高盛熱衷做對衝 Q1依然重倉科技股

根據美國證券交易委員會(SEC)披露,高盛(GS.US)遞交了截至2022年3月31日的第一季度(Q1)持倉報告(13F)。

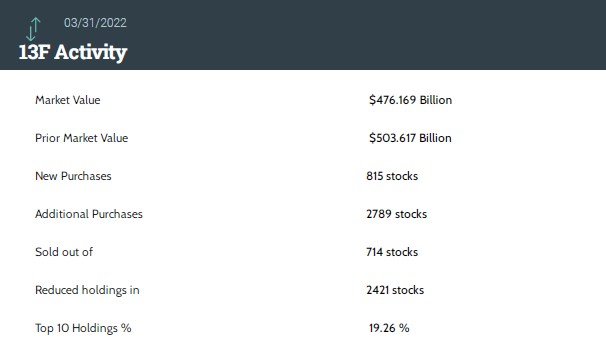

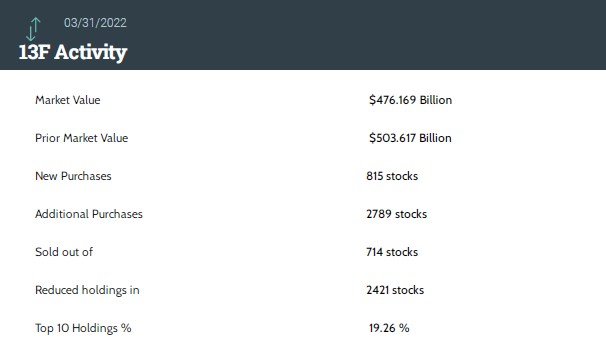

據統計,高盛第一季度持倉總市值爲4761.69億美元,上一季度總市值爲5036.17億美元。在第一季度的持倉組合中,新增815只個股,增持2789只個股;同時清倉了714只個股,減持2421只個股。其中,前十大持倉標的佔總市值的19.26%。

