集萬千寵愛!

跌下神壇的Rivian(RIVN.US)似乎再次成爲資本市場的寵兒。

在去年11月10日正式登陸納斯達克後,有“特斯拉殺手”之稱的Rivian便受到資本市場的大力追捧,上市首日大漲近30%,盤中市值曾短暫觸及1040億美元。上市後第5個交易日,Rivian股價升至179.47美元的高點,市值高達1615.23億美元,成爲僅次於特斯拉(TSLA.US)和豐田(TM.US)的全球第三大車企。

但資本的歡呼聲戛然而止,Rivian開啓連跌模式。在虧損擴大、汽車產量預期下調、首席運營官Rod Copes離職等一系列不利因素的衝擊下,其股價一路下跌,在上市不到2個月後跌破78美元的發行價。受特斯拉大跌拖累,Rivian在1月28日盤中一度跌至50美元的低點,較最高點跌70%。

如“衆星捧月”般再成爲資本寵兒

不過,隨着各大機構公佈持倉報告,Rivian又重新成爲市場關注的焦點。

智通財經瞭解到,德州、加州、馬裏蘭州、猶他州、科羅拉多州、北卡羅來納州和威斯康星州的養老基金在第四季度買入了Rivian股票,其中,加州公務員退休基金購買了逾30.5萬股,德克薩斯州教師退休基金持有約3.3萬股。

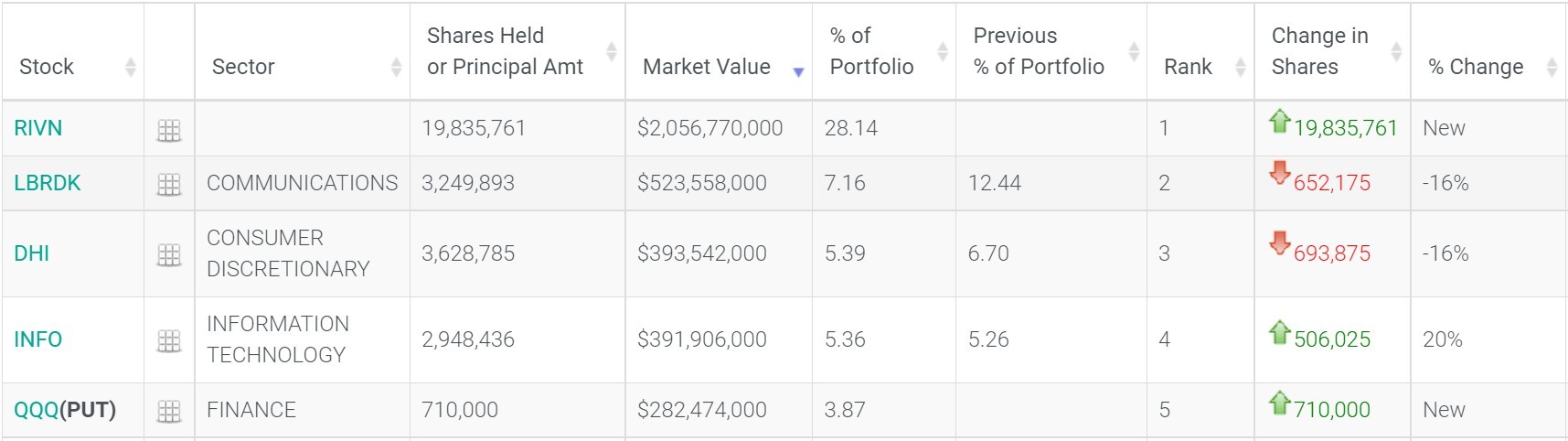

此外,貝萊德(BLK.US)、摩根大通(JPM.US)、德意志銀行(DB.US)、索羅斯旗下基金Soros Fund Management、摩根士丹利(MS.US)、黑石集團(BX.US)和高盛(GS.US)等在第四季度建倉Rivian。其中,在索羅斯基金前五大重倉股中,Rivian位列第一,持倉約1983.57萬股,持倉市值約20.57億美元,佔投資組合比例爲28.14%。

