蘋果王者地位不保!

uSMART盈立智投 05-12 21:55

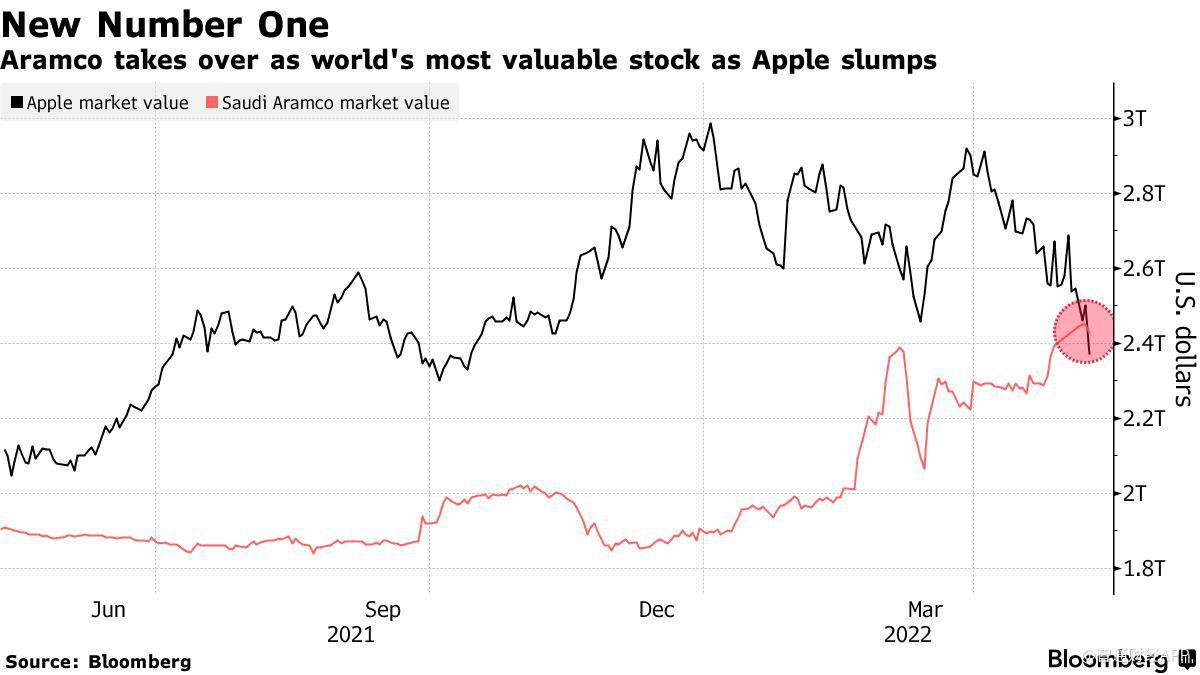

沙特阿美石油公司取代蘋果(AAPL.US)成爲世界上市值最大的公司,因投資者開始遠離科技股,轉向投資能源領域。通貨膨脹、俄烏衝突等一系列因素導致油價飆升。

週三,沙特阿美的股價一度接近歷史最高水平,市值約爲2.43萬億美元,自2020年以來首次超過蘋果。蘋果股價下跌超5%,至146.5美元,使其估值約爲2.37萬億美元。

即使此舉被證明是短暫的,蘋果再次奪回榜首,但這種角色互換突顯了全球經濟中主要的力量。

油價的飆升雖然給沙特阿美帶來了更多利潤,但卻加劇了通貨膨脹的上升,迫使美聯儲以幾十年來最快的速度提高利率,打壓科技股的股價表現。

Tower Bridge Advisors的首席投資官James Meyer表示:“在業務或基本面方面,你不能把蘋果與沙特阿美相比,但商品領域的前景已經改善。他們是通貨膨脹和供應緊張的受益者。”

今年早些時候,蘋果市值爲3萬億美元,其市值比沙特阿美多出約1萬億美元。然而,自那時起,蘋果股價已下跌了近20%,而沙特阿美則上漲了28%。

Ingalls&Snyder的高級投資組合策略師Tim Ghriskey表示,由於美聯儲今年將進一步加息至少150個基點,且烏克蘭危機還沒有得到解決,科技股重獲主導地位可能還需要一段時間。Ghriskey稱:“很多科技股出現了恐慌性拋售,從那裏出來的資金似乎特別傾向於能源,鑑於商品價格,能源板塊目前有一個有利的前景。”

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.