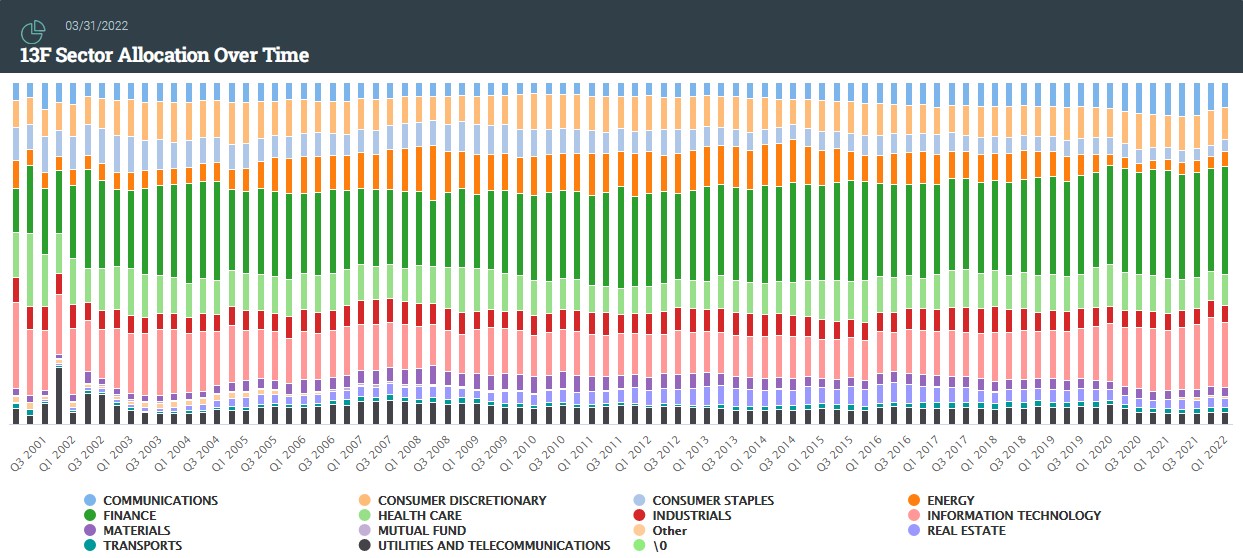

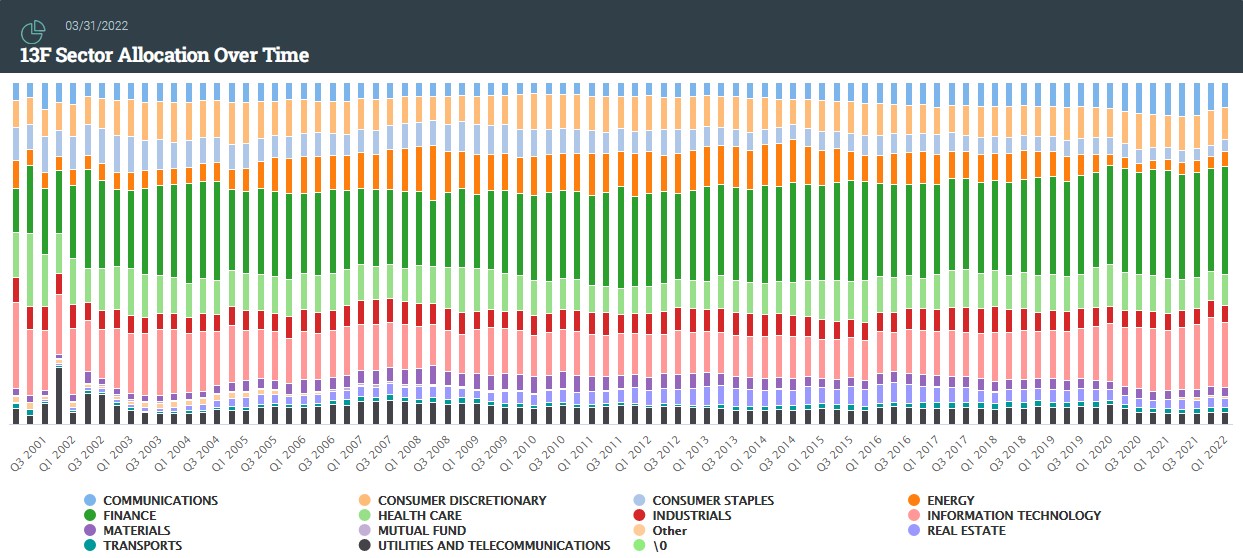

從持倉偏好來看,金融、信息技術、健康護理類個股位列前三,佔總持倉比例分別爲31.64%,19.06%以及9.16%。

在前五大重倉標的中,標普500指數ETF(SPY.US)位列第一,持倉約4598.77萬股,持倉市值約207.7億美元,佔投資組合比例爲4.36%,較上季度持倉數量增加了22%;

蘋果(AAPL.US)位列第二,持倉約7579.33萬股,持倉市值約132.34億美元,佔投資組合比例爲2.78%,較上季度持倉數量增加了11%;

微軟(MSFT.US)位列第三,持倉約3517.59萬股,持倉市值約108.45億美元,佔投資組合比例爲2.28%,較上季度持倉數量增加8%;

標普500指數ETF看跌期權(SPY.US,PUT)位列第四,持倉約2242.64萬股,持倉市值約101.29億美元,佔投資組合比例爲2.13%,較上季度持倉數量增加2%;

亞馬遜(AMZN.US)位列第五,持倉約218.8萬股,持倉市值約71.33億美元,佔投資組合比例爲1.5%,較上季度持倉數量增加13%。

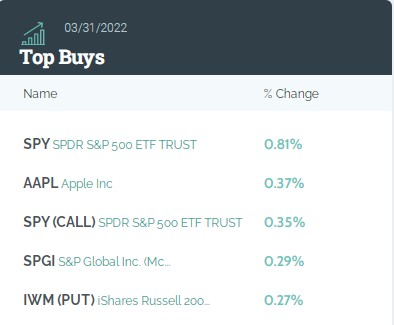

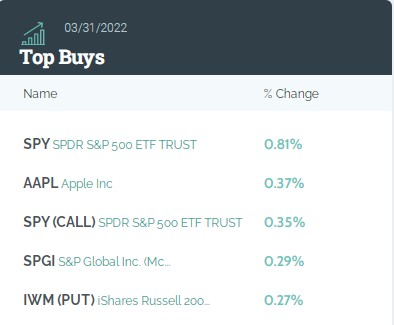

從持倉比例變化來看,前五大買入標的分別是:標普500指數ETF(SPY.US)、蘋果(AAPL.US)、標普500指數ETF看漲期權(SPY.US,CALL)、標普全球(SPGI.US)、安碩羅素2000ETF看跌期權(IWM.US,PUT)。

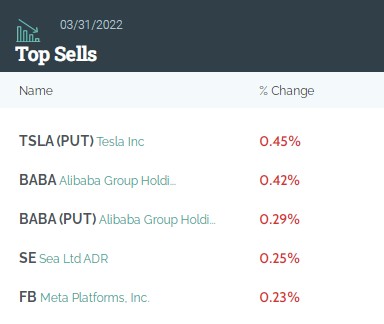

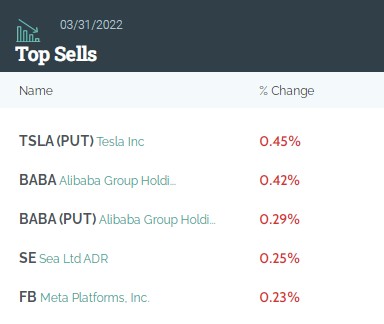

前五大賣出標的分別是:特斯拉看跌期權(TSLA.US,PUT)、阿裏巴巴(BABA.US)、阿裏巴巴看跌期權(BABA.US,PUT)、Sea(SE.US)、Meta(FB.US)。

高盛一季度建倉安碩債券指數ETF看漲期權(HYG.US,CALL)、安碩摩根大通美元新興市場債券ETF看漲期權(EMB.US,CALL)、Datadog看漲期權(DDOG.US,CALL)等,清倉阿裏巴巴看漲期權(BABA.US,CALL)、安森美半導體看漲期權(ON.US,CALL)等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.