This week, after experiencing "Black Monday", global stock markets gradually stabilized as expectations for a U.S. economic recession cooled.

Data released yesterday showed that the number of people applying for unemployment benefits in the United States last week fell by nearly the largest amount in a year, and economic anxiety eased. All major sectors in the S&P 500 index increased on Thursday, the first time since November 2022. The biggest gainer was that U.S. Treasury bonds fell across the board, with short-term Treasury bonds leading the decline.

As of the close, the S&P 500 was up 2.3%. rose 3.1%, while the Nasdaq 100 rose 2.4%. The Russell 2000 Index (RUT.US) rose 2.4%.

In such a market environment, exchange-traded funds (ETFs) have also become the focus of investors' attention. On Thursday, Nvidia (NVDA.US) ranked first with a turnover of $39.8 billion, followed by the SPDR S&P 500 ETF (SPY) and QQQ Nasdaq ETF (QQQ), with turnover of 33.1 billion and 21.1 billion respectively.

These ETFs are not only one of the main flows of market funds, but also provide investors with effective risk diversification tools.

SPDR S&P 500 ETF (SPY.US): A loyal follower of the S&P 500

The SPY ETF, or SPDR S&P 500 ETF Trust, is an exchange-traded open-end index fund (ETF) that tracks the performance of the S&P 500 Index.

The S&P 500 Index represents the 500 largest companies in the U.S. stock market by market capitalization, covering leading companies in various industries such as information technology, technology, health care, and finance. As one of the largest ETFs in the world, SPY, which tracks the S&P 500 Index, not only provides investors with an efficient and convenient way to diversify into large-cap U.S. stock markets, but also reflects the overall health of the U.S. economy by tracking the performance of these blue-chip stocks. This situation can be said to be a "barometer" of the health of the U.S. stock market.

SPY’s features and performance

The pricing mechanism of the SPY ETF is very cleverly designed, and its per-share price is roughly equivalent to one-tenth of the value of the S&P 500 Index. For example, if the S&P 500 hits 4,000, the SPY ETF's price per share would theoretically be around $400. This feature makes the SPY ETF an effective way for investors to capture the performance of the S&P 500 Index.

Today, the S&P 500 reaches 5319, while the SPY ETF is trading at 530.65 per share.

(Source: uSMART)

(Source: uSMART)

Key differences between SPY and S&P 500 Index

S&P 500 Index (S&P 500): The S&P 500 Index is a U.S. stock market benchmark index compiled by Standard & Poor's and includes 500 large companies listed on major U.S. stock exchanges. The index is widely considered the best gauge of overall U.S. stock market performance. The S&P 500 is merely a mathematically constructed index and it does not represent any actual investment vehicle or financial product.

SPDR S&P 500 ETF (SPY): SPY is an exchange-traded fund (ETF) managed by State Street Global Advisors. SPY is designed to closely track the performance of the S&P 500, so it holds actual shares of the S&P 500's constituent stocks. SPY is a financial product that can be traded on the stock exchange. Investors can indirectly invest in all companies included in the S&P 500 Index by purchasing SPY.

Advantages of investing in SPY

Diversified Portfolio: SPY tracks the S&P 500 Index, which consists of the 500 largest U.S. companies by market capitalization and covers a wide range of industries, including technology, finance, healthcare, consumer goods, industrials, and more. By investing in SPY, investors can gain broad exposure to these companies and industries, significantly reducing individual stock and industry risks.

Stable long-term returns: The S&P 500 is widely considered the benchmark for U.S. stock market and overall economic performance. Over the long term, the S&P 500's annualized returns have been relatively stable, providing investors with solid capital appreciation overall despite the cyclical fluctuations the market has experienced. Therefore, SPY is an ideal choice for investors who seek stable growth and hope to accumulate wealth through long-term holdings.

Extremely high liquidity and low management expense ratio: SPY is one of the world's most traded ETFs, with huge average daily trading volume. This means that investors can easily buy and sell SPY without worrying about liquidity issues, with low transaction costs and a management expense rate of only 0.09%.

Dividend distribution: As a dividend-paying fund, SPY implements quarterly dividends, providing investors with stable cash flow. Investors can obtain relatively stable dividend income by holding SPY.

