AUX ELECTRIC CO., LTD. (stock code 2580.HK) launches its Hong Kong IPO with an offer period from August 25 to August 28. The company plans a global offering of 207,161,200 shares with a 15% over-allotment option; the indicative offer price range is HK$16.00–HK$17.42. Each board lot is 200 shares, with an application amount of about HK$3,519.14 per lot at the maximum price. Dealings on the Main Board of HKEX are expected to commence on September 2, with China International Capital Corporation (CICC) as Sole Sponsor.

AUX: A top-five global air-conditioner supplier

Issue split: Hong Kong Public Offering ~5% (10,358,200 shares); International Offering ~95% (about 196,803,000 shares).

Offer price: HK$16.00–HK$17.42; board lot 200 shares; estimated application monies ~HK$3,519.14 per lot at the cap.

Offer period: August 25–28 (expected pricing August 29).

Listing date: September 2.

Sole Sponsor: China International Capital Corporation (CICC).

Company Profile

AUX focuses on household and central air-conditioners, covering design, R&D, manufacturing, sales and services, operating under the master brand “AUX” with a multi-brand matrix across domestic and overseas markets. According to Frost & Sullivan, AUX ranked No. 5 globally by sales volume in 2024 with a 7.1% market share. The company continues to push energy-saving, comfort, health and intelligent product strategies.

Financial Information

Per the prospectus, AUX recorded revenue of RMB 19.53bn, 24.83bn and 29.76bn in 2022–2024, with net profit of RMB 1.44bn, 2.49bn and 2.91bn respectively. For Q1 2025, revenue was RMB 9.35bn and net profit RMB 0.925bn. At the mid-point price of HK$16.71, estimated net proceeds are ~HK$3.287bn, to be used roughly 50% for intelligent manufacturing & supply-chain upgrades, 20% for global R&D, 20% for strengthening sales and distribution channels, and 10% for working capital.

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$10 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 20 May 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

How to Subscribe for Hong Kong IPOs via uSMART HK

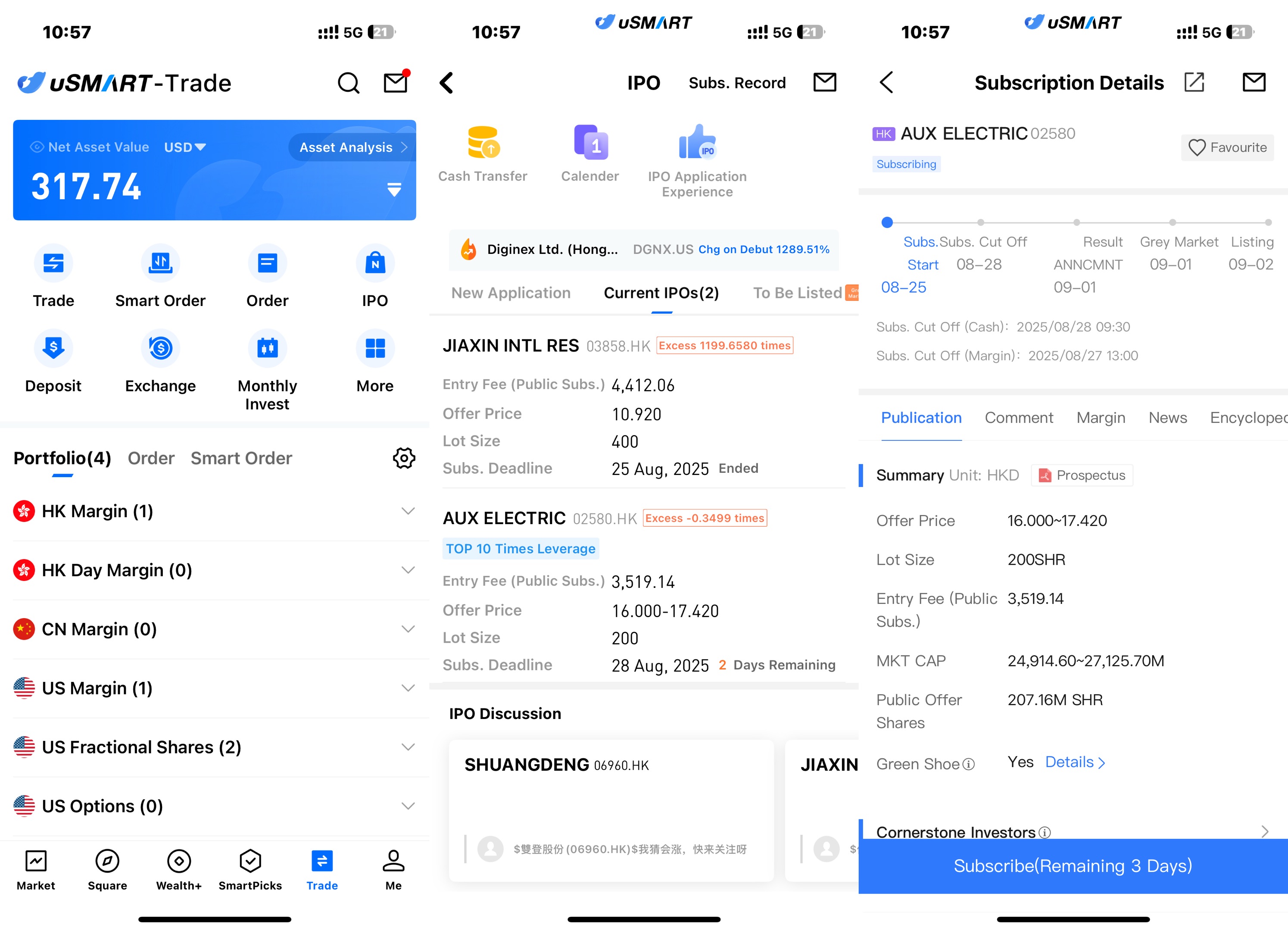

The uSMART HK App features an IPO Centre with exclusive perks. After logging in, tap “Trade” at the bottom‑right, choose “IPO Subscription,” select the target IPO, tap “Public Offer,” enter the share quantity and submit your order.

(Image source: uSMART HK app)