“木頭姐”變“韭菜姐”?

uSMART盈立智投 10-28 22:38

在美國網紅券商Robinhood(HOOD.US)公佈財報的前幾天裏,“木頭姐”凱西·伍德(Cathie Wood)旗下基金加倉了該公司。

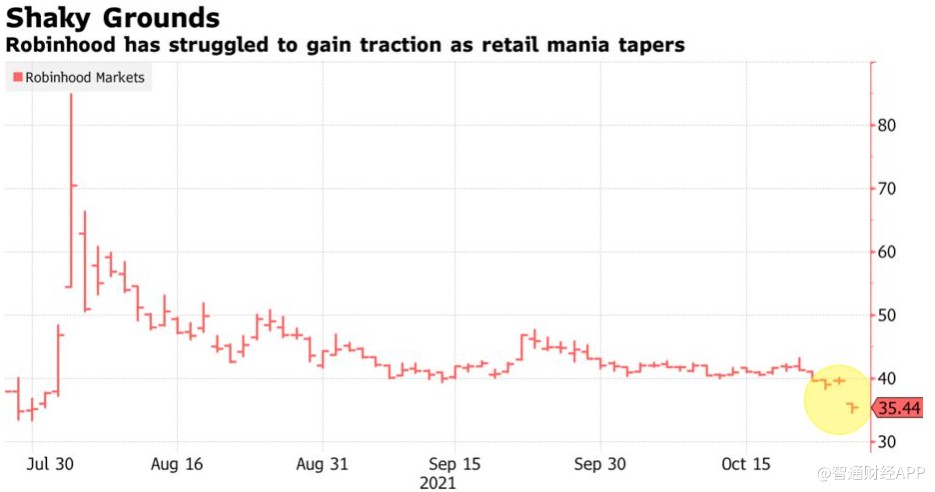

伍德旗下的其中一支基金買入了超過83.6萬股的Robinhood股票,價值至少3240萬美元。而該倉位在Robinhood公佈財報後備受打擊,因三季度營收低於市場預期,Robinhood在週三的交易中大跌超10%,收盤價格已經低於其IPO發行價的38美元。

伍德的旗艦基金ARKK今年以來下跌了4.7%,而標普500指數的回報率超過20%。隨着Robinhood股價從8月份高點下跌58%,伍德的倉位也承受了不小的損失,她旗下的基金是Robinhood的五大持有者之一。

華爾街對Robinhood財報失利的拋售態度,與散戶投資者逢低買入的心態形成了鮮明的對比。在散戶交易員聊天室Stocktwits上,Robinhood成爲了熱門股票,散戶正在討論買入該股票,在富達(Fidelity)的投資平臺上,該股與特斯拉(TSLA.US)一起成爲了最受歡迎的購買標的。

值得注意的是,自Robinhood在7月登陸美股市場以來,伍德便開始一直穩步加倉。數據顯示,截至週二收盤,伍德旗下基金持有約974萬股的Robinhood股份,價值約3.85億美元。

在3個月前,Robinhood曾警告稱其三季度財報將是“醜陋”的,而該公司目前給出的四季度預期一樣不容樂觀。公司預計第四季度不超過3.25億美元,而預期爲5億美元;預計全年收入低於18億美元,低於預期的20.3億美元;預計第四季度新增資金賬戶約66萬個。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.