輪證日報 |恒指跌穿25000,熊證漲60%

| 今日市場短評

恒指早盤低開75點或0.3%,高見25244點後跌幅擴大,跌穿二萬五關。截至收盤,恒生指數收跌1.84%,本周累跌5.84%;恒生科技指數跌2.46%,失守6000點關口,本周累跌10.54%。

科技股、煙草股、生物技術、汽車、黃金及貴金屬、內房股走弱。

個股方面,新股心瑋醫療跌24.56%,平安好醫生跌14.39%,阿裏健康跌13%;多只科技股刷新新低,網易跌4.69%,嗶哩嗶哩跌5.18%,阿里巴巴跌2.59%,快手、騰訊控股午後回升。

| 窩輪(認股證)焦點

騰訊控股(00700)

騰訊認購證(16086)到期日:2021年11月杠杆:11.33倍

騰訊控股公佈,於2021年08月19日回購18萬股,每股回購價介乎419.40港元至435.20港元,涉資7696.51萬元。

中泰國際:騰訊控股給予買入評級 目標價562.00港元

中泰認為監管持續增強將增加公司合規相關成本及對部分業務帶來短期影響(如K-12教育廣告將因監管大幅減少,公司需時引進其他廣告主),主動加大在企業服務及軟體、高工業化水準遊戲及短視頻等領域的投資亦將影響短期利潤增量,但均利好長期可持續發展。公司堅實的用戶基礎及逐步完善的生態圈將支持未來變現釋放。我們調整對公司的盈利預測,預計21/22年非國際財報準則每股基本盈利分別為14.67/16.84元人民幣。公司預期未來仍將有行業監管政策陸續落地,我們預期政策風險仍將是近期市場焦點之一。基於此,我們將22年目標P/E下調至28倍,與去年底因“平臺經濟反壟斷指南(徵求意見稿)”出臺帶來政策不確定性的最低位相若,略高於2018年因遊戲開啟防沉迷、暫停遊戲版號發放、大股東首次減持、業績不如預期等一系列事件導致的估值最低位,以反映近期政策風險及長期機遇並存,相應下調目標價至562.00港元,潛在升幅達33%,重申“買入”評級。

| 牛熊證焦點

恒生指數(HSI)

恒指熊證(58073)到期日:2022年1月回收價:26182杠杆:15.32倍

大市跌穿25000點 專家指監管消息影響大市港股今早低開後早段即跌穿25000點,之後雖再重上,但走勢偏弱難以穩守。安裏主席兼行政總裁黃偉康表示,目前港股跌勢難止,技術上已難講大市的支持位,監管消息不斷,大市氣氛差令A股及港股投資者不敢貿然入市。不過黃偉康提到,不少大型基金的科技股比例已跌到低位,基金內的科技股份已沽盡,認為此後重磅科技股可跌空間不大,撇除監管消息,暫未再有大跌趨勢,就看政策何時會轉向寬鬆。黃偉康預計,短期內恒指或會下試24000點。黃偉康指投資氣氛都趨向保守,較難選取個股入市,防守性較強板塊如物管股和本地地產股會較為安全,整體大市都要待監管政策較為放鬆之時才會向好。

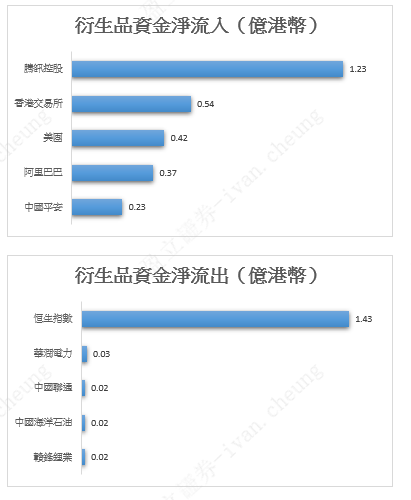

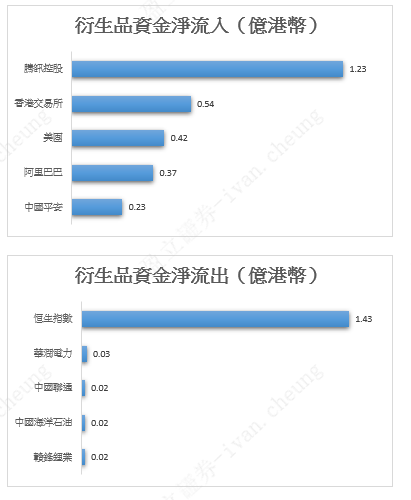

| 衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.