Joyson Electronics (0699.HK) has launched its Hong Kong IPO. The subscription period is from October 28 to November 3, with a global offering of 155,100,000 H-shares and a 15% over-allotment option. The maximum offer price is HK$23.60 per share, with a minimum purchase of 500 shares and an entry fee of approximately HK$11,919.01. The shares are expected to be listed on the Hong Kong Stock Exchange on November 6. The joint sponsors are CICC and UBS Group.

Joyson Electronics: The World's Second Largest Automotive Passive Safety Giant

Offer Ratio: 10% for Hong Kong public offering (15,510,000 shares), 90% for international placement (139,590,000 shares).

Offer Price: Maximum HK$23.60 per share; minimum 500 shares; entry fee approximately HK$11,919.01.

Subscription Dates: October 28 to November 3 (pricing date is expected to be November 4).

Listing Date: November 6.

IPO Sponsors: CICC, UBS Securities.

Company Overview

Joyson Electronics is a provider of smart automotive technology solutions, primarily offering automotive electronics and safety products. According to Frost & Sullivan, based on 2024 revenue, the company is the second-largest global supplier of automotive passive safety products and ranks 41st in the global automotive parts industry. Its business covers over 100 global automotive brands, with more than 60 production sites and over 25 R&D centers in 25 countries.

Financial Information

According to the prospectus, Joyson Electronics' revenue for 2022-2024 was approximately RMB 49.79 billion, RMB 55.73 billion, and RMB 55.86 billion, respectively, with net profits of RMB 233 million, RMB 1.24 billion, and RMB 1.33 billion, respectively. The company’s revenue for the first four months of 2025 was about RMB 19.71 billion, with a net profit of about RMB 491 million. Based on the maximum offer price of HK$23.60, assuming no exercise of the over-allotment option, the company expects to raise a net amount of about HK$3.46 billion. The funds will be used for R&D in smart automotive technologies (about 35%), improving production and supply chain capabilities (about 35%), expanding overseas business (about 10%), potential investments and acquisitions (about 10%), and working capital (about 10%).

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$10 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 20 May 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

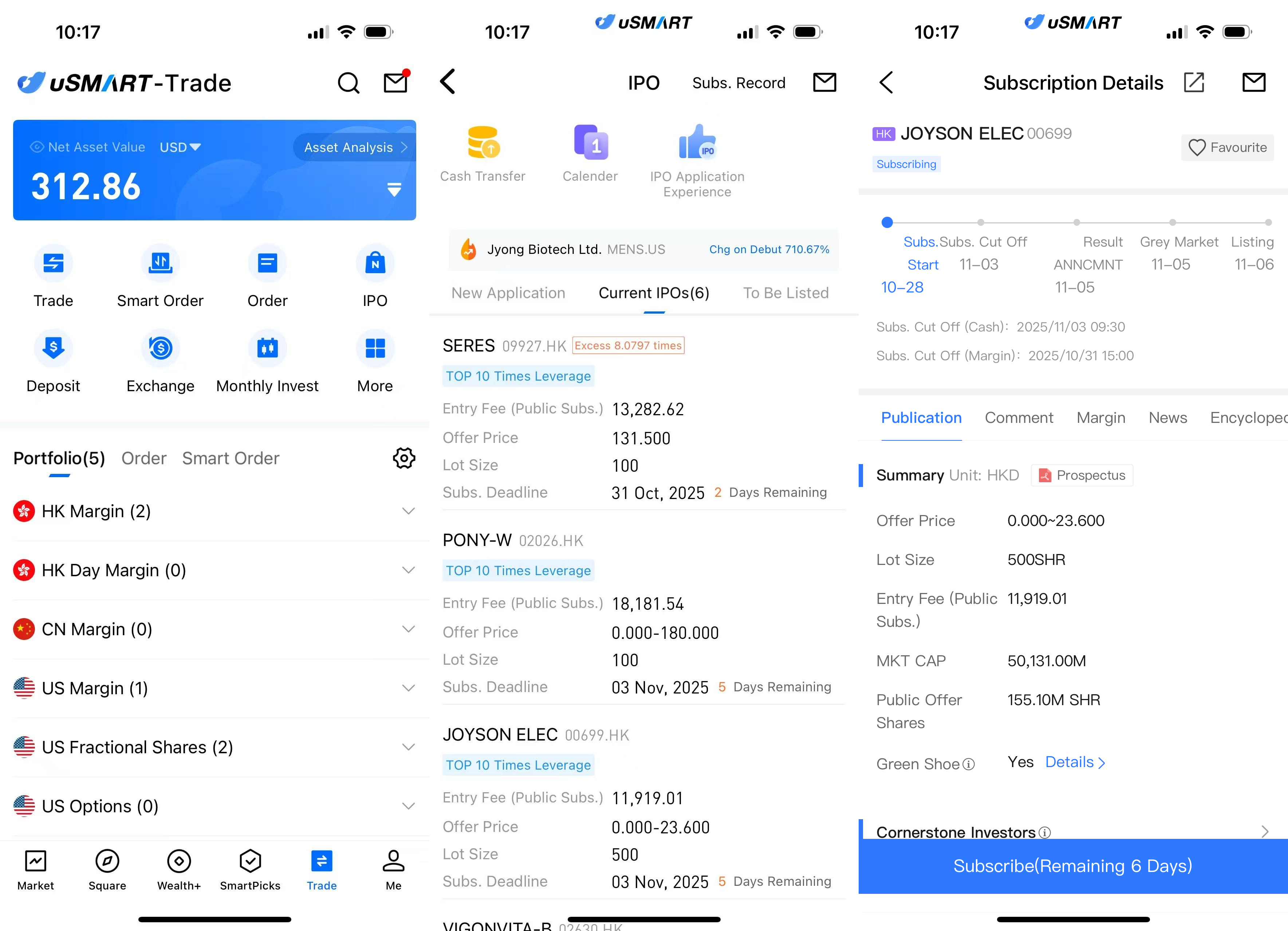

How to Subscribe for Joyson Electronics via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select Joyson Electronics, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)

(Image source: uSMART HK App)