一週財經日曆 | 理想汽車週四上市,蔚來、百度重磅財報來襲!

一、宏觀方面

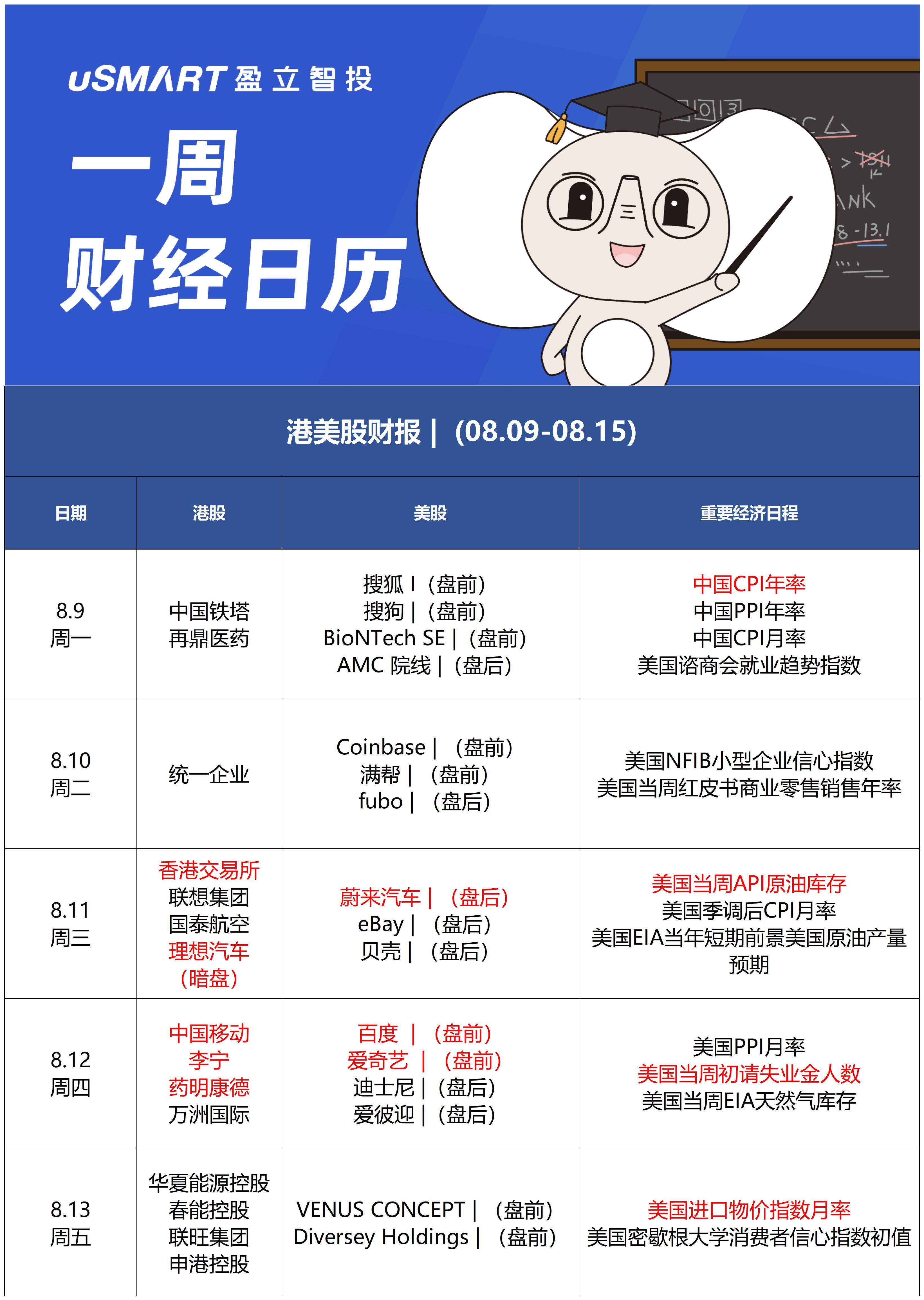

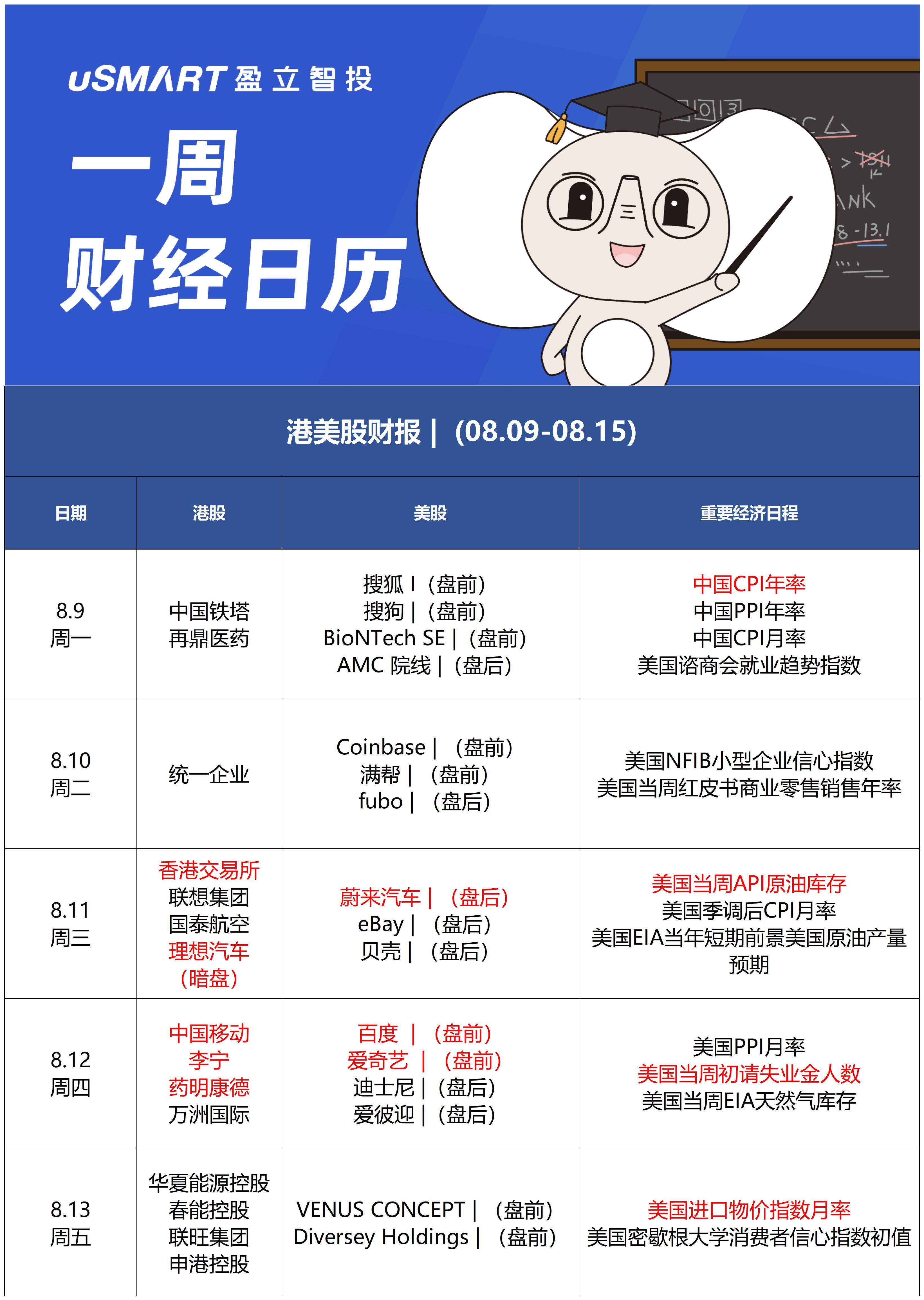

經濟數據方面,下週重點關注週四公佈的美國截至8月7日當週初請失業金人數。美國勞工部這週五公佈了超出預期的就業數據,美國7月新增非農就業94.3萬人,高於市場預計的84.5萬人,失業率則降至5.4%,同樣好於預期。分析師指出,如果8月非農數據繼續保持強勁勢頭,將支持美聯儲開始縮減購債,但一個不確定因素是疫情的發展,如果疫情繼續惡化,可能會抑制經濟活動和就業市場復甦。

其它重磅數據方面,包括中國7月CPI年率、美國7月未季調CPI年率、月率、美國至8月6日當週EIA原油庫存(萬桶)、美國7月進口物價指數月率等,都是觀察經濟狀況的重要指標。

關注熱門股解禁時間表。下週港股市場藥明生物(02269.HK)、恆大汽車(00708.HK)、美股市場中概股圖森未來(TSP)均將迎來解禁期,投資者需注意交易風險,因解禁期到來後往往會出現大幅拋售潮,當日股票價格或將承壓。