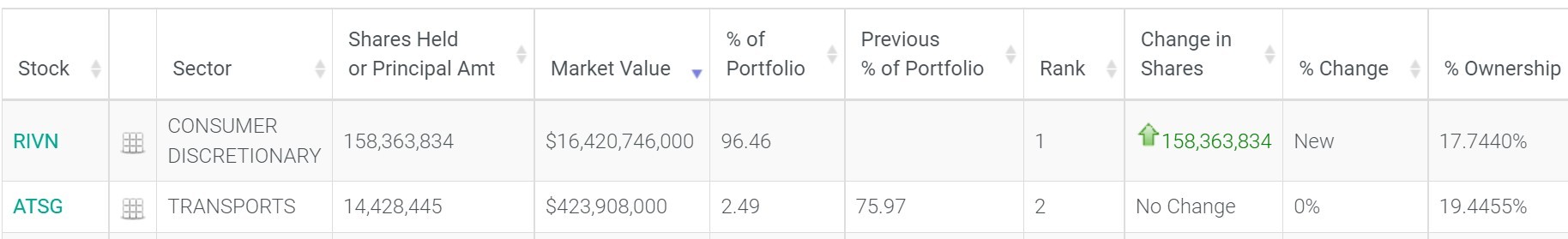

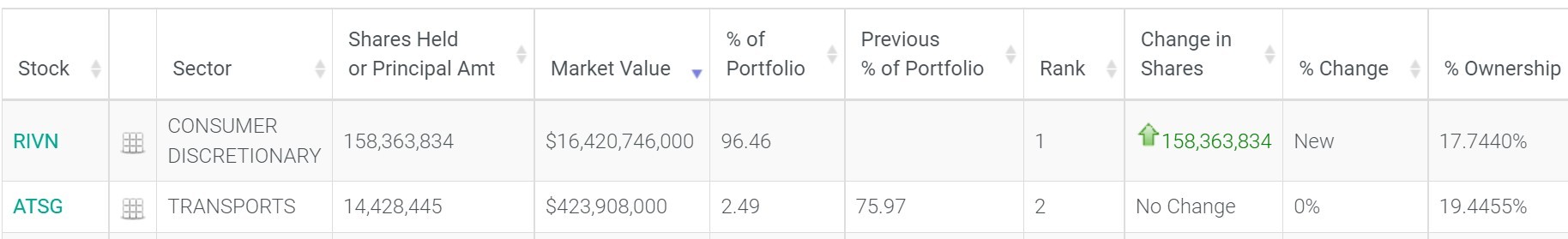

值得關注的是,Rivian最大的支持者和客戶之一亞馬遜(AMZN.US)在四季度重本建倉Rivian,持倉約1.58億股,持倉市值約164.2億美元,佔投資組合比例爲96.46%。