Invesco QQQ ETF (QQQ): The place for tech stocks

Unlike SPY, the Invesco QQQ ETF (QQQ) mainly tracks the Nasdaq 100 Index, which includes the 100 largest non-financial companies listed on the Nasdaq exchange, most of which are technology companies. QQQ’s holdings include many world-renowned technology giants, such as Apple, Microsoft, Amazon, Google parent company Alphabet, Facebook parent company Meta, etc. This makes QQQ synonymous with technology stock investment.

QQQ’s investment features and performance

QQQ is known for its concentrated nature of technology stocks. Its constituent stocks are mainly American technology stocks. These companies have outstanding performance in innovation, R&D investment and patent applications. QQQ's stock selection method is mainly based on market capitalization weighting, which means that companies with larger market capitalization also have higher weights in ETFs. This stock selection strategy allows QQQ to fully reflect the growth trends of the technology industry.

QQQ's annualized returns have significantly outperformed the S&P 500 over the past decade, driven largely by the rapid growth of technology stocks. Although the technology industry is highly volatile, QQQ has attracted many investors who are optimistic about the long-term development of the technology industry with its concentrated investment in high-growth companies. It is worth noting that QQQ's management expense rate is 0.20%, which is slightly higher than SPY, but the potential returns brought about by its high growth also make this cost seem insignificant.

Types of investors that QQQ is suitable for

QQQ is suitable for investors who have a deep understanding of the technology industry and are willing to bear higher volatility in exchange for high growth potential. Since its constituent stocks are mainly concentrated in the technology and communications industries, investors seeking industry diversification may want to consider other more diversified ETF products.

Advantages of investing in QQQ

High growth: QQQ mainly tracks the Nasdaq 100 Index, which covers the 100 largest and fastest-growing non-financial companies listed on the Nasdaq exchange. Many constituent stocks are world-renowned technology companies, such as Apple, Microsoft, Amazon, Google parent company Alphabet, Facebook parent company Meta, etc. The high growth potential of the technology industry makes QQQ's long-term return significantly higher than other traditional indexes.

Concentrated investment in technological innovation: QQQ provides investors with the opportunity to concentrate on technology stocks. These companies are usually at the forefront of industry innovation, have strong market competitiveness and sustained profitable growth. For those investors who are optimistic about the future development of the technology industry, QQQ provides a convenient investment channel.

Extremely high liquidity: QQQ has a huge trading volume and is one of the most traded ETFs in the world. This means that investors can easily buy and sell QQQ amid market fluctuations without worrying about liquidity issues.

Dividends: As a dividend-paying fund, QQQ implements quarterly dividends, providing investors with stable cash flow. Investors can obtain relatively stable dividend income by holding QQQ.

Is now the time to buy SPY and QQQ?

Despite this week's volatility in stocks, UBS Group AG's Solita Marcelli remains confident that U.S. stocks will continue to rise in the coming months.

The chief investment officer of the bank's wealth management unit said recent market volatility has not shaken her fundamental view on stocks in 2024. She noted that the Fed's first rate cut is imminent and that the S&P 500 has risen an average of about 17% in the next 12 months after the Fed begins easing policy amid solid economic growth. "So I think the market can be supported," Marcelli said in an interview. “There are also some contrarian buy signals emerging.”

Goldman Sachs believes that although the U.S. non-farm payrolls data in July was weak and the unemployment rate exceeded expectations, this does not indicate that the labor market or the economy will deteriorate rapidly. The higher-than-expected unemployment rate this time was mainly caused by temporary layoffs, which usually do not represent the risk of an economic recession. Continued growth in job vacancies and end demand indicates that labor demand remains strong.

Goldman Sachs is skeptical of the risk of the economy slipping into recession quickly, noting that the Federal Reserve still has enough room to cut interest rates and take action to support the economy if necessary. Therefore, Goldman Sachs believes that the current recession risk is limited, and the U.S. stock market has a great chance of rebounding in the future.

