美銀客戶現金囤積量創二十年新高

美國銀行最新公佈的基金經理調查結果顯示,隨着市場對全球經濟增長的樂觀情緒降至歷史低點,以及市場對滯脹甚至經濟衰退的擔憂加劇,投資者正大舉囤積現金。美國銀行分析師們表示,最新調查結果透露的信息是:美股下跌趨勢或將持續。

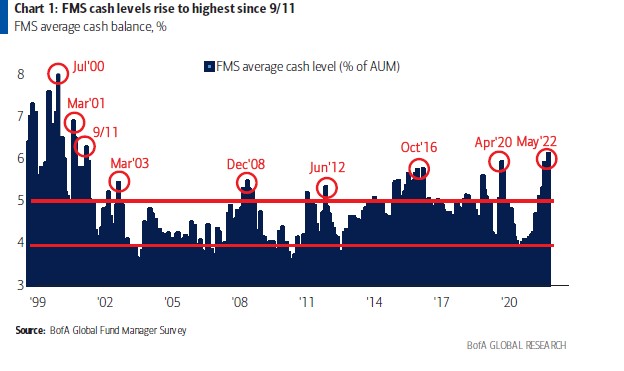

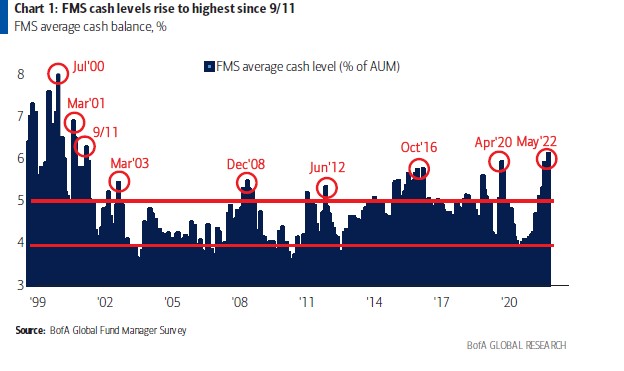

美國銀行客戶的“現金囤積量”達到二十年來最高水平

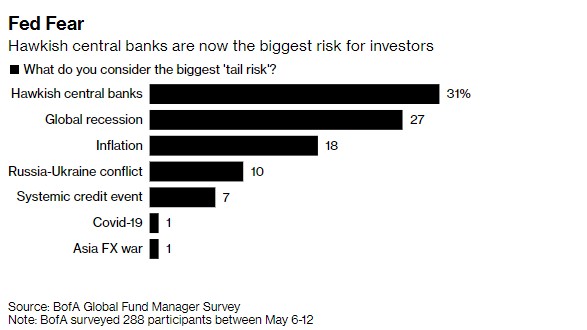

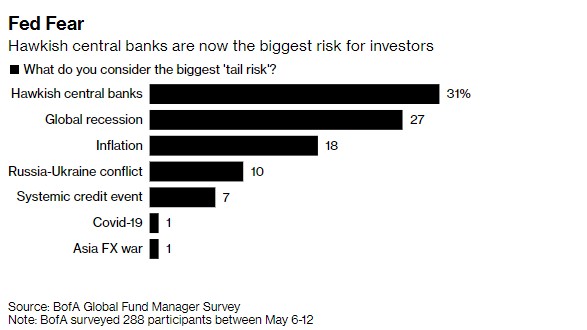

5月調查結果顯示,投資者現金水平觸及2001年9月以來最高,而對滯脹的擔憂則達到2008年以來最高水平,美國銀行將調查的結果描述爲“相當悲觀”。美國銀行對管理着8720億美元資產的機構投資者進行的最新調查還顯示,投資者認爲各大央行集體“轉鷹”是最大尾部風險,緊接着是全球經濟陷入衰退。

在此之前,隨着全球各大央行在通脹居高不下之際仍堅持收緊貨幣政策,全球股市出現自全球金融危機以來最長的單週連跌。儘管因股票估值變得更具吸引力,股市自上週五以來出現小幅度反彈,但來自摩根士丹利的Michael Wilson等策略師表示,在未來收益還將出現更大程度虧損。

美國銀行策略師Michael Hartnett在報告中表示,多數投資者認爲當前股市行情很容易出現“熊市反彈”,但多數仍認爲尚未觸及最終低點附近。調查結果顯示,緊隨衰退擔憂之後的是通脹風險和俄烏衝突,結果還顯示,看跌情緒的極端程度已足以觸發美國銀行分析模型的“買入”信號,這是一種“反向指標”,用於預測進入股市的最佳時機。

調查還顯示,科技股處於自2006年以來最大規模的“看空狀態”。隨着利率上升,投資者對未來收益感到擔憂,在最新一輪拋售中,泡沫較大(多數爲尚未盈利公司)科技股的拋售幅度尤其劇烈。

調查結果顯示,總體而言,投資者普遍爲“現金多頭”,同時看漲大宗商品、醫療保健和必需消費品板塊,對於科技股、整體股市、歐股以及新興市場看跌情緒較濃厚。

5月調查結果還顯示:

投資者目前預計美聯儲在本輪緊縮週期中將加息7.9 次,而4月份調查結果爲7.4次。

自2020年5月以來,多數基金經理減持股票資產。

自2020年5月以來,投資者倉位轉向最具防禦性的版塊,公用事業、必需品和醫療保健類股合計淨增持約43%。

貨幣風險被視爲金融市場穩定的最大潛在風險,超過地緣政治風險。

標普500指數的“美聯儲推動式看跌”預計爲 3,529,比當前水平低約 12%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.