輪證日報 | 航空股走強,南航認購證漲30%

今日市場短評

港股午後走勢曾好轉,恆指一度升約90點,隨後升幅收窄,再次翻綠。截至收盤,恆指小幅收漲0.06%,恆生科技指數收跌1.04%。電力股、醫藥外包概念股拖累大市,內房股、航空股表現強勢。個股方面,第一服務控股收跌42.31%,昭衍新藥收跌12.26%,華潤電力收跌11.66%,易居企業控股收漲12.99%,商湯收漲5.81%,中國恆大小幅收漲1.26%。

窩輪(認股證)焦點

中國南方航空股份(01055)

南航認購證(24003)到期日:2022年2月

槓桿:11.88倍

航空股集體上漲 國內燃油附加費取消徵收或刺激春運

消息面上,於2021年11月15日恢復徵收的國內航線燃油附加費,將於1月5日停收。 據瞭解,目前國內航線的燃油附加費徵收,採取的是與航空煤油價格聯動機制,允許航空公司在不超過按公式計算的最高標準範圍內,自主確定具體標準。2021年11月份恢復徵收主要在於,進入2021年以來航空煤油價格進入了上行通道,爲了彌補油價上漲帶來的成本增加, 恢復徵收燃油附加費一定程度上可以緩解航空公司的運營成本,而此次取消徵收一定程度上也是依託於油價下行。 不過值得注意的是,此次燃油附加費的停收,正值春運即將來臨。根據交通運輸部發布的預測,2022年全國春運的客運量較2021年將有大幅度增長,甚至超過2020年,預計整個2022年春運量將比2021年同期增長1倍以上。

牛熊證焦點

比亞迪股份(01211)

比迪牛證(61114)到期日:2022年9月回收價:253

槓桿:11.93倍

花旗:上調比亞迪股份目標價至587港元,預計2022年新能源汽車銷量130萬輛花旗稱,因比亞迪股份12月強勁的積壓訂單、西安工廠恢復生產等因素,預計公司1月有效工作日的銷量和產量均將繼續環比提升,分別上調公司A和H股目標價至504元人民幣和587港元。花旗將比亞迪2022-2024年新能源汽車銷量預測分別調升至130萬、175萬和200萬。

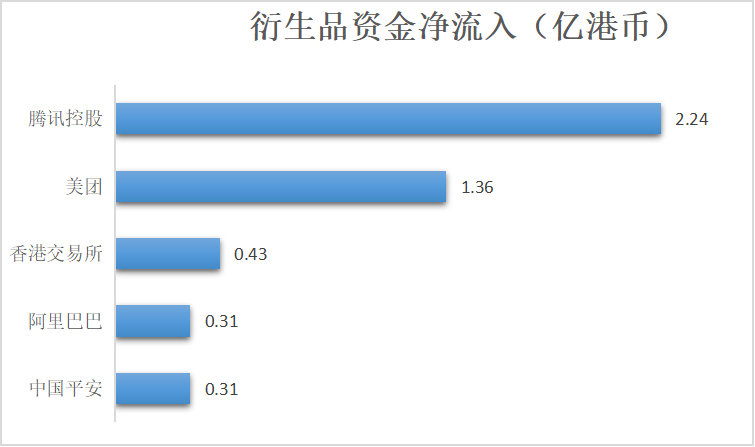

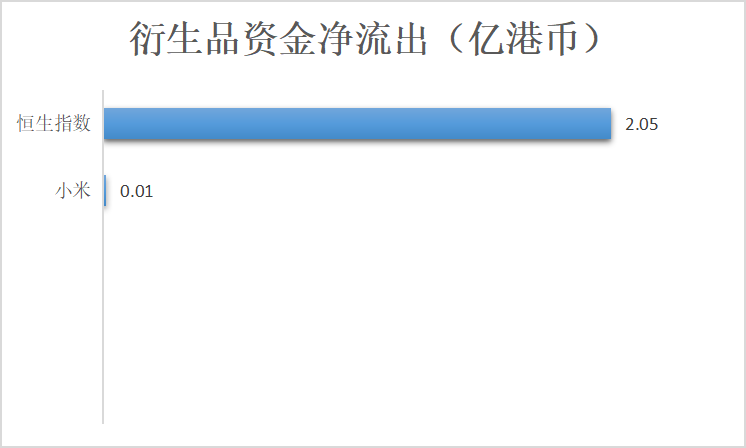

衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.