Hunan MingMing Busy Commercial Chain Co., Ltd. (BUSY MING GROUP CO., LTD., 1768.HK) has launched its Hong Kong IPO, with the offering period running from January 20 to January 23, 2026. The company intends to offer 14,101,100 H-shares globally, with a 15% over-allotment option. The offering price will range from HKD 229.60 to HKD 236.60 per share, with a minimum lot size of 100 shares, and an entrance fee of approximately HKD 23,898.62. The shares are expected to be listed on the Hong Kong Stock Exchange’s Main Board on January 28, 2026. Goldman Sachs (Asia) and Huatai Financial Holdings (Hong Kong) are the joint sponsors.

MingMing Busy: China’s Largest Snack and Beverage Retail Chain

Issue Ratio: 10% for Hong Kong Public Offering (1,410,200 shares), 90% for International Placement (12,690,900 shares).

Issue Price: HKD 229.60—236.60 per share; 100 shares per lot; entrance fee approximately HKD 23,898.62.

Offer Period: January 20–23, 2026 (Pricing Date expected on January 26, 2026).

Listing Date: January 28, 2026.

IPO Sponsors: Goldman Sachs (Asia) LLC and Huatai Financial Holdings (Hong Kong) Limited.

Company Profile

MingMing Busy is a mature and fast-growing food and beverage retailer in China. It operates under two brands, "MingMing Snack" and "Zhao Yiming Snacks," primarily through a franchise model. The company employs a wholesale-retail approach, offering a wide variety of high-quality, cost-effective snack food and beverages, along with a fun and comfortable in-store experience. According to a report by Frost & Sullivan, in terms of GMV (Gross Merchandise Value) in 2024, the company is China’s largest chain retailer in the snack food and beverage category. It is also ranked fourth overall in terms of GMV in food and beverage retail. As of September 30, 2025, the company had a broad network of 19,517 stores across 28 provinces in China.

Financial Information

The company’s IPO prospectus reveals the following financial performance: 2022 Revenue: RMB 4.286 billion, 2023 Revenue: RMB 10.295 billion, 2024 Revenue: RMB 39.344 billion, 2022 Net Profit: RMB 72 million, 2023 Net Profit: RMB 218 million, 2024 Net Profit: RMB 829 million, Nine Months Ending September 30, 2025: Revenue of RMB 46.371 billion, Net Profit of RMB 1.558 billion. At an offer price midpoint of HKD 233.10 per share, assuming no exercise of the over-allotment option and green-shoe option, the company expects to raise net proceeds of approximately HKD 3.124 billion. The funds will be allocated for: 25% to enhance supply chain and product development, 20% for store network upgrades and empowering franchisees, 20% for brand building and promotion, 20% for enhancing technology and digital capabilities, 5% for strategic investments and acquisitions, 10% for working capital.

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$20 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 5 December 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

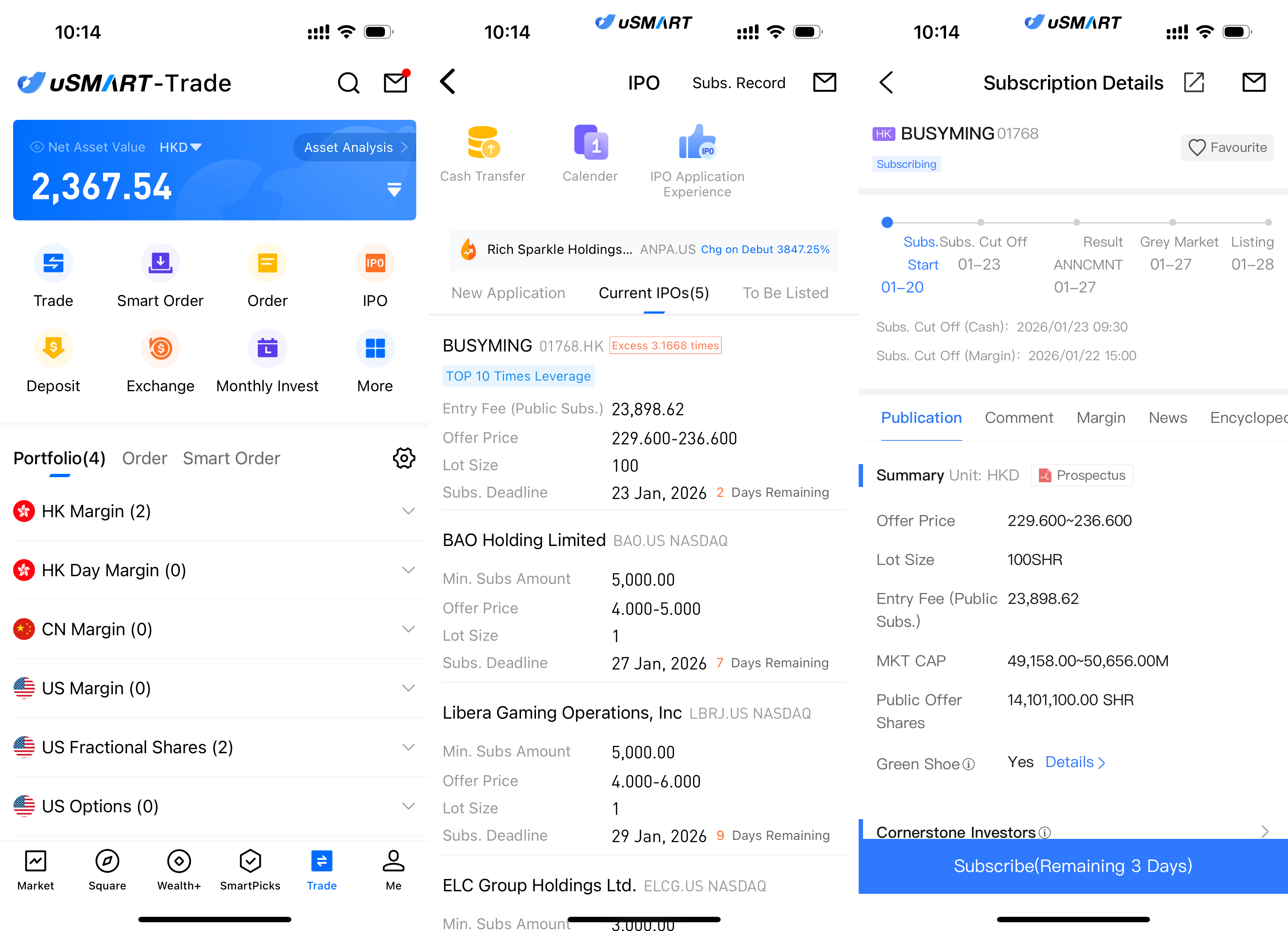

How to Subscribe for MingMing Busy via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select MingMing Busy, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image Source: uSMART HK app)