收購Five9失敗後,Zoom前景如何?

9月底,Zoom(ZM.US) 宣佈終止147 億美元收購智能雲聯絡中心提供商Five9(FIVN.US)的交易。在此之前,Zoom的股價已經經歷了一段疲軟時期。

收購Five9失敗後,Zoom繼續走低。目前,Zoom的股價較歷史高點下跌了約40%。

Zoom在疫情期間實現了爆發式增長,但隨着人們重返學校和辦公室,其增長勢頭開始放緩。在後疫情時代,Zoom還值得投資者關注嗎?

爲什麼要收購Five9?

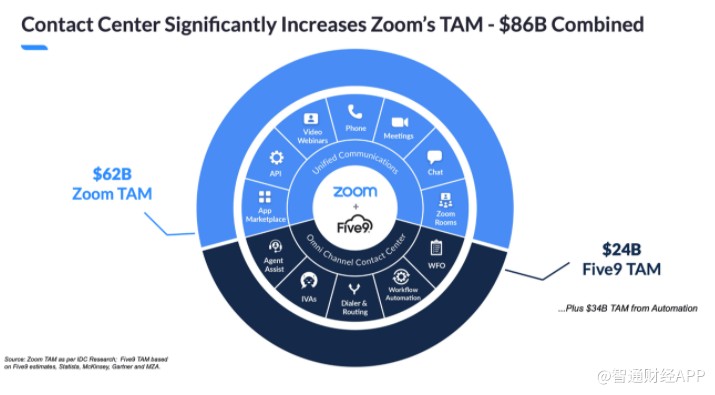

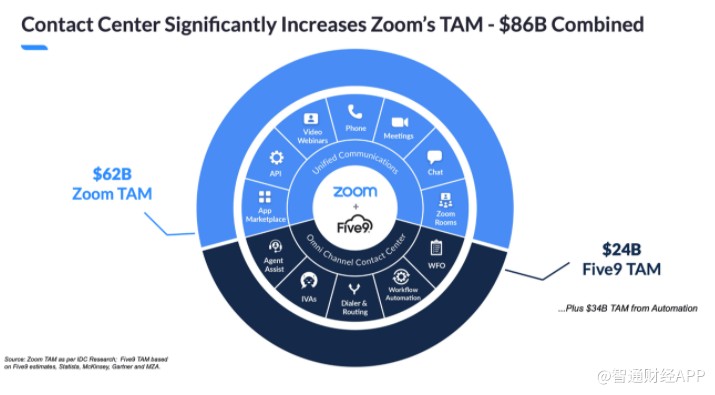

從數據上看,Zoom收購Five9能夠大大增強其業務實力。

在不計入自動化總潛在市場(TAM)的情況下,收購Five9能夠使Zoom的TAM增加到至少860億美元。

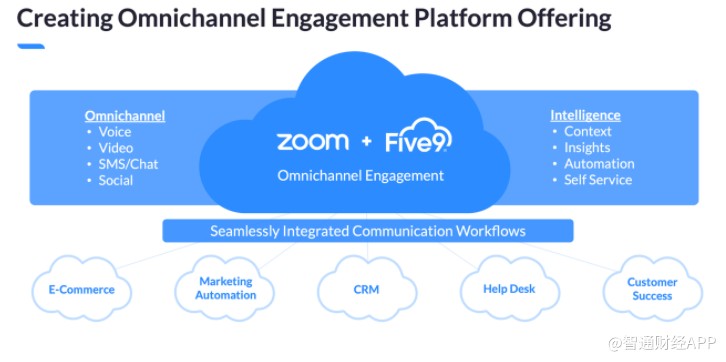

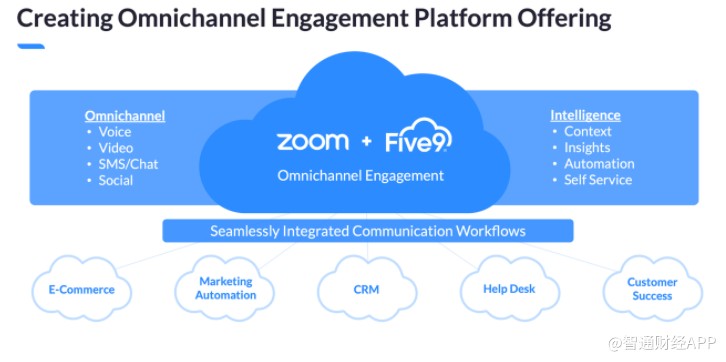

合併後的公司將成爲一個更全面的全渠道參與平臺,有助於加速業務增長。

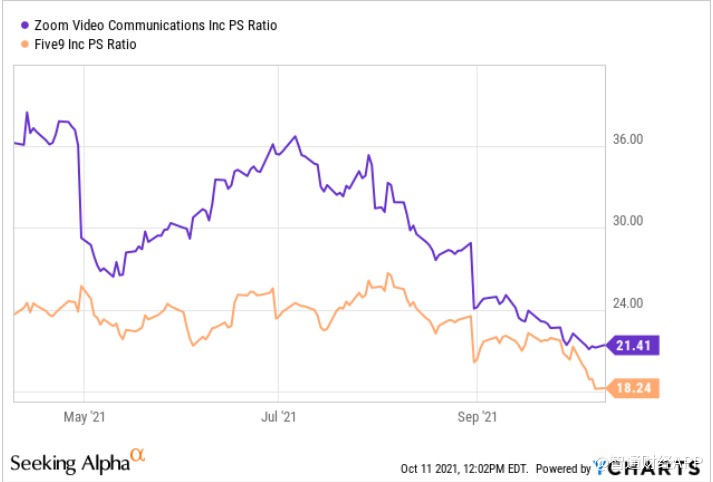

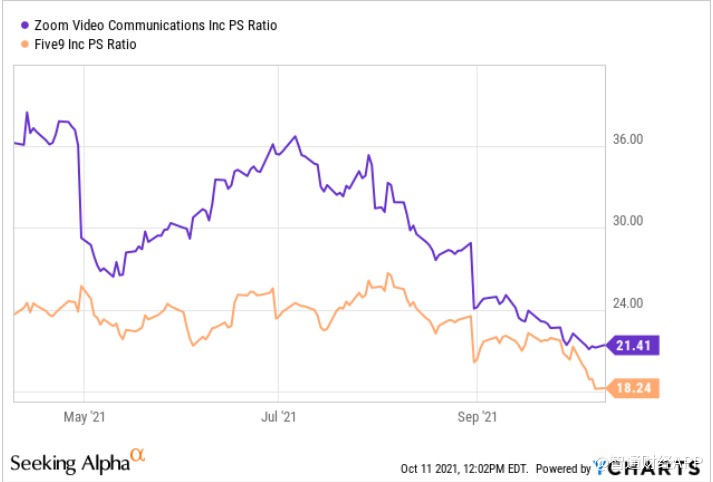

然而,合併交易並不順利。Zoom在7月中旬宣佈合併消息時,其股票溢價遠遠高於Five9。但由於近期Zoom的股票表現不佳,這種溢價優勢幾乎消失了。

由於溢價較低,加上對Zoom增長的擔憂,Five9股東沒有通過與Zoom合併的協議。

收購失敗後,Zoom發展前景如何?

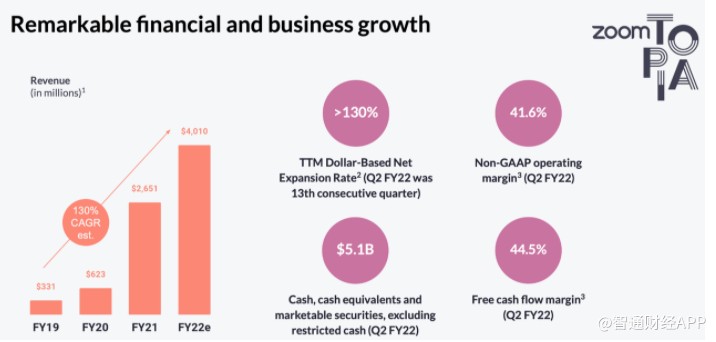

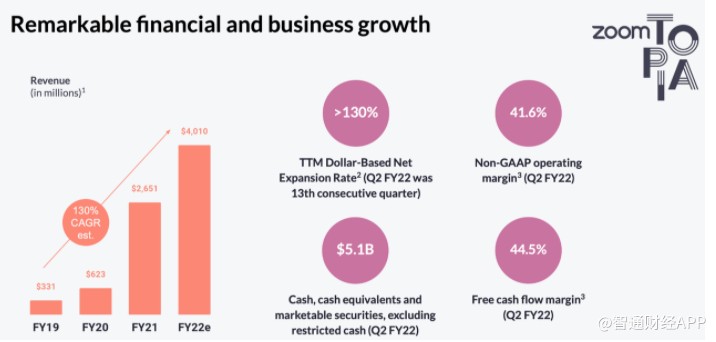

