廣發證券-中國有色礦業(1258.HK):被低估的高成長性國際化銅礦公司,首次覆蓋給予“買入”評級,中期業績同比預增769%

核心觀點

中國有色礦業:產業鏈完整的國際化礦業公司

全球領先的垂直綜合銅生產商;深耕非洲市場,發展潛力較大;股權結構穩定,分佈集中。

公司盈利能力良好,業績表現優異

銷量一路走高,營收穩步向好;產品結構優異,開拓高毛利產品線;量價齊升,毛利率有上行趨勢。

銅的中長期潛在供需缺口逐步擴大

銅精礦資本開支週期低谷效應逐步顯現,新投礦山產量增速有限;全球顯性庫存歷史相對低位,隱性庫存較少;電力基建及地產竣工大幅增長,汽車銷量邊際大幅好轉;RCEP+碳中和,中長期銅消費增長核心驅動力;拜登基建計劃將在長期明顯拉動銅消費。

多向持續發力,助力業績提升

礦產資源星羅棋佈,具備資源優勢;擴大冶煉產能,深化公司產能優勢;贊比亞、剛果金收緊銅精礦出口政策,有望促進公司冶煉發展;區位優勢顯著,火法技術領先行業;財務數據表現優異,資產回報率高。

盈利預測及投資建議

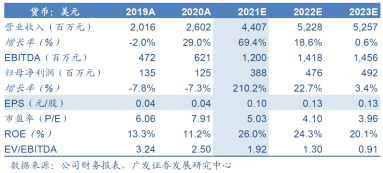

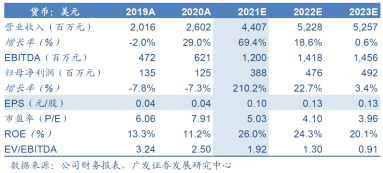

預計公司2021-2023年可實現營收分別為44.07億美元、52.28億美元以及52.57億美元,對應可實現歸母淨利潤分別為3.88億美元、4.76億美元以及4.92億美元,EPS分別為0.10美元/股、0.13美元/股以及0.13美元/股。以最新收盤價計算,對應PE分別為5.03倍、4.10倍以及3.96倍。基於可比公司估值,我們認為公司合理價值為7.8港元/股(美元兑港幣匯率:7.77),對應2021年10倍PE,首次覆蓋給予“買入”評級。

風險提示

新增銅礦項目投產及爬產不及預期;新增火法冶煉項目投產;剛果金及贊比亞政策不確定性;全球需求萎縮導致銅價大幅下跌。

盈利預測

中國有色礦業(1258.HK)預計上半年純利同比增加769%

中國有色礦業7月9日公佈,預期集團截至2021年6月30日止六個月,比較2020年同期,公司擁有人分佔利潤大幅增長,約為2.04億美元,增加約769%。

董事會預期集團截至2021年6月30日止六個月的公司擁有人分佔利潤增加的主要原因是:銅價同比大幅上漲;及由於新投產項目產能釋放,銅產品產量同比大幅提升。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.