摩根大通:機構正從黃金轉向比特幣

在今年早些時候,當比特幣從4月15日6.3萬美元的歷史高點下跌逾一半時,摩根大通跨資產策略師Nikolaos Panigirtzoglou認爲投資者應該賣出比特幣,他告訴機構客戶,比特幣的上漲勢頭已經消退,唯一合理的方向是下跌。

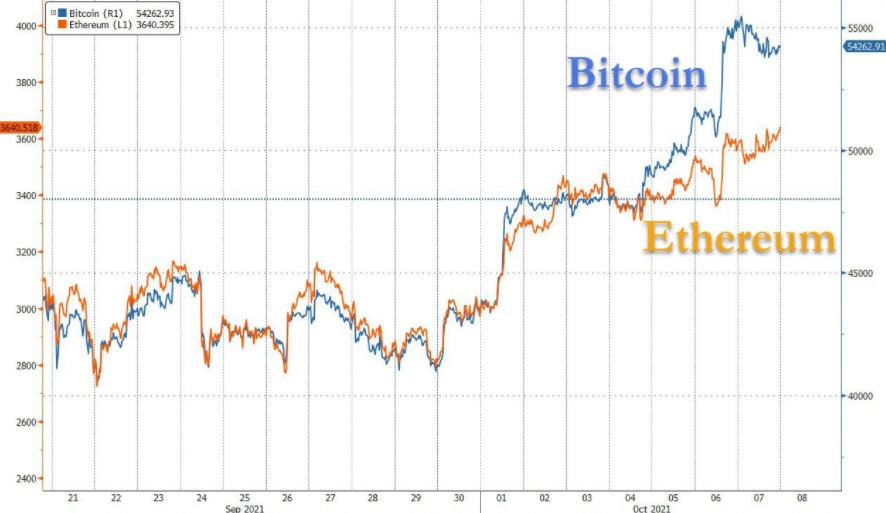

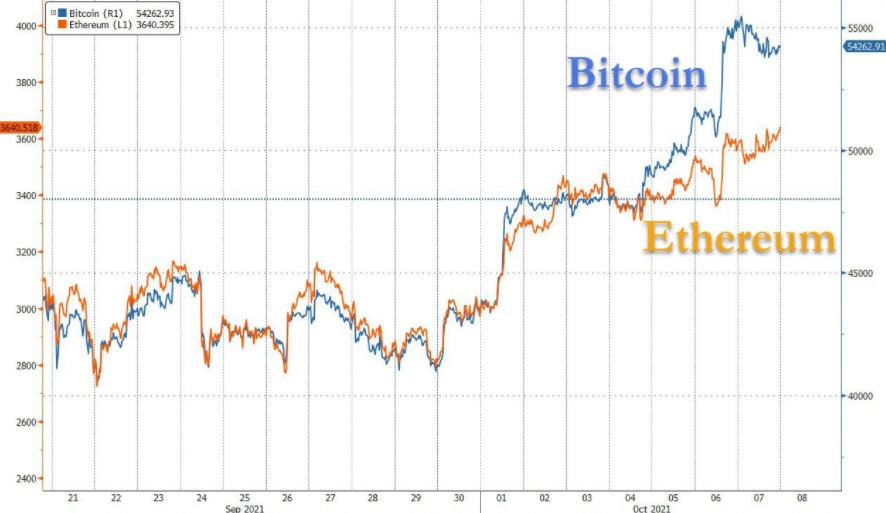

但是本週三比特幣飆升,價格再次超過55000美元,同時總市值超過1萬億美元,並且加密市場的總市值超過2.3萬億美元時,Panigirtzoglou的觀點出現了180度的轉變,他在最新的報告中寫道,“比特幣價格的增長是一種健康的發展,因爲它比其他市值更小的加密貨幣更有可能反映出機構對加密貨幣市場的參與程度。”

該分析師在此前的報告中表示,機構投資者“正在涌入以太坊,並撤離比特幣。”

