輪證日報|餐飲股普漲,九毛九認購證漲50%

今日市場短評

美股週四高開低走,道指抹去400點漲幅,標普500指數自去年10月以來首次收在4500點之下。港股今日開盤,恆生指數低開0.22%,隨後翻紅。截至收盤,恆生指數漲0.05%,報24965.55點;國企指數漲0.29%,紅籌指數跌漲1.32%。盤面上,旅遊及觀光板塊、啤酒股、餐飲股造好,軍工股、教育股、蘋果概念股走低。個股方面,奈雪的茶收漲8.42%,攜程集團收漲7.92%,融創中國收漲4.95%,阿裏巴巴收跌3.35%,藥明康德收跌3.74%,佳兆業集團收跌4.9%。

窩輪(認股證)焦點

九毛九(09922)

九毛認購證(28797)到期日:2022年4月

槓桿:6.71倍

餐飲股普漲

大和:下調九毛九目標價至24港元 評級買入

大和發表報告指,市場對九毛九去年業績的估計可能低估了去槓桿化的影響 ,而且由於大流行持續存在,今年該公司業績復甦的前景不明朗,不過認爲其基本面長期不變。該行將九毛九目標價由31.5港元下調至24港元 ,維持“買入”評級。大和預計,九毛九去年淨利潤將錄得1.9倍的按年增長,市場對其預測(增長約2.5倍)更爲樂觀。該行將其2021至23年每股盈利下調21%至30%,以反映在復甦慢於預期、新銷售點開業以及新銷售點需要更長時間提升的情況下,去槓桿帶來影響更大。該行預測九毛九今年收入和淨利潤在將分別按年增長約41%和64%。該股17.08港元,總市值248億港元。

牛熊證焦點

騰訊控股(00700)

騰訊牛證(68038)到期日:2022年8月

回收價:425.243槓桿:8.58倍

騰訊控股公佈,於2022年01月20日回購44萬股,每股回購價介乎452.00港元至471.60港元,涉資2.04億元。本年內至今爲止(自普通決議案通過以來) 累計購回證券數目爲1041.32萬股,佔於普通決議案通過時已發行股份數目的0.109%。

1月21日零點剛過,“公募一哥”易方達基金副總經理張坤在管基金悉數披露2021年四季報,其持倉情況也隨之揭開神祕面紗。

整體來看,張坤在2021年四季度進一步提升了股票倉位,但對持倉集中度進行了一定的分散。

前十大重倉股中,騰訊控股、海康威視、伊利股份獲得張坤增持,高端白酒股則成爲減倉的重點。

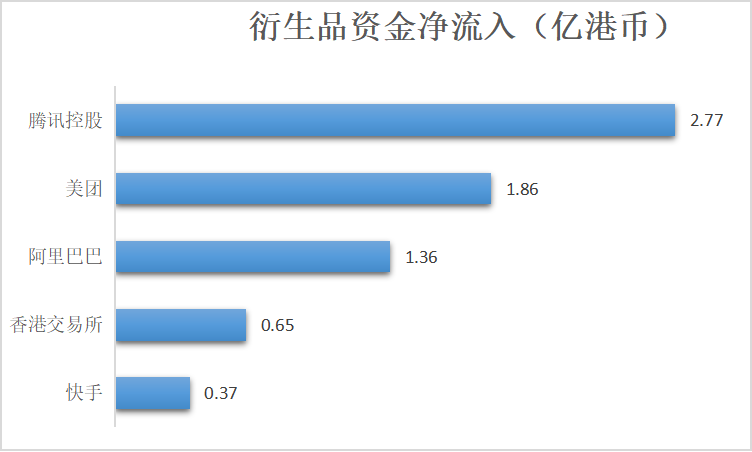

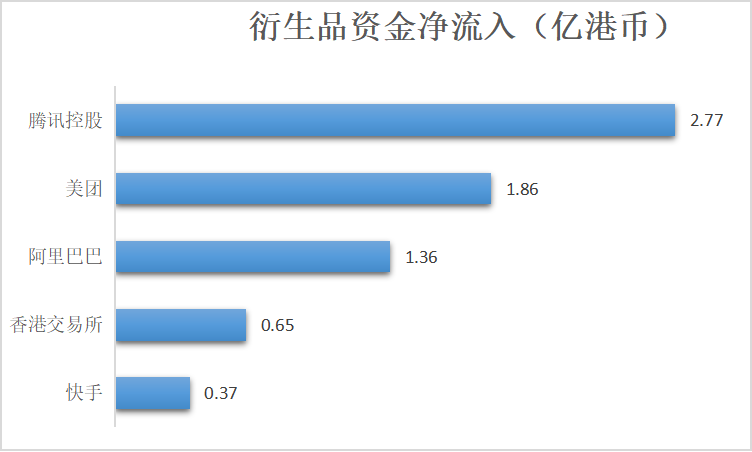

衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.