大和升小米目標價,牛證漲40%

今日市場短評

恒指中午收漲0.5%。午盤震盪走低,收跌0.03%。本周,恒指累漲2.25%,國指累漲2.46%,紅籌指數累漲2.09%,恒生科技指數累漲7.25%。

盤面上,恒大概念股、汽車股普漲,電力股、電影概念股走弱。個股方面,恒大汽車收漲25.48%,東風集團股份收漲14%,阿里影業收跌9.47%,泡泡瑪特收跌7.21%。

窩輪(認股證)焦點

比亞迪股份(01211)

比迪認購證(15288)到期日:2021年10月槓桿:6.39倍

匯豐研究:維持比亞迪股份“買入”評級 目標價升11%至389港元

匯豐研究發佈研究報告稱,維持比亞迪股份“買入”評級,目標價由350港元升11%至389港元,由於新能源汽車銷售動力,升2021-23年盈利預測2%/3%/6%,並調高混能汽車及電池汽車銷量,同時對電動車及電池部門看法正面。

報告中稱,公司七月新能源汽車銷售上升263%,跑贏整體市場的增長203%,相信新能源汽車銷售動能會維持。該行又指,看到公司磷酸鐵鋰電池組合在上半年擴張強勁,占中國整體電池的37%,而去年同期為 28%。該行預計,電池部門外部積壓訂單會增加,又指刀片電池將在原始設備製造商中獲得更多商業動力。

牛熊證焦點

小米集團(01810)

小米牛證(59608)到期日:2022年3月回收價:23.5槓桿:12.74倍

大和:升小米評級至跑贏大市 目標價28元大和發表報告指,將小米投資評級由持有升至跑贏大市,維持目標價28港元,相當預測市率28倍,並調升集團今年至2023年的收入預測2%至5%,以反映硬體產品銷售強勁。該行認為,小米近期股價的回調,及在監管打擊下的基本面有彈性,令小米吸引力增加。該行指小米今年第二季業績穩建優於預期,硬體業務於推廣季節的毛利率仍較該行預期為佳。該行表示,集團宣佈就新電動車業務收購自動駕駛技術公司DeepMotion,認為其產品和銷售管道獲取市場佔有率的策略有良好效果。

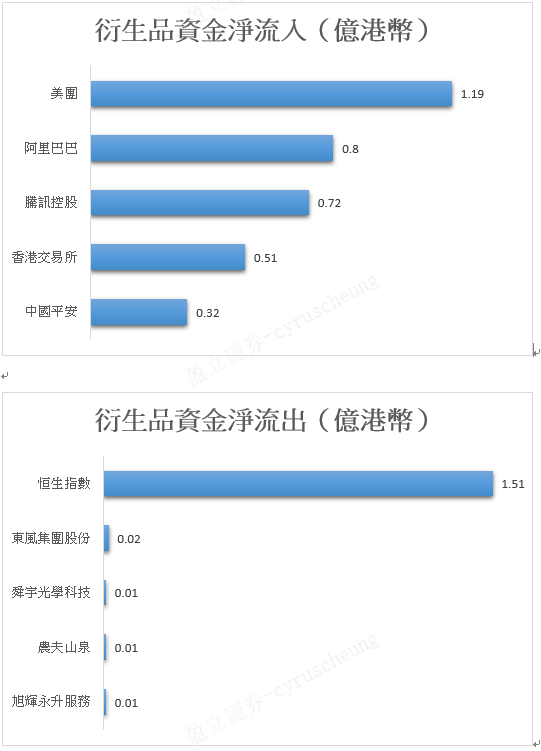

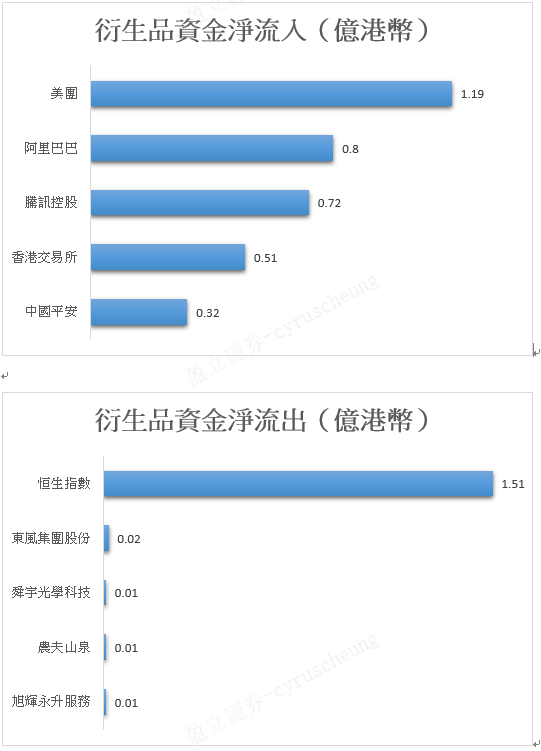

衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.