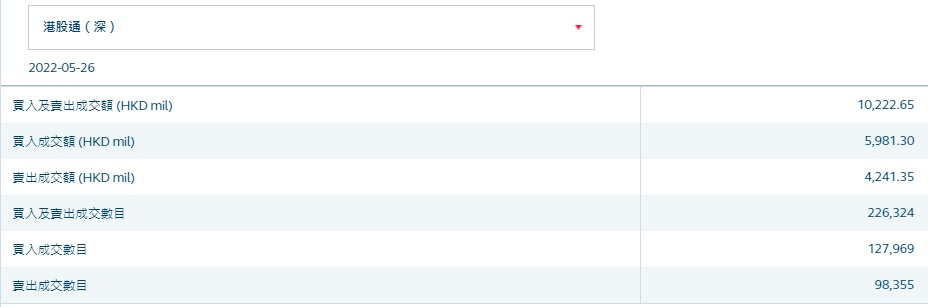

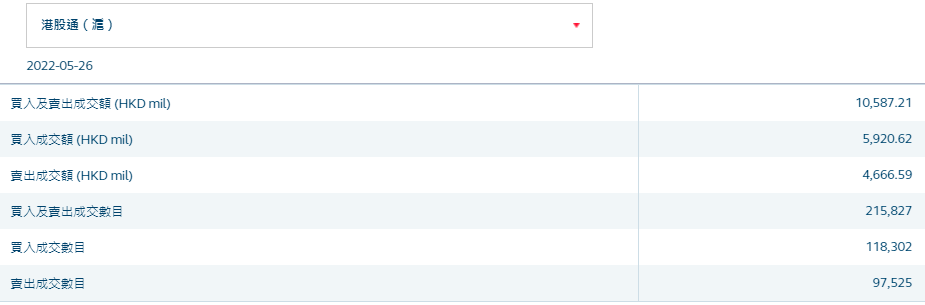

5月26日港股市場,北水成交淨買入29.94億,其中港股通(滬)成交淨買入12.54億港元,港股通(深)成交淨買入17.4億港元。

北水淨買入最多的個股是騰訊(00700)、中海油(00883)。

數據來源:盈立智投APP

十大成交活躍股

數據來源:港交所

個股點評

騰訊(00700)、快手-W(01024)分別獲淨買入5.02億、1.57億港元。消息面上,中信證券研報認爲,互聯網行業作爲消費行業下遊,受到疫情和宏觀消費因素影響,預計一、二季度業績仍存壓力,但基於下半年疫情向好、經濟回暖的預期,消費復甦有望傳導到廣告、電商板塊,爲下半年互聯網公司業績帶來正向催化。目前互聯網行業估值處於低位,政策導向有望趨於穩定,公司核心業務基本面保持穩健,建議佈局業績和估值層面有望迎來改善的互聯網公司。

吉利汽車(00175)、長城汽車(02333)分別獲淨買入1.36億、1.12億港元。消息面上,國常會提出階段性減徵部分乘用車購置稅600億元及其他多項利好汽車行業恢復和發展的政策。裏昂認爲,減購置稅將帶動100萬至200萬輛新乘用車需求,使行業擺脫當前困境。中金則認爲,即使政策僅持續到年底,保守情況下仍有望拉動百萬輛級別銷量,對需求拉動幅度在5%。

李寧(02331)、安踏體育(02020)分別獲淨買入1.3億、2287萬港元。消息面上,大摩近日表示,雖然公司加大折扣,庫存堆積如山,但情況似乎可控。除非再次爆發重大疫情,否則需求應會恢復。該行指出,體育用品經銷商的經營壓力有所緩解,只要沒有再次爆發重大疫情,相信李寧及滔搏的股價將徘徊在3月15日的低位之上。該行認爲,李寧屬當中最安全復甦概念股,因其於目前低迷情況下擁有強勁的品牌動力及良好的庫存結構。

中海油(00883)獲淨買入4.7億港元。消息面上,國泰君安證券表示,與市場預期不同,我們認爲原油需求最差時間已過。我們認爲夏季如果氣溫高於往年,則全球旺盛的發電需求可能會提振化石能源的需求。其次Q3原油消費將季節性環比提升,以及我們預計隨着疫情的好轉以及復工復產情況的推進,物流的恢復,後續國內原油需求同樣將逐漸好轉(4月受疫情影響同比下滑151萬桶/天)。總體來看,我們認爲5月下旬-Q3原油需求將邊際好轉。

兗礦能源(01171)獲淨買入2.56億港元。消息面上,兗礦能源公告,擬發行H股可轉換債券本金金額約17.94億美元,用以增持兗州煤業澳大利亞有限公司股份,本次交易價格每股兗煤澳洲股份3.6美元。中信證券稱,增持有助兗礦能源進一步分享海外煤價紅利,利好公司業績預期。

此外,中國移動(00941)獲淨買入5502萬港元。而建設銀行(00939)、藥明生物(02269)分別遭淨賣出8039萬、4821萬港元。

港股通最新持股比例排行

(港股通持股比例排行,交易所數據T+2日結算)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.