輪證日報 |思摩爾獲投行看好,牛證漲50%

| 今日市場短評

恒指早盤一度倒跌約0.5%,隨後持續走高,最終全日收漲1.23%,報26605.62點;恒生科技指數收漲2.48%,報6830.15點。

盤面上,科網股、恒大概念股、煙草概念股表現強勢,蘋果概念、半導體股走軟。

個股方面,美團全日收漲8.44%,快手漲3.03%,騰訊控股漲5.33%,恒大物業漲20.5%,恒大汽車漲8.02%,思摩爾國際漲11.14%。

| 窩輪(認股證)焦點

美團(03690)美團認購證(16631)到期日:2022年1月槓桿:5.92倍

科網股今日集體反彈

野村發表報告表示,根據近期該行與投資者的溝通後,發現不少海外投資者對內地互聯網行業股票持謹慎態度,擔心行業面臨監管力度加大,或導致股價持續波動。相比之下,該行發現不少中國香港及內地基金在互聯網行業股份最近顯著調整後態度更加積極,開始收集個別藍籌股,如騰訊、阿里巴巴及網易。

該行認為,內地互聯網股份短期仍會呈區間上落,倘若內地監管環境趨於穩定,估計可能會在今年第四季度出現持續回升。

| 牛熊證焦點

思摩爾國際(06969)

斯摩牛證(56086)到期日:2022年8月回收價:35槓桿:3.35倍

中金看好公司全球霧化科技龍頭領先地位

中金近日發佈研報稱,維持思摩爾國際“跑贏行業”評級與目標價74港元。

中金在研報中稱,思摩爾國際核心能力強大、領先優勢突出,專利體系、生產能力、產品品質、客戶優勢等共築深厚壁壘;深度綁定全球大客戶,競品替代難度較大,業績持續快速成長;積極開拓新品類、新業務,全球霧化龍頭成長空間廣闊。該行堅定看好公司全球霧化科技龍頭的領先地位,短期波動或帶來中長期投資機遇。公司憑藉強大核心優勢已深度綁定全球頭部客戶,其他競爭者短期難以獲得頭部客戶大體量訂單,公司業務以出口為主且面向全球有望受益多個主要國家政策門檻提升,份額向頭部集中,重申強者愈強邏輯。

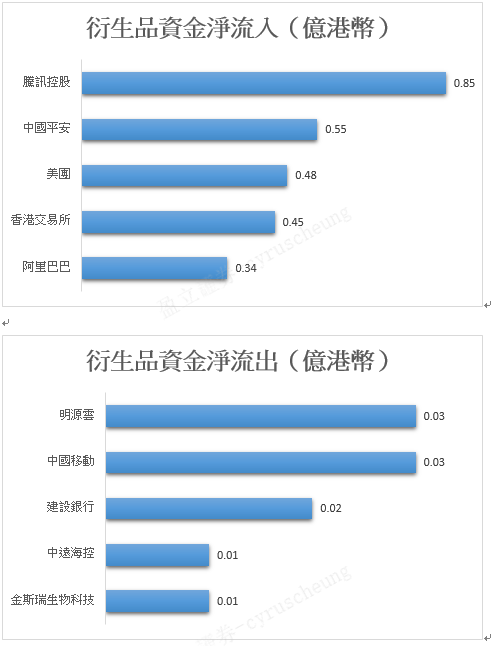

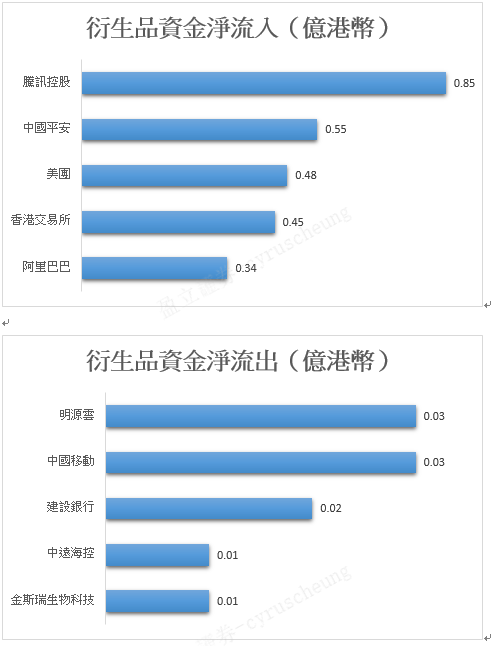

| 衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.