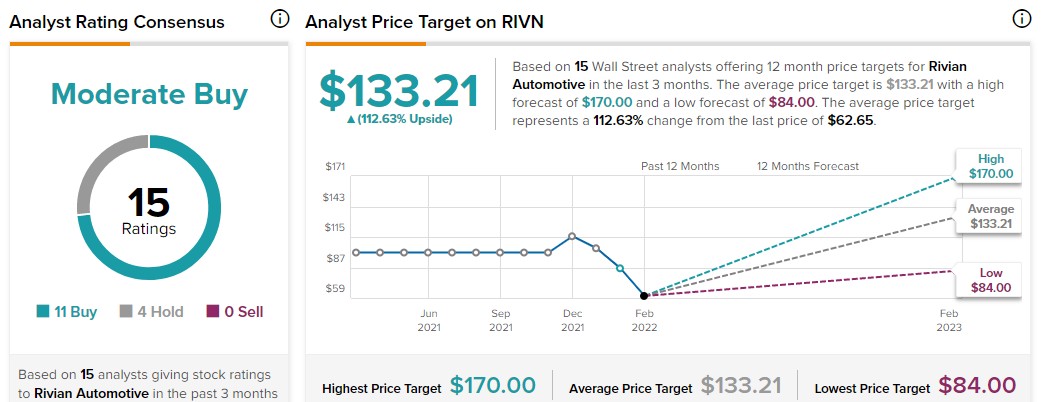

受各大機構增持的消息提振,Rivian股價回升。截至週一(2月14日),Rivian收漲6.46%,報62.65美元,市值約564億美元。儘管如此,Rivian的股價上市至今仍跌近20%,年初至今跌近40%。

華爾街怎麼看?

近日,摩根士丹利分析師Adam Jonas發佈研報,予Rivian“增持”評級,目標價147美元。 Jonas認爲Lucid(LCID.US)可能只值16美元左右,相比之下,儘管Rivian的股價目前已高於60美元,但該股看起來要更爲劃算。Jonas不認爲Rivian會在今明兩年實現盈利,但Rivian具備更大的市場吸引力,有望獲得更多的訂單。

Redburn分析師 Charles Coldicott也表示看好Rivian,予該股“買入”評級,公允價值爲141美元。Coldicott承認,從表面上看,Rivian估值似乎有些瘋狂,但他計算數據後表示,這隻股票的估值並沒有那麼高。Coldicott預計,Rivian到2030年的銷量可能達到150萬輛,營收780億美元,EBITDA利潤率爲17.5%。Rivian的增長前景強勁,因爲它擁有行業領先的技術,其業務可能會帶來比當前更豐厚的利潤。

此前,在Rivian因交貨短缺引發市場擔憂之際,Wedbush、摩根士丹利、Piper Sandler等投行爲Rivian低產辯護,並對其長期前景持樂觀態度。Wedbush指出,Q3的交貨短缺是一個供應問題,而不是需求問題,相信Rivian能夠在這場電動汽車軍備競賽中佔據可觀的市場份額。摩根士丹利預計Rivian在2022年消費者交付量爲1.8萬輛,商業交付量爲1.2萬輛,這或能支撐一個較高的估值。

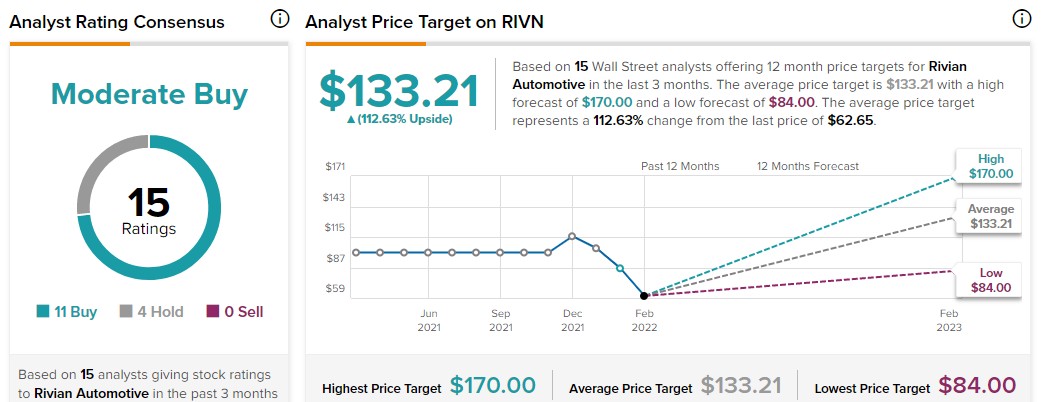

多數華爾街分析師同樣看好Rivian。最近3個月,有11位分析師予該股“買入”評級,4位予“持有”評級,共識評級爲“適度買入”,平均目標價爲133.21美元,較當前股價有113%的上漲空間。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.