輪證日報|醫藥股領漲,信達認購證漲70%

今日市場短評

港股三大指數弱勢收跌,恆指跌0.82%,國指跌1.05%,恆生科技指數跌0.22%。盤面上,醫藥外包概念、醫美概念股表現強勢,內銀股、內險股、石油股下挫。個股方面,昭衍新藥收漲13.14%,藥明康德收漲12.13%,時代天使收漲10.41%,中銀香港收跌4.09%,龍光集團收跌12.04%,中國石油股份收跌3.53%,衆安在線收跌4.57%。

窩輪(認股證)焦點

信達生物(01801)

信藥認購證(19600)到期日:2022年12月

槓桿:9.91倍港股醫藥股漲幅擴大,信達生物盤中漲潮15%

信達生物(01801.HK)與馴鹿醫療共同開發BCMA CAR-T候選產品獲美國FDA孤兒藥資格

信達生物(01801.HK)宣佈,與創新生物製藥公司馴鹿醫療共同開發的候選產品全人源自體B細胞成熟抗原(BMCA)嵌合抗原受體自體T細胞(CAR-T)注射液,近日獲得美國食品藥品監督管理局(FDA)授予孤兒藥資格認定,用於治療復發/難治性多發性骨髓瘤。 信達生物高級副總裁周輝表示,FDA授予孤兒藥認證爲公司開發BCMA靶向CAR-T的一個裏程碑,將進一步加快產品臨牀開發和註冊上市。

牛熊證焦點

中芯國際(00981)

中芯牛證(52082)到期日:2022年12月

回收價:18.58槓桿:6.98倍

華泰證券上調中芯國際目標價14.3%至40港元 維持“買入”評級

華泰證券發研報指,中芯國際4Q21業績表現強勁,4Q21收入環比增長11.6%,符合公司指引(11%-13%)。毛利率爲35.0%,高於彭博一致預期(33.8%)。其中,其4Q21實現資本開支環比上升97%,這意味着美國實體清單的影響正在消退;1Q22指引強勁,收入預計環比增長15%-17%,毛利率預計36%-38%。該行表示,中芯國際在4Q21資本開支爲21億美元(環比增長97%),並在公告中指引2022年資本支出預算爲50億美元。這意味着由於2020年12月被列入美國實體名單而面臨的業務連續性問題已基本解決。此外,中芯國際也透露出產能擴張計劃將順利進行,重申了在三個新晶圓廠滿負荷運行後的未來幾年內總產能翻番(4Q21已達到62.1萬片/月)的目標。儘管全球芯片短缺有望在2022年開始緩解,但受到終端客戶強勁的國產化需求推動,預計公司將在2022全年保持接近滿載的稼動率,其2022年收入有望增長39%。該行上調2022/2023年收入預測9.8%/16.2%至75.8/89.8億美元,預測2024年收入爲107.4億美元,當前代工行業2022年PB均值爲3.0倍。考慮到實體清單影響尚未完全消除,該行將目標價從35港元,上調14.3%至40港元,維持買入評級。

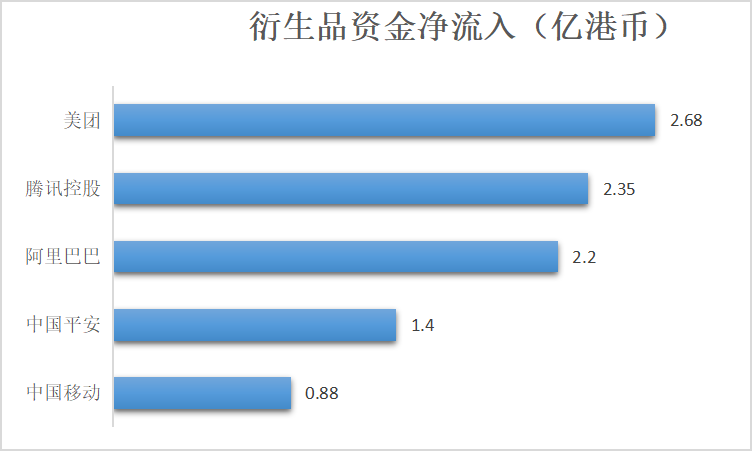

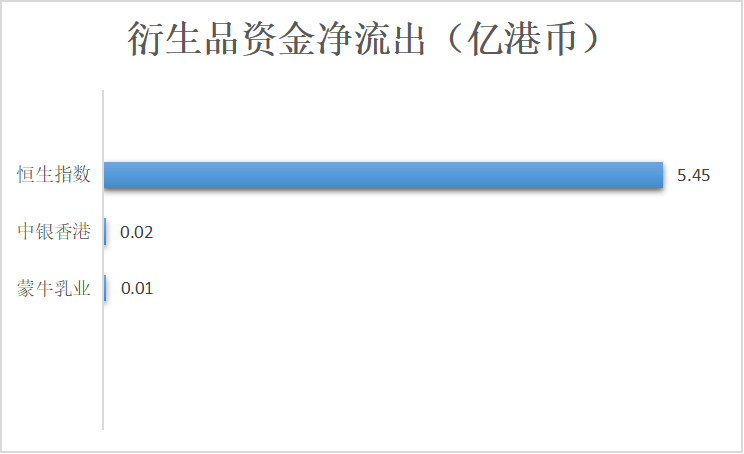

衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.