透視港股通丨快手納入港股通,內資加倉近4億

北水總結

9月2日港股市場,北水成交淨賣出6.26億,其中港股通(滬)成交淨賣出21.06億港元,港股通(深)成交淨買入14.8億港元。

北水淨買入最多的個股是快手-W(01024)、小米集團-W(01810)、吉利汽車(00175)。北水淨賣出最多的個股是藥明生物(02269)、港交所(00388)、舜宇光學(02382)。

數據來源:盈立智投APP

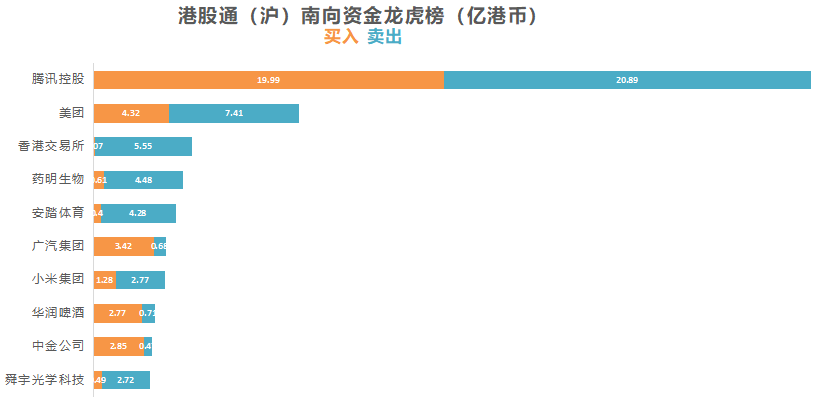

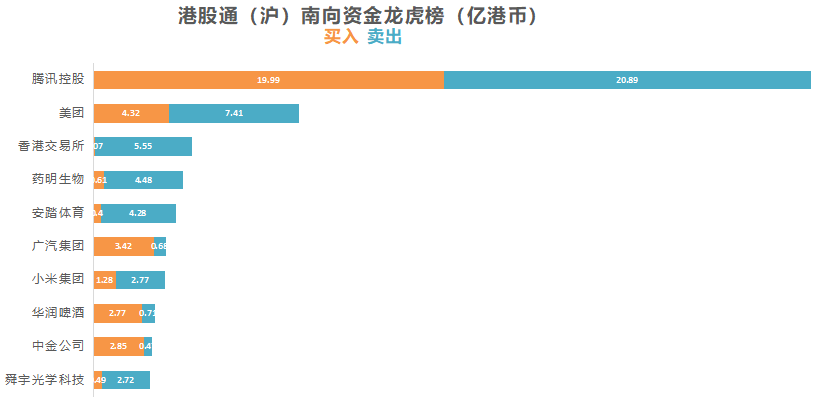

十大成交活躍股

數據來源:盈立智投APP

個股點評

快手-W(01024)獲淨買入3.99億港元。消息面上,9月2日,深交所公告,根據《深圳證券交易所深港通業務實施辦法》的有關規定,港股通股票名單發生調整並自今日起生效,將快手調入深港通下的港股通股票名單。

小米集團-W(01810)獲淨買入3.71億港元。消息面上,9月1日,小米公司發言人宣佈,小米汽車正式完成了工商註冊,公司名稱爲小米汽車有限公司,註冊資金100億元人民幣,小米集團創始人、董事長兼CEO雷軍出任法人代表。據悉,目前小米汽車團隊已有約300人。

廣汽集團(02238)獲淨買入2.74億港元。消息面上,廣汽集團近日公告,將結合全資子公司廣汽埃安發展的整體狀況,擬通過對新能源汽車研發能力及業務、資產的重組整合,推進廣汽埃安的混合所有制改革,對其增資擴股並引入戰略投資者。廣汽埃安將仍爲本公司的控股子公司。未來,廣汽埃安將充分利用資本市場,積極尋求於適當時機上市。瑞銀髮研報指,若“埃安”最終分拆上市,將釋放廣汽重大價值及觸發估值重評。

騰訊(00700)獲淨買入2.65億港元。消息面上,摩根士丹利發表研究報告指,騰訊分享了監管下最新看法及潛在的商業影響。該行認爲,騰訊的多個業務板塊依然保持韌性,維持其增持評級,目標價爲700港元,但需注意遊戲行業監管的不確定性、社交媒體的競爭加劇等原因。此外,騰訊近期持續回購,8月18日至9月1日期間,累計回購約154.26萬股,涉資約6.99億港元。

東嶽集團(00189)獲淨買入2.64億港元。消息面上,東嶽集團昨日發佈公告,擬配售1.45億股配售股份,配售價格每股23港元,較8月31日收市價每股26.8港元折讓約14.18%,所得款項淨額約33.1億港元。公告稱,公司擬將配售所得款項淨額用於提高集團PVDF及其原材料(即R142b冷卻劑)的產能;提高集團PTFE及其原材料(即R22冷卻劑)的產能;及補充集團的一般營運資金。此外,據媒體報道,國內多品種製冷劑價格上漲,R410a市場價格上漲1000元-2000元/噸,R134a市場價格上漲500元/噸,R22市場價格上漲500元/噸。

中金公司(03908)獲淨買入2.38億港元。消息面上,中泰證券發佈研究報告稱,維持中金公司“買入”評級,上半年業績出色,淨利增速在排名前10的大型券商中位列第一,其在權益衍生品和財富配置類業務位列行業領先,預計全年淨利增長51.6%至109.3億元,當前股價對應21年的PE和PB爲6.65倍和0.87倍。

此外,華潤啤酒(00291)、中移動(00941)、金斯瑞生物科技(01548)分別獲淨買入2.87億、2.59億、6140萬港元。而藥明生物(02269)、港交所(00388)、舜宇光學(02382)分別遭淨賣出6.95億、5.47億、2.22億港元。

當日港股通淨買入和淨賣出排行榜

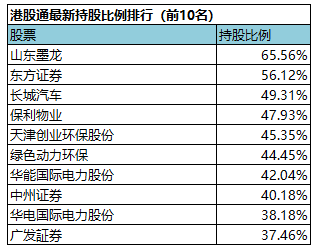

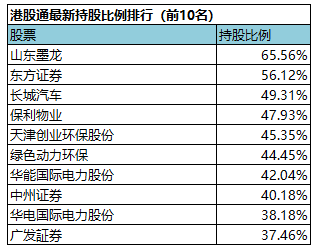

(港股通持股比例排行,交易所數據T+2日結算)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.