新股速遞 | 創勝集團:基石認購超80%,禮來、高瓴、淡馬錫等機構雲集

1、招股信息

(1)簡稱及代碼: 創勝集團-B,6628.HK

(2)招股日期: 9.14-9.17

上市日期: 9.29

計息日: 11天

(3)發行價格: 15.8-16港元

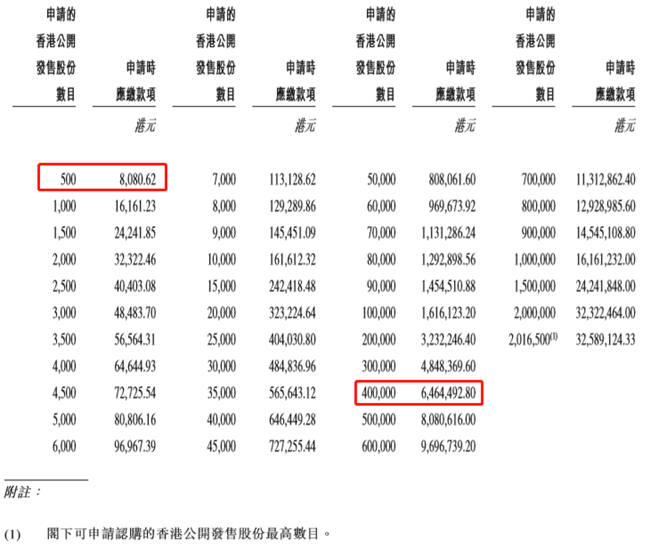

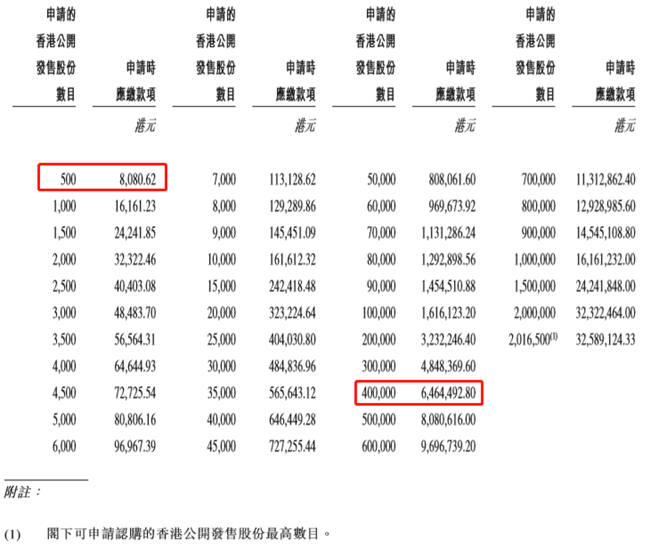

(4)入場費: 8080.62港元,乙頭需認購40萬股(800手),金額約647萬港元,若以20倍槓桿,3.5%年化利率計算,乙頭融資利息成本約爲6478港元

(5)發行股數: 4033萬股,90%國際配售,10%公開發售,1手500股

(6)超額配股權: 有,可按發售價發行最多604.95萬股(佔發售股份的15%),以補足國配的超額認購

(7)集資金額: 6.37-6.45億港元

(8)市值: 70.36-71.25億港元

(9)PE: 虧損

(10)保薦人: 高盛、中金

(11)基石: 4名,共認購5.28億港元股票,佔發售股份的81.89%-82.92%,包括禮來基金、淡馬錫、卡塔爾投資局、中國國有企業結構調整基金

2、回撥機制

15倍以內,公開比例爲10%,甲乙組分別有4033手

15-50倍,公開比例提升至30%,甲乙組分別有12099手

50-100倍,公開比例提升至40%,甲乙組分別有16132手

100倍或以上,公開比例提升至50%,甲乙組分別有20165萬手

3、公司簡介

創勝集團是一家尚未盈利的生物科技公司,目前有1種核心產品MSB2311,一種針對實體瘤的人源化PD-L1單抗候選藥物,以及4種關鍵候選藥物和多種前期創新生物候選藥物。從研發情況來看,均處於或早於臨牀2期階段。

核心產品MSB2311作爲第二代抑制劑,相較其他PD-(L)1抗體具有獨特性,可以極大延長藥物靶標在腫瘤的停留時間和提高體內腫瘤的殺傷活性,在2期試驗中已經納入對TMB-H腫瘤的有效性和安全性評估。

截至2021年3月,中國僅8種PD-(L)1抗體獲得上市批準,但均無獲批用於TMB-H腫瘤。創勝集團的MSB2311是目前中國唯一一款處於臨牀開發階段並納入TMB-H腫瘤試驗的PD-(L)1候選藥物,預計未來這個領域的市場規模將由2025年的1540萬美元增長至2035年的5億美元。

創勝集團自2016年以來共獲得2.58億美元融資,獲得了紅杉資本、禮來亞洲基金、高瓴等知名機構的投資。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.