資管巨頭Janus Henderson警告:明年市場將面臨更大的通脹考驗

駿利亨德森投資公司(Janus Henderson Investors)的多資產團隊主管Paul O'Connor表示,威脅全球風險資產的供應鏈危機並不算什麼,真正的考驗將在明年到來,屆時服務業的繁榮將推高勞動力成本,並迫使各國央行更果斷地收緊政策。

O'Connor表示,隨着各經濟體在2022年開放,消費者對服務業需求的回升,將使美國和其他地區本已十分緊張的勞動力市場更加吃緊。這意味着,即便當前商品通脹瓶頸緩解,能給市場帶來的任何喘息,都將只是暫時的。而目前看到的商品瓶頸只是明年重大事件的彩排,明年將是服務業繁榮,以及隨之而來的所有相關定價和政策壓力,這可能會給央行帶來更多麻煩。

因此,O'Connor在其投資組合中繼續減持政府債券和投資級債券,且對股市持中立態度,並表示即使有強勁的增長預期,如果服務業推動利率重新定價,可能會對股市造成“連帶損傷”。

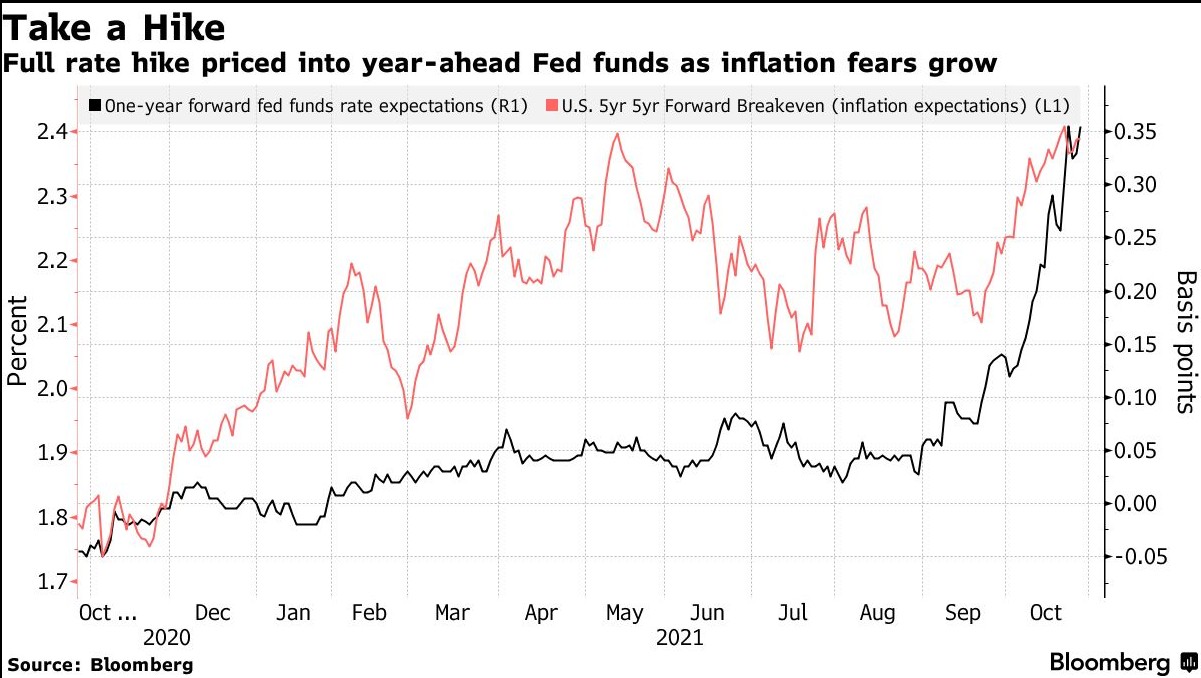

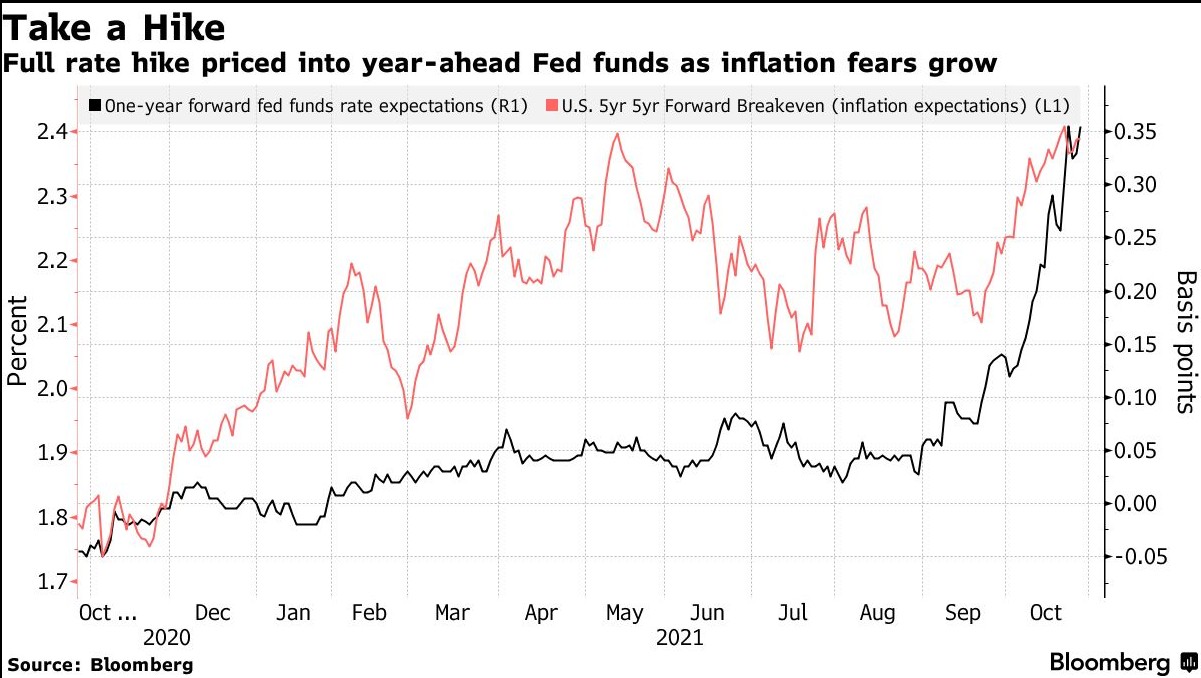

持續通脹的威脅仍然是投資者的熱門話題,從方舟投資的凱西•伍德、特斯拉的馬斯克,再到美國前財長Larry Summers,所有人本週都在討論這個話題。儘管部分人贊同美聯儲的觀點,認爲物價上漲將是暫時的,但也有越來愈多的交易員正提前押注加息。

此外,通脹預期還對債券市場造成衝擊,據悉,Bloomberg Global Aggregate Total Return Index今年下跌了4%以上。儘管股市目前保持堅挺,但MSCI ACWI全球指數略低於歷史高點。

O'Connor表示,風險在於,在未來某個時點,通脹壓力會變得十分明顯,並迫使央行更果斷地收緊政策,這對風險資產來說是個更大問題。“全球範圍內的利率重新定價尚未完成,”O'Connor表示,“當前瓶頸已將央行推入貨幣緊縮的第一階段,隨着明年服務業復甦,央行在貨幣緊縮方面可能會面臨更大的壓力。”

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.