輪證日報|科技股反彈,騰訊牛證漲50%

今日市場短評

港股兩日共彈586點一舉重上廿天線,連升三週升300點。港股今早反覆向上。恆指高開30點或0.13%,報23523;之後曾倒跌94點,低見23399。港股午後震盪走高,恆指最多漲超290點。截至收盤,恆指收漲1.08%,實現三連漲。盤面上,互聯網醫療股、地產股、物管股領漲大市,汽車經銷商板塊、啤酒股普跌。個股方面,世茂集團收漲19.15%,阿裏健康收漲10.83%,快手收漲10.11%,小鵬汽車收跌4.26%。

窩輪(認股證)焦點

明源雲(00909)

明源認購證(27122)到期日:2022年10月槓桿:5.55倍

明源雲漲幅持續擴大,近三個交易日累計漲幅超26%

國金證券維持明源雲“買入”評級,目標價51.9港元,較現價有2.5倍漲幅。保持原盈利預測,對應22年收入的合理市值1002.9億港元。 此外,日前董事會決定動用股份購回授權,可能以總金額不超過1億美元的港元不時於公開市場購回股份。

牛熊證焦點

騰訊控股(00700)

騰訊牛證(66854)到期日:2022年12月回收價:420

槓桿:11.06倍

高盛:維持騰訊控股“買入”評級 目標價降至702港元

高盛發佈研究報告稱,維持騰訊控股“買入”評級,列入“確信買入”名單,目標價由733港元下調4.2%至702港元,下調2022/23年收入預測2%/2%,主因同期廣告收入預測各下調11%/10%,同期經調整純利預測下調7%/4%。

報告中稱,騰訊已於過去14個月剝離約500億美元投資,但同時加快新投資,2021年內,共有265個新投資項目,遊戲及企業服務公司佔45%,有助貢獻2022-24年新遊戲渠道組合,及推升中、長期收入及盈利,同時減低現存資產控股公司折讓。但宏觀憂慮因素持續,預期2021年第4季中國互聯網收入增長14.8%,低於疫情初期水平;同期板塊市場開支也放緩至13%,由於監管措施負面影響。

該行預計,去年第4季騰訊廣告收入同比跌8%;下調公司去年第4季收入預測3%至1487億元人民幣,同比升11%,主要下調廣告及金融科技板塊收入預測。基於較低的毛利率及經營槓桿,下調第4季經調整經營利潤預測7%至325億元人民幣,每股盈測下調至2.22元人民幣。

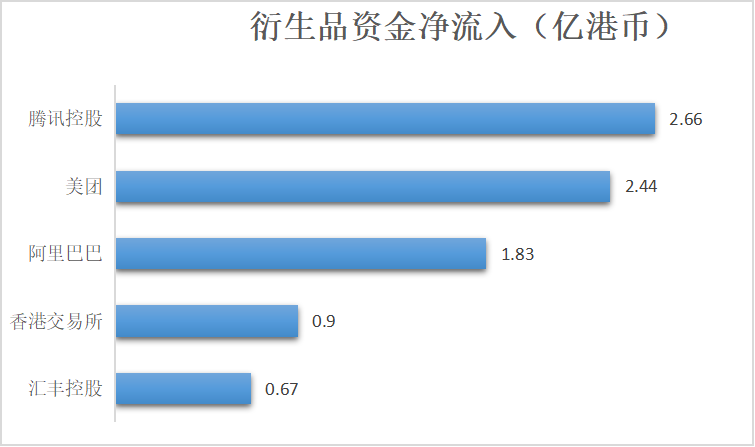

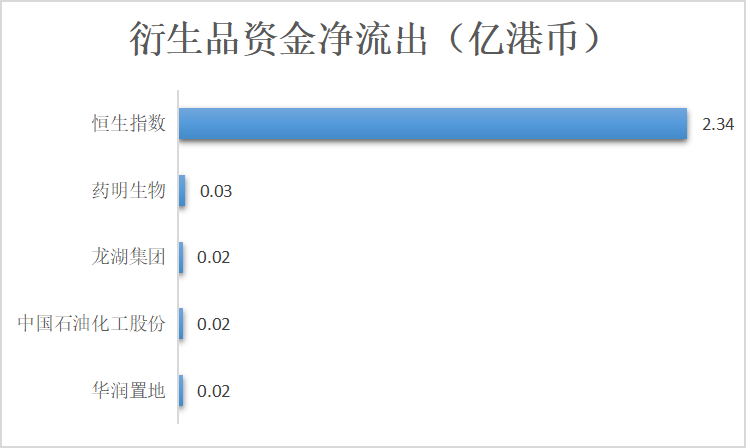

衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.