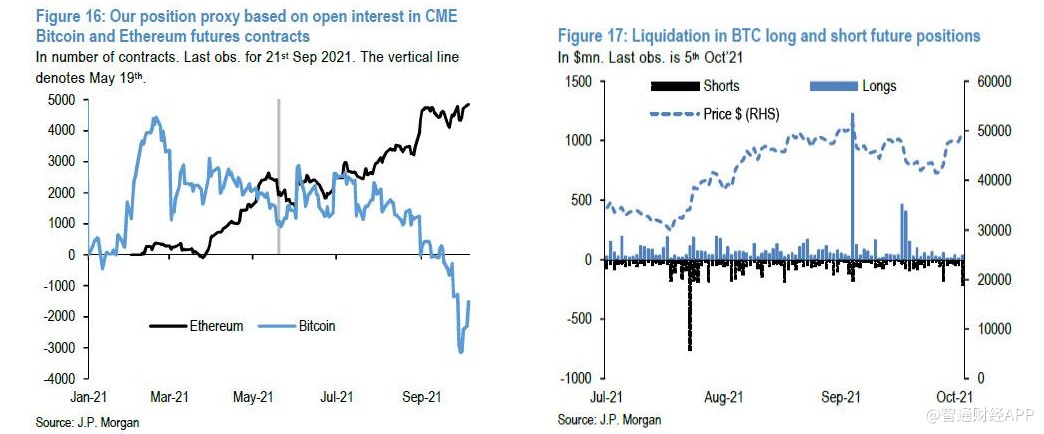

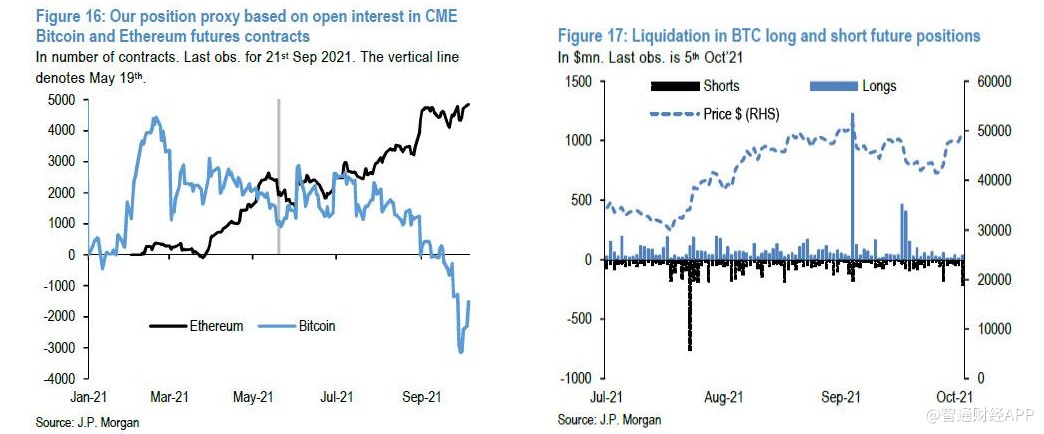

Panigirtzoglou在其最新報告中提到這個失誤,他寫道:“在8月和9月的大部分時間裏,我們曾爭論過,我們基於CME期貨的頭寸代理顯示出機構投資者對以太坊和比特幣的強烈偏好。但如圖16所示,自9月底以來,這種偏好似乎已經逆轉,比特幣的倉位代理大幅反彈。”

“這一反彈至少部分反映瞭如圖17所示的空頭回補,圖17描述了所有期貨交易所的比特幣期貨清算。從圖17可以看出,在過去的一兩個星期裏,比特幣期貨空頭的平倉量似乎有所增加。”

Panigirtzoglou指出,“機構投資者認爲比特幣可能是一個比黃金更好的對衝通脹的工具。”

該分析師還列出了一些其他推動比特幣價格上漲的原因:

1)美國政策制定者最近保證,無意效仿其他國家禁止使用或挖掘加密貨幣的措施;

2)薩爾瓦多對比特幣的採用;

3)投資者對通脹的擔憂再次出現,使他們重新對比特幣作爲通脹對衝工具產生了興趣;比特幣作爲一種通脹對衝工具的吸引力或許得到了增強,因爲近幾周金價未能對通脹擔憂加劇做出迴應,表現得更像是一種反應實際利率的產品,而非通脹對衝工具。

4)實際黃金和數字黃金之間的價格差距不斷擴大,比特幣不僅爲風險資產提供了可靠的分散投資工具(與比特幣對任何其他資產類別的回報率相比),還顯示出與近幾個月不斷飆升的通脹預期之間的強烈相關性,不像黃金今年大幅下跌。

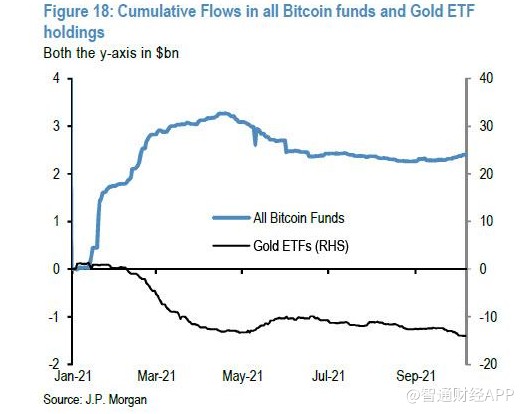

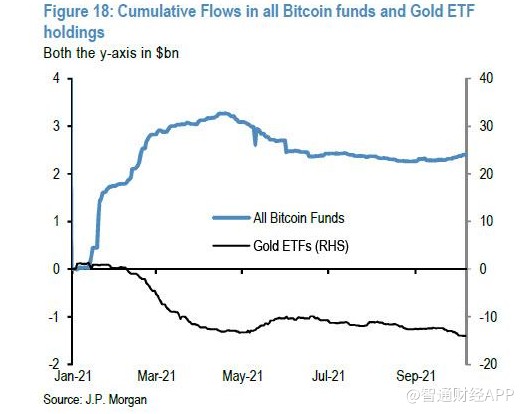

摩根大通表示,“初步跡象表明,此前在2020年第四季度大部分時間和2021年初出現的資金從黃金ETF轉向比特幣的趨勢,最近幾周開始重新出現。”

如果摩根大通的分析是正確的,比特幣不僅是一種可接受的通脹對衝工具(肯定比黃金更好),而且是摩根大通將推廣給機構客戶的一種資產,尤其是那些持有60/40均衡投資組合的客戶,One River的首席信息官Eric Peters長期以來一直持有一個觀點,那就是如果全球60/40投資組合中哪怕只有一小部分重新配置爲數字貨幣,那麼流入比特幣等加密貨幣的潛在資金就會非常可觀。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.