作爲參照,短視頻第一股快手(01024.HK)8月5日有38.82億股股票解禁,佔發行後股本的94.81%。當日迎來天量解禁潮的快手,最終股價大跌15%,跌破100元關口,報85港元/股。以8月4日收盤價105.2港元/股計,此波解禁市值高達4,083億港元。

二、新股方面

港股方面,理想汽車(02015.HK)將於8月12日登陸港交所。下週港股打新市場,將迎來理想汽車回港的二次上市。理想汽車發佈公告,國際發售與香港公開發售的最終發售價格均爲118港元,發售價相當於每 股美國存託股份約30.36美元。理想汽車此次發行1億股,募資淨額爲116億港元。

三、財報方面

財報方面,下週財報季熱度不停歇!

其中美股包括AMC院線(AMC)、BioNTech SE(BNTX)、Coinbase Global, Inc.(COIN)、滿幫(YMM)、Unity Software Inc.(U)、蔚來(NIO)、eBay(EBAY)、愛彼迎(ABNB)、迪士尼(DIS)、百度(BIDU)等重磅財報公司,而港股有中國鐵塔(00788.HK)和港交所(00388.HK)等也將公佈財報。

BioNTech將在8月9日美股盤前公佈Q2業績。據彭博分析師預期,2021年Q2 BioNTech營收爲34.99億歐元,同比增長超82倍;調整後淨利潤約爲19.65億歐元;調整後每股收益爲2.383美元。

此外值得關注的是,輝瑞和BioNTech正準備下個月開始針對Delta異株的Covid-19疫苗的臨牀試驗,因爲人們擔心現有的疫苗對這種在全球大部分地區傳播的毒株提供的保護不足。

Coinbase將在8月10日美股盤前公佈2021年Q2業績。據分析師預期,2021年Q2Coinbase營收爲18.10億美元;調整後淨利潤約爲6.19億美元;調整後每股收益爲2.383美元。因此投資者需要關注此次業績公佈Coinbase的交易量和交易用戶數等信息。

蔚來汽車將在8月11日美股盤後公佈Q2業績。據分析師預期,2021年Q2蔚來汽車營收爲83億人民幣,同比增長123.2%;調整後淨利潤約爲虧損6.74億人民幣;調整後每股收益爲-0.503人民幣。投資者要重點關注芯片供應的短缺是否會持續下去,從而影響蔚來2021年的交付增長。

百度將在8月12日盤前公佈2021年Q2業績。據分析師預期,2021年Q2百度營收爲309.3億人民幣,同比增長18.8%;調整後淨利潤約爲46.05億人民幣,同比下降1.62%;調整後每股收益爲13.13人民幣,同比下降10.9%,投資者可重點關注廣告方面業績。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.