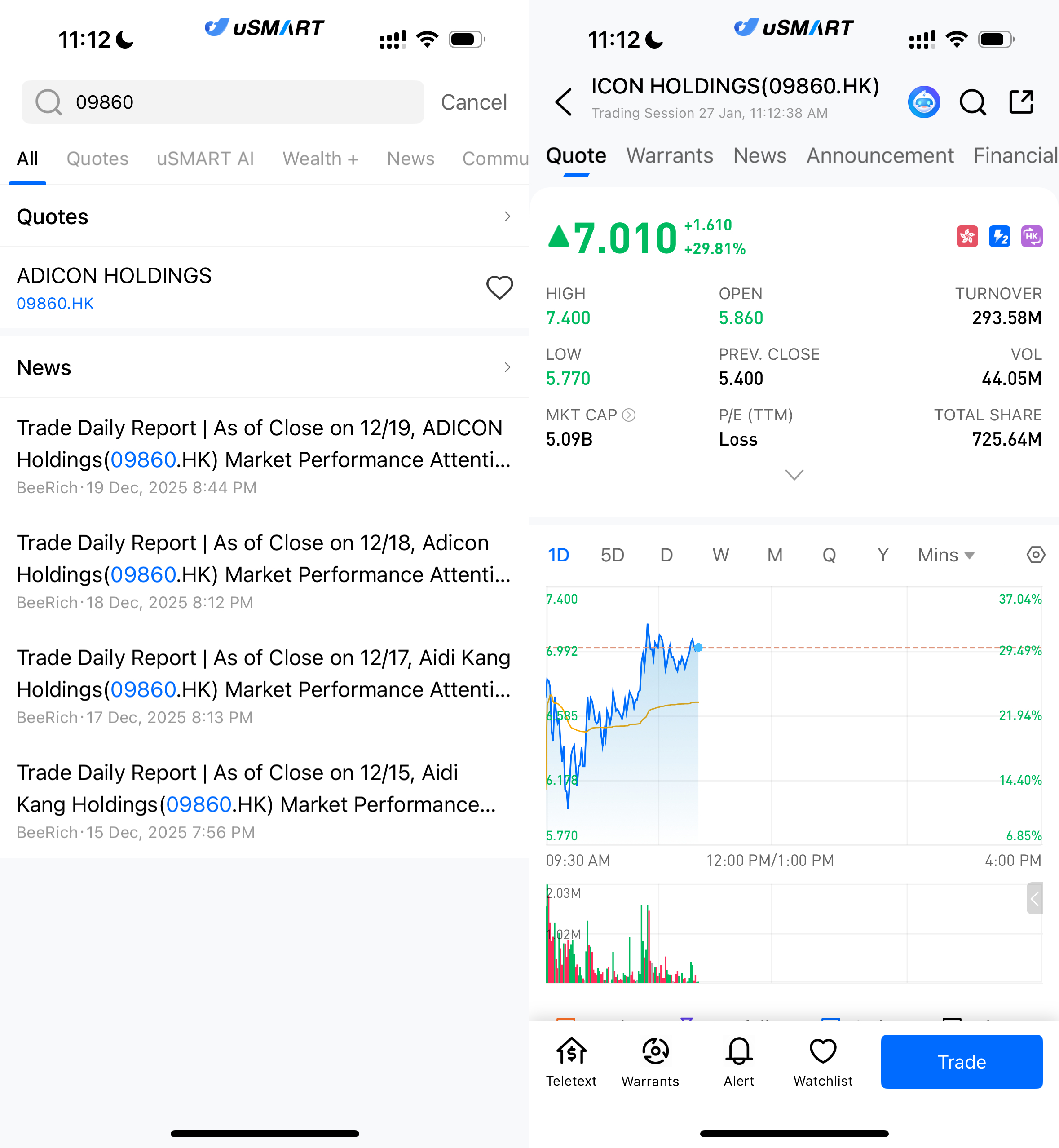

On January 27, EddingKong Holdings (09860.HK) saw a strong rally in trading, with its stock price rising by up to 30%, reaching a high of HKD 7.40. As of the morning session, the stock was priced at HKD 7.02, up 30.00%, with a trading volume of approximately HKD 292 million, reflecting a significant increase in turnover.

(Image source: uSMART HK App)

Advancing M&A Integration, EddingKong Expands into Preclinical and Translational Research

In terms of recent developments, EddingKong announced in November 2025 that it intends to acquire 100% of Crown Bioscience (Crown), a transaction valued at USD 204 million. The deal is expected to be completed by mid-2026. Upon completion, Crown will become a wholly-owned subsidiary of EddingKong, and its business capabilities will be integrated into the group’s overall service framework.

Through this acquisition, EddingKong will extend its services beyond its existing medical testing and diagnostic services into key areas such as preclinical research and translational medicine, thereby enhancing its early-stage drug development capabilities.

Introducing Models and Data Resources to Strengthen Oncology R&D Support

The acquisition will bring valuable resources and technical capabilities in oncology and immuno-oncology models, including PDX models, CDX models, and biomarker solutions. These capabilities will help EddingKong enhance its services in preclinical drug efficacy evaluation and research support.

With the integration of these models and research platforms, EddingKong’s ability to support drug screening, efficacy validation, and other related services is expected to grow significantly.

Integrating AI and Bioinformatics to Broaden Service Applications

On the digital front, the acquisition will provide EddingKong with access to preclinical data platforms and AI capabilities, further advancing the company’s development in data-driven R&D support services. By integrating data assets and bioinformatics tools, EddingKong will enhance its ability to offer services in areas like drug combination research and R&D efficiency improvements. These new capabilities will also lay a strong foundation for the company's future development in integrating AI with medical diagnostics and R&D support.

Deepening Global Expansion with Increased International Business Share

EddingKong’s strategic positioning in AI medical diagnostics, combined with the acquisition of Crown Bioscience, will further strengthen its synergistic capabilities between diagnostic services and drug development support. The integration of Crown’s model resources, data platforms, and international client base will help EddingKong build a more comprehensive service chain across preclinical research, translational research, and diagnostic services. According to current projections, after the deal is completed, around 23% of EddingKong’s revenue will come from international markets, further optimizing the company’s internationalization and business structure.

How to Buy Kingsoft Cloud via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (03896.HK), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)