分析師:做空ARK!

儘管表面上看,近期市場對Omicron變種的擔憂推動了股市的震盪,但實際上市場在上週就已經出現了異常。據瞭解,標普500指數11月整體保持相對穩定,但成長型股票、MEME股以及對衝基金青睞的其他公司的股價卻出現了下跌。

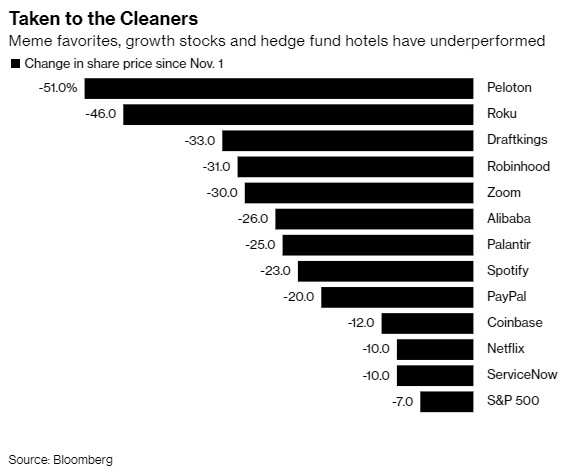

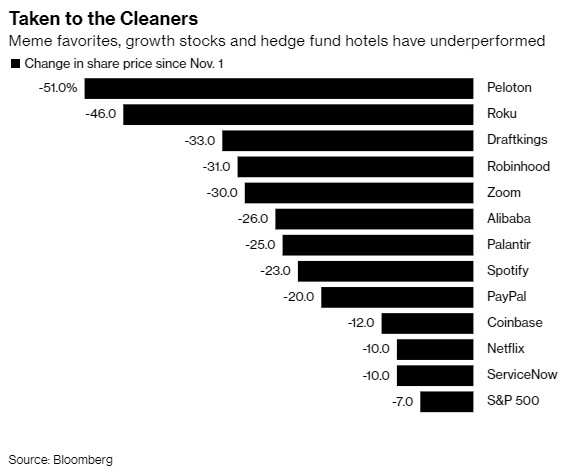

圖1

其中,從11月1日至今,Peloton(PTON.US)跌幅已達51%,Roku(ROKU.US)跌幅也達46%,Draftkings(DKNG.US)、Robinhood(HOOD.US)、Zoom(ZM.US)跌幅超30%,相比之下,標普500指數僅跌7%。

對此,高盛策略師David Kostin的觀點是,儘管這些高增長、低利潤企業中有許多前景誘人,但其目前的估值依賴於長期未來現金流,因此這些企業尤其容易受到利率上升或營收不及預期風險的影響。

此外,Kostin還指出,目前股票的平均做空比例處於2000年科技泡沫以來的最低水平,從2020年初佔市值的2.2%降至目前的1.5%。這意味着當市場出現回調時,賣出就會變得非常擁擠。

爲了理解當所有人都試圖同時離開市場時會發生什麼,看看大摩的一個指數是很有幫助的,該指數根據對衝基金提交的13-F數據,列出了前50名最擁擠的股票。

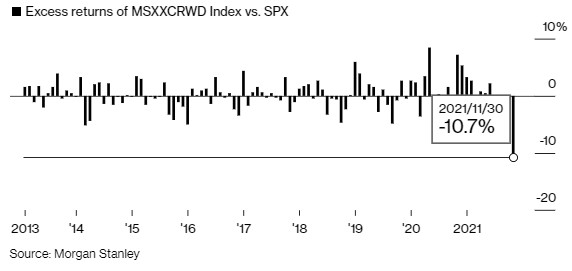

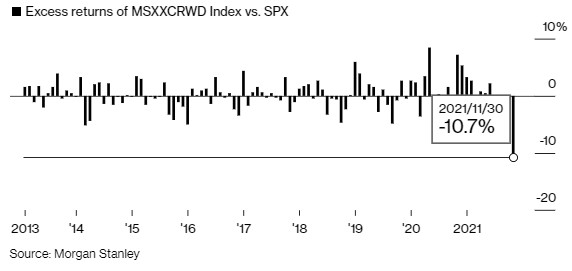

圖2

這一籃子股票創下了與標普500指數相比的歷史最差表現。

市場人士認爲,美聯儲加快緊縮步伐、科技公司業績不及預期,以及對衝基金希望在年底前獲利了結,都是導致股市出現極端走勢的原因。儘管如此,缺乏明顯的單一催化劑還是讓人想起了2007年8月的令人不安的記憶。據悉,當時華爾街受到了計算機驅動的投資模式短暫崩盤的衝擊,這場危機後來被稱爲“量化浩劫(Quant Quake)”。

但也有人在此次混亂中發現了機會,Tallbacken Capital Advisors LLC分析師Michael Purves建議投資者使用最擁擠的股票來對衝市場波動加劇的風險。該分析師建議做空Cathie Wood的旗艦基金ARK Innovation,因爲這隻基金是散戶投資者喜愛的熱門股票的代表,並且自11月1日以來已下跌19%。

Purves表示:“在股市波動加劇的形勢下,我們認爲最佳風險/回報是建立在估值更多地取決於故事而不是數字的市場。”

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.