轮证日报 | 哔哩哔哩营收破纪录,认购证大涨

| 今日市场短评

今日港股继续走强,恒指早盘开涨0.87%,盘中一度升至1.44%,重返20天线上方。截至今日收盘,恒指收涨1.42%。

盘面上,教育股与物业管理股板块走强,石油股与旅游观光股拉升,汽车股板块疲软。

个股方面,同程艺龙收涨12.22%,信达生物涨5.23%,恒大汽车收跌3.32%。

| 窝轮(认股证)焦点

哔哩哔哩(09626)哔哩认购证(17400)到期日:2021年9月杠杆:6.2倍

哔哩哔哩一季度营收破纪录同比增68%达39.01亿元

哔哩哔哩-SW发布2021年第一季度财务业绩,净营业额总额达人民币39.01亿元,同比增加68%。月均活跃用户(月活用户)达2.23亿,而移动端月活用户达2.085亿,同比分别增加30%及33%。日均活跃用户(日活用户)达6010万,同比增加18%。平均每月付费用户(月均付费用户)达2050万,同比增加53%。

中国石油化工股份(00386)中化认购证(23999)到期日:2021年7月杠杆:12.37倍

瑞银:上调中石化目标价至4.9港元 评级买入瑞银发表报告,预期中石化的勘探及开采和化工业务可引领盈利升级,估计集团今年可录得自2013年以来最佳的盈利。虽然其股价表现年初至今已跑嬴,但该行相信目前股价仍未捕捉到潜在的强劲增长。瑞银上调中石化股份目标价,由4.7港元升至4.9港元,评级维持买入,并调升集团今年至2023年每股盈利预测分别29%、21%及13%,最新预料其今年盈利按年有87%改善。

| 牛熊证焦点

香港交易所(00388)

港交牛证(57324)到期日:2021年7月回收价:439.98杠杆:19.01倍

四月香港交易所债券上市数量增加逾3倍,集资额1933亿港元创近六个月新高

四月,香港交易所上市债券市场共有43只债券在港上市,集资额达1,933亿港元,创近六个月新高。与去年同期相比,月度债券上市数量增加逾3倍,对应的上市债券集资额增加逾1.4倍,反映市场复苏已步入正轨和上市债券市场的持续发展。

截至四月底,香港交易所上市债券市场存续债券数量达到1656只,较去年同期增加约18%;市场规模已超过6万亿港元。

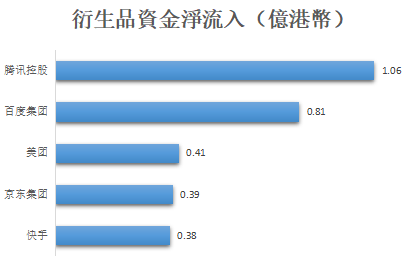

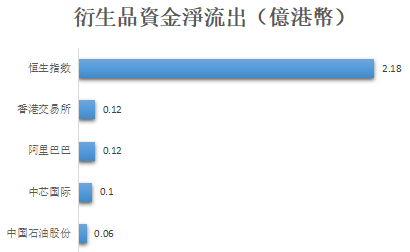

| 衍生品资金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.