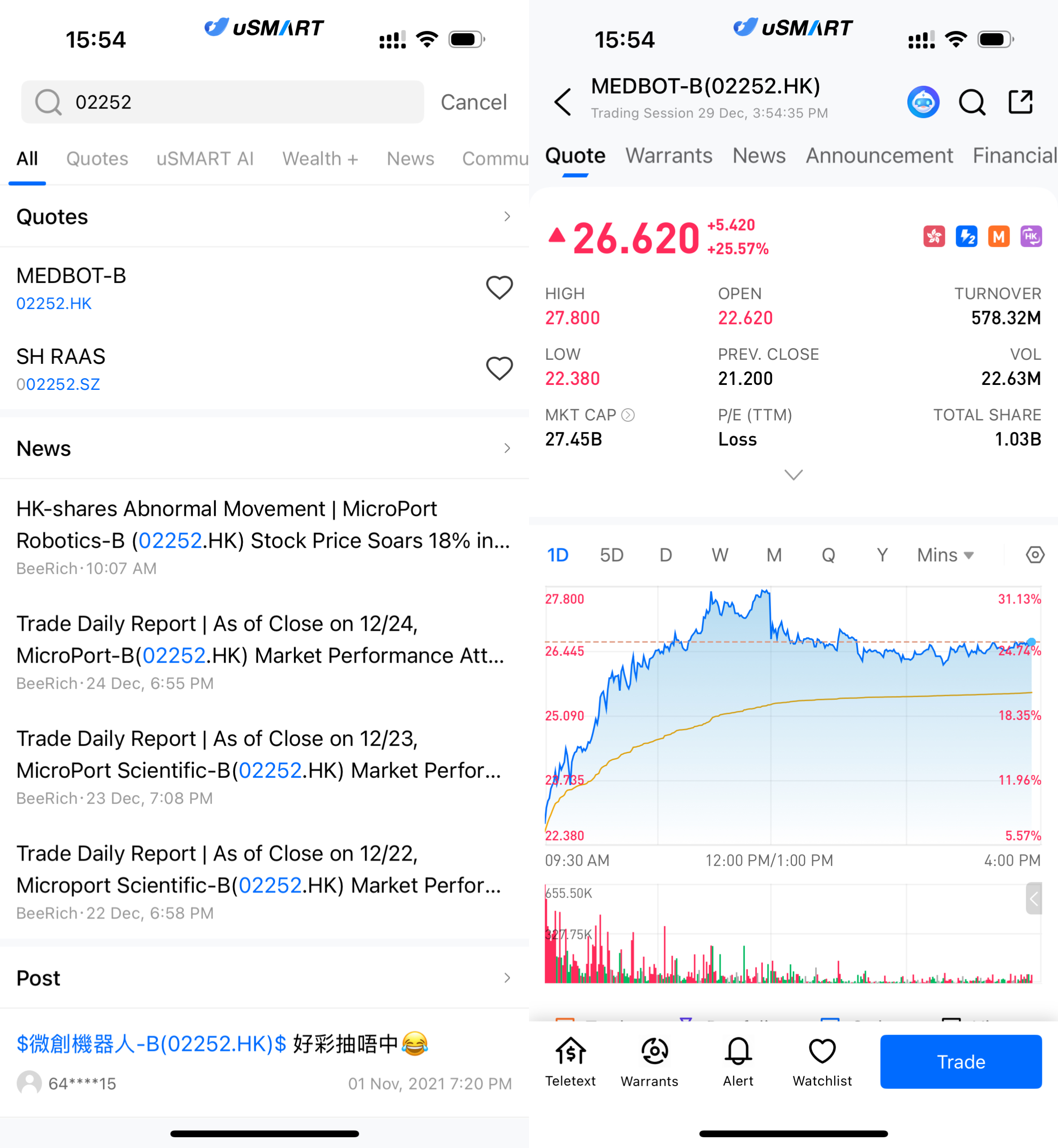

December 29, 2025 — Shares of MicroPort Robotics-B (02252.HK) rallied sharply today. As of the latest trading session, the stock touched an intraday high of approximately HK$27.8 per share, representing a gain of more than 25% from the previous close. Both trading volume and turnover expanded significantly, underscoring heightened investor enthusiasm.

(Image source: uSMART HK app)

Core Product Approval Marks Continued Execution of Technology Pipeline

From a fundamental perspective, MicroPort Robotics has recently achieved a key milestone. The company’s self-developed UniPath™ Electronic Bronchoscope Navigation System has officially received registration approval from China’s National Medical Products Administration (NMPA), adding an important product to its portfolio in the endoscopy and respiratory intervention space.

Industry observers note that bronchoscopic surgical robots operate in a segment characterized by high technical barriers and strong clinical value. Their applications span lung cancer early screening and the diagnosis and treatment of complex pulmonary lesions, offering substantial market expansion potential. This approval not only further completes MicroPort Robotics’ multi-specialty布局, but also signals the company’s ongoing ability to translate its technology platform into approved products.

Against the backdrop of a more rational and standardized medical device approval environment in China, regulatory clearance itself carries considerable weight, laying a solid foundation for subsequent commercialization and revenue conversion.

Rising Orders and Installations Accelerate Commercialization

Beyond regulatory progress, MicroPort Robotics continues to make headway on the commercialization front. The company has disclosed that cumulative orders across its laparoscopic, orthopedic, and vascular intervention product lines have exceeded 230 units. Among them, its flagship TouMai laparoscopic surgical robot has secured over 160 commercial orders globally, with installed units surpassing 100 systems for the first time.

These figures are regarded as meaningful benchmarks within China’s domestic surgical robotics sector. Market participants generally view installed base as a key indicator of commercialization capability, reflecting not only successful technical validation but also growing acceptance among hospitals and surgeons.

As the installed base expands, recurring revenue streams from consumables, maintenance services, and expanded surgical indications are expected to develop into longer-term cash flows, supporting improvements in revenue mix and gross margin profile.

Robotics Sector Gains Momentum as Policy Expectations Rise

At a broader level, the rally in MicroPort Robotics’ share price has also been supported by improving sentiment across the robotics sector. Recently, policymakers have continued to release positive signals for China’s robotics industry, including accelerated development of standards for intelligent robotics, embodied intelligence, and humanoid robots, reinforcing expectations for the sector’s long-term growth potential.

Within healthcare, surgical robots are widely viewed as a critical component of high-end medical equipment localization, combining both technological advancement and import substitution narratives. As domestic hospitals become more receptive to locally produced equipment, companies in the space may gradually expand market share, benefiting from policy support, demand growth, and cost advantages.

As one of the few players with a diversified multi-product portfolio, MicroPort Robotics has naturally become a focal point for capital inflows.

Capital Markets Perspective: Growth Story Still in a Validation Phase

Despite the strong short-term share price performance, the market remains relatively rational. The surgical robotics industry is still in an early stage of penetration, and a comprehensive improvement in profitability will depend on continued expansion of installations, higher procedure volumes, and ongoing cost optimization.

For MicroPort Robotics, key areas to watch include the pace of commercialization, progress in overseas market expansion, the balance between R&D investment and cash flow, and the replicability of its core products across different clinical specialties.

Overall, the recent strength in MicroPort Robotics’ share price reflects not only tangible company-specific catalysts such as new product approvals and order growth, but also a broader recovery in robotics sector sentiment. Against the backdrop of accelerating development in China’s high-end medical equipment industry, the company’s future performance as a key industry participant remains worthy of close attention.

How to Buy MicroPort Robotics via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (02252.HK), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)