迪士尼還是奈飛?誰更值得長期持有

uSMART盈立智投 08-19 22:13

摩根士丹利發佈了一份關於流媒體領域的研究報告,強調迪士尼(DIS.US)和奈飛(NFLX.US)是它一直到今年年底最看好的兩隻股票。

該行分析師預計,這兩家公司在第三季度和第四季度的流媒體內容表現將更爲強勁,這大概率會提振股價。

但這兩家公司今年以來的表現都不佳,在2021年下跌了約3%。

有媒體通過線上視頻的方式採訪資深投資經理,他們在第三季度和第四季度押注於哪隻流媒體股票——多元化的迪士尼還是以視頻播放爲主的奈飛?

“事實上,這兩隻股票我都有,但我更喜歡奈飛,奈飛配置的比例更高。”New Street Advisors創始人Delano Saporu表示。

Saporu表示,已經被推高的用戶增長以及隨後的用戶數量不穩定現象應該會得到緩解,而且管理層已經對未來的用戶數預期進行了調整。他認爲這樣一來,奈飛就有了在下個季度報告中“給人驚喜的能力”。

“投資者有很多機會進行長期投資,目前奈飛的市銷率不到9倍,市盈率53倍左右,估值上存在溢價空間。我認爲基本面也有不少理由能讓投資者感到興奮。”Saporu補充道。

和Saporu一樣,Miller Tabak首席市場策略師Matt Maley對這兩家公司都有長期的信心。然而,他認爲其中一家更值得長期持有。

“我非常看好迪士尼在技術方面的潛力。我也喜歡它更加多樣化的事實,而且現在市場估值總體偏高,所以如果市場出現一些基本面方面的利空,這隻股票相對風險比較小,安全邊際較足。”Maley表示。

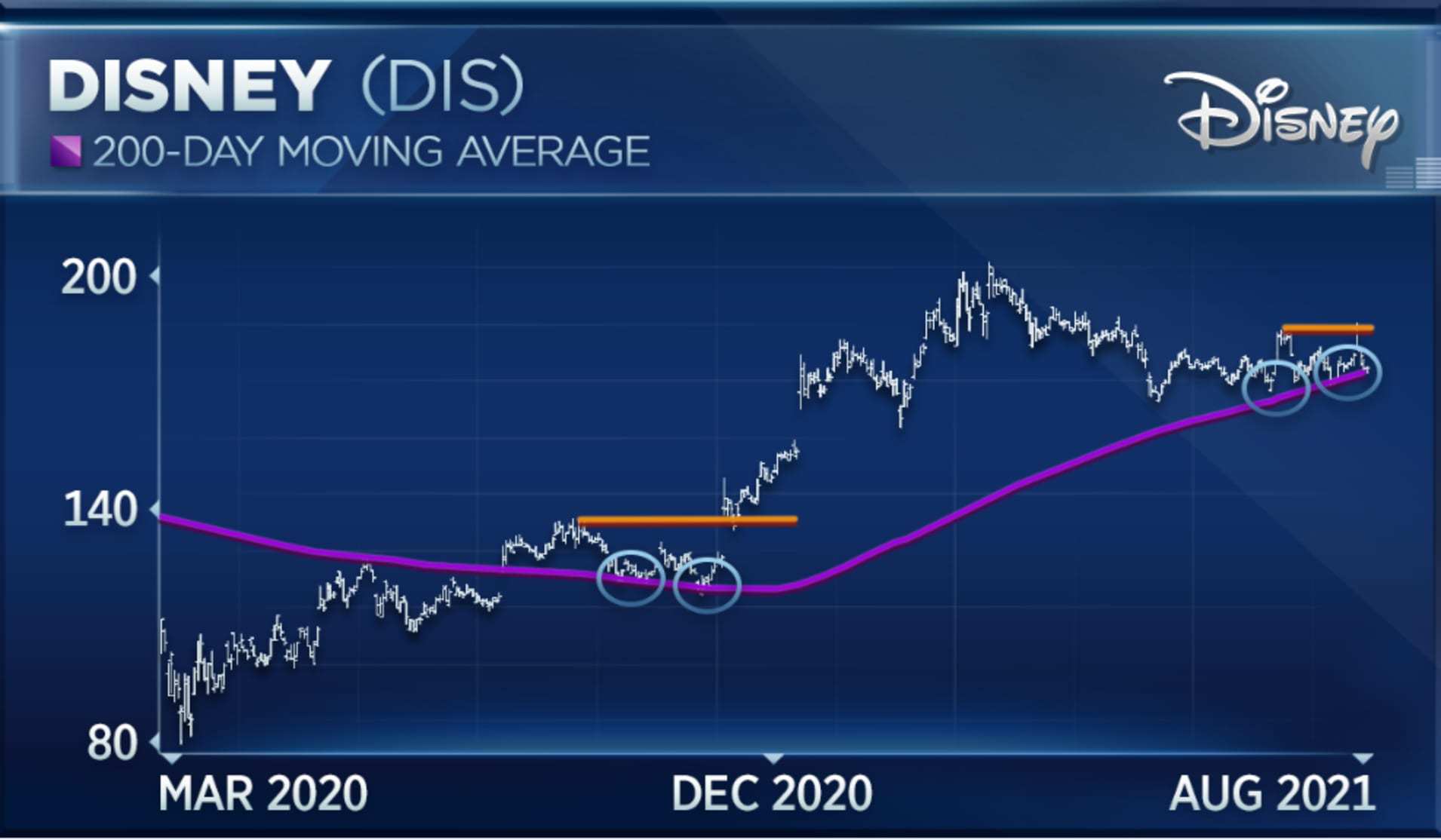

“如果你看到過去年秋天發生的事情,你就會知道:它最終強勢突破200日均線時,在接下來的四五個月裏,它將爆炸式地上漲,持續反彈超50%。”

Maley補充稱,突破184美元阻力位將吸引更多的資金入場,屆時推動該股持續上行。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.