輪證日報 |大摩看好網易前景,牛證漲100%

| 今日市場短評

港股昨日倒升逾兩百點後,今早再高開249點,高見23258,之後升幅收窄,曾僅升61點,低見23033,二萬三關有支持。下午甫開失守上午低位(23033點),低見22979,僅微升8點,尾盤漲幅擴大。截至收盤,恆指收漲0.57%。盤面上,科技股、汽車股、體育用品股領漲大市,房地產板塊、電力股下挫。個股方面,嗶哩嗶哩收漲5.97%,李寧收漲5.08%,小鵬汽車收漲6.4%,中國恆大收跌3.33%。

| 窩輪焦點

貓眼娛樂(01896)

貓眼認購證(28120)到期日:2022年12月槓桿:2.5倍

大摩:料電影業短期內不會全面復甦,予貓眼娛樂、IMAX中國增持評級

摩根士丹利發表研究報告指,認爲中國電影業短期內不會全面復甦,並將2022財年票房預測由原來的590億元人民幣,下調至520億元人民幣,估計全面復甦將由2023年推遲至2024年。另預期在有限大製作電影的情況下,中國農曆新年的票房約65億至75億元人民幣,按年跌4%至17%。 該行於戰略上更爲看好貓眼娛樂,主要由於其良好的業績紀錄,並認爲該股目前估值並未計入在大片化趨勢下其製作業務的市場份額增長的因素,目標價由16港元降至11.4港元,評級“增持”。IMAX中國是大片化趨勢下的主要受惠者,其市場份額由2021財年的3.2%,增加至2023財年的4.4%,以及未反映公司2021至2024財年淨利潤複合年增長率28%的因素,目標價由19港元降至16.8港元,評級“增持”。

| 牛熊證焦點

網易(09999)

網易牛證(50111)到期日:2022年8月回收價:140槓桿:9.97倍

大摩:予網易(NTES.US)目標價140美元 看好國際市場遊戲收入未來提升

大摩發佈研究報告稱,予網易“增持”評級,預計國際市場的遊戲收入在三至五年內,可由目前的10%提升至最少30%,相信哈利波特、Diablo及魔戒等全球知名IP將有助於公司明年打入國際市場,予目標價140美元。

大摩表示,網易持續透過內容及技術創新推動競爭力提升,加上行業壁壘不斷升高,看好公司前景。此外,網易擁有清晰的遊戲發佈時間表,明年上半年將推出Diablo Immortal及魔戒,明年第二季預計推出“哈利波特魔法覺醒”國際版,另外首季預計推出類似Roblox的遊戲平臺等。

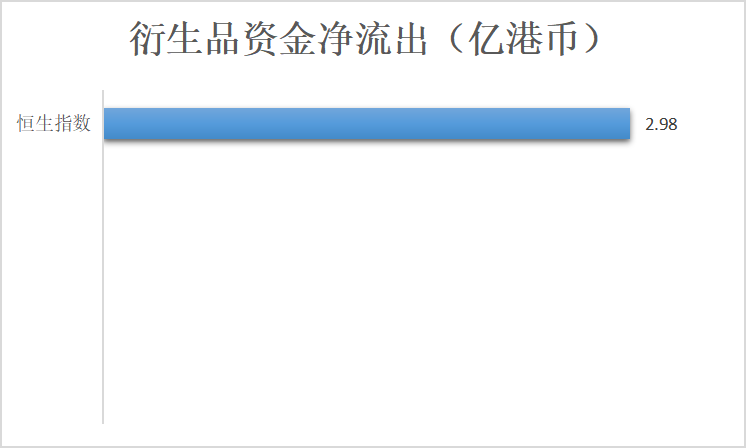

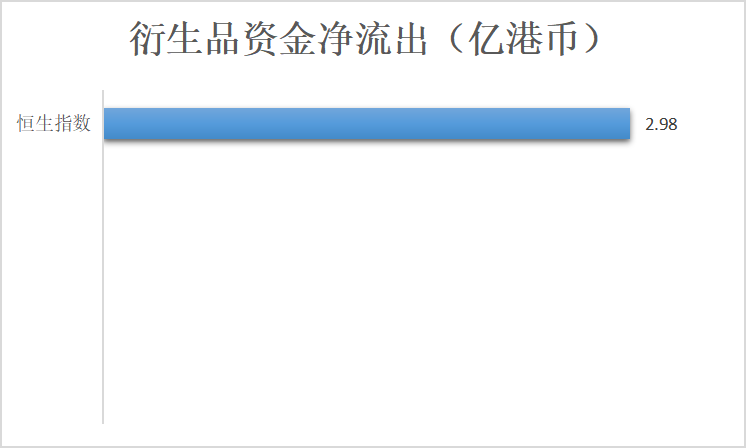

| 衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.