不過,在沒有Five9的情況下,Zoom的業績也表現強勁,在過去三年裏營收以三位數的年複合增長率增長。

收購失敗後,隨着經濟重新開放,Zoom將如何發展?

研究服務公司Best Of Breed分析師Julian Lin預計,Zoom增長將大幅放緩,因爲未來的增長模式不太可能與過去類似。不過,Zoom仍是視頻會議領域的領導者,這種市場地位有望使它繼續以健康的速度增長。

Lin認爲,Zoom未來的增長將來自三大支柱。首先,第三方很容易在外部應用程序中集成使用Zoom視頻會議工具。

其次,其客戶端集成了一系列第三方應用程序,用戶可以在會議過程中直接使用這些程序。

最後,Zoom未來的部分增長將來自Zoom Rooms和Zoom Phone等產品,目前這些產品的滲透率非常低。

值不值得買入?

華爾街普遍預期Zoom的營收在未來10年將以兩位數增長。

Lin將Zoom的評級從“中性”上調至“買入”。該分析師認爲,Zoom擁有健康的現金流,最近一個季度,其調整後的淨利潤率爲28%。無論疫情何時結束,視頻會議的需求都將繼續存在,Zoom有望從這一長期增長的行業中獲利。Lin表示,Zoom並不是最便宜的科技股,儘管它從歷史高點急劇下跌。 不過,鑑於它所處行業的長期增長趨勢和較低的風險,該股有望提供令人滿意的回報。

Stifel分析師J. Parker Lane將Zoom的目標股價從350美元下調至300美元,並維持“持有”評級。Lane 對該公司核心業務前景充滿信心。Lane表示,從功能的角度來看,Zoom 仍然是視訊會議領域的佼佼者,明顯領先於微軟 (MSFT.US) 的 Teams、思科 (CSCO.US) 的 Webex,以及 Verizon (VZ.US) 的 BlueJeans 等競爭對手。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.