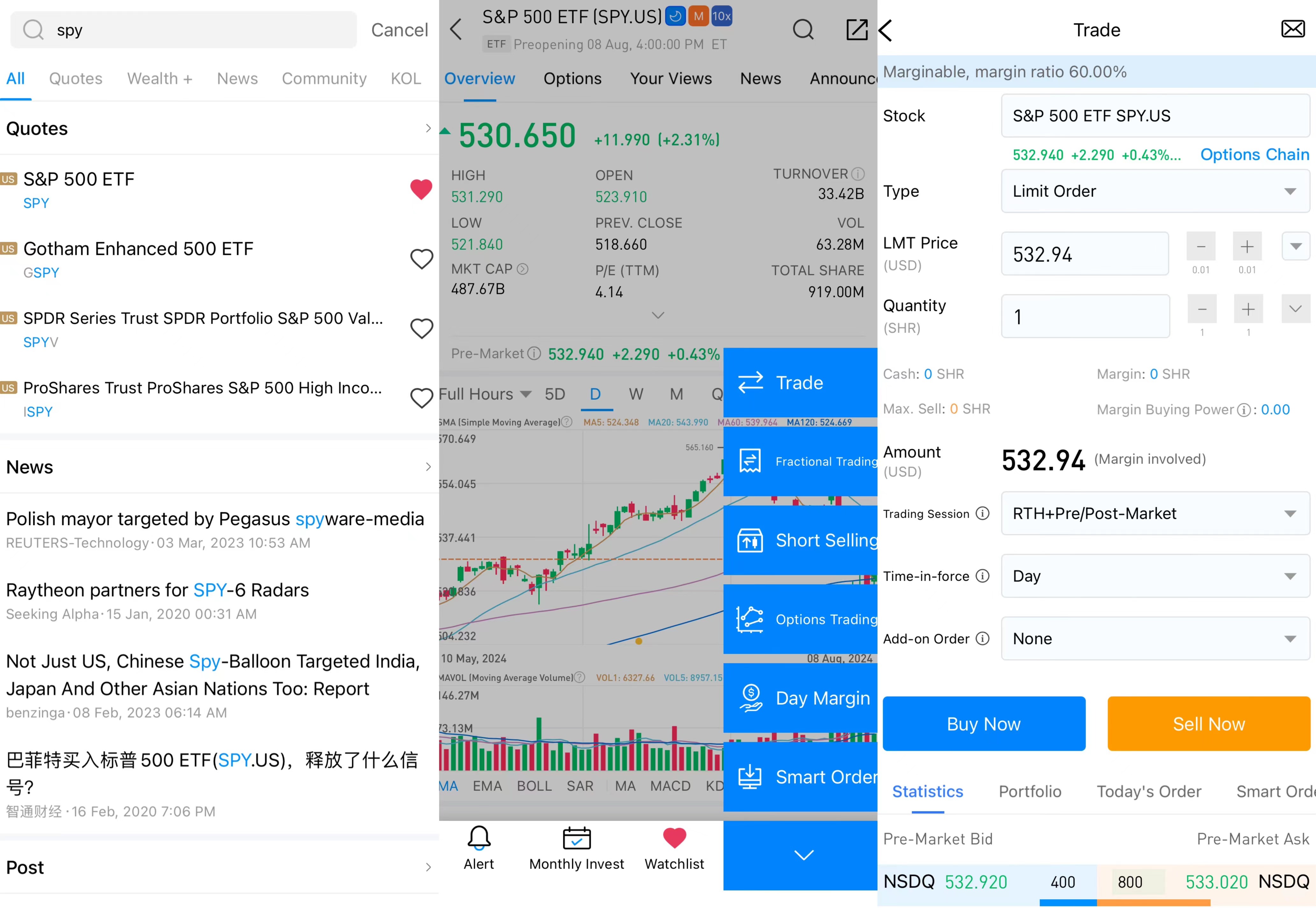

How to invest in SPY and QQQ on uSMART?

After logging into uSMART HK APP, click "Search" from the upper right corner of the page, enter "SPY" or "QQQ", you can enter the details page to learn about transaction details and historical trends, click "Trade" in the lower right corner, and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the picture operation instructions are as follows:

(Source: uSMART)

(Source